Question: Question 4 Use the following information to answer the next question. Not yet answered The last dividend paid by Klein Company was $1.00. Marked out

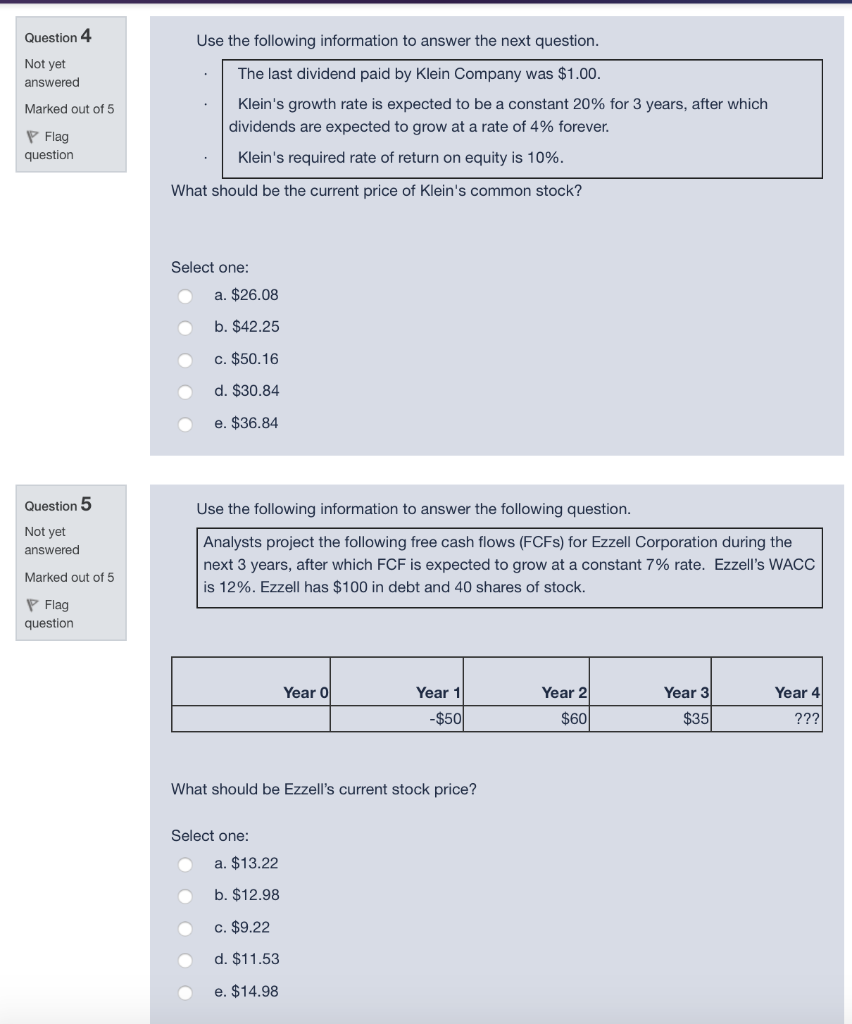

Question 4 Use the following information to answer the next question. Not yet answered The last dividend paid by Klein Company was $1.00. Marked out of 5 Klein's growth rate is expected to be a constant 20% for 3 years, after which dividends are expected to grow at a rate of 4% forever. P Flag question Klein's required rate of return on equity is 10%. What should be the current price of Klein's common stock? Select one: a. $26.08 o b. $42.25 c. $50.16 d. $30.84 e. $36.84 Question 5 Use the following information to answer the following question. Not yet answered Analysts project the following free cash flows (FCFS) for Ezzell Corporation during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Ezzell's WACC is 12%. Ezzell has $100 in debt and 40 shares of stock. Marked out of 5 P Flag question Year 0 Year 1 -$50 Year 2 $60 Year 3 $35 Year 4 ??? What should be Ezzell's current stock price? Select one: a. $13.22 b. $12.98 c. $9.22 d. $11.53 e. $14.98

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts