Question: QUESTION 4 Use the following to answer the next three questions. Delta Inc. stock currently trades for $50, but you believe the company's stock will

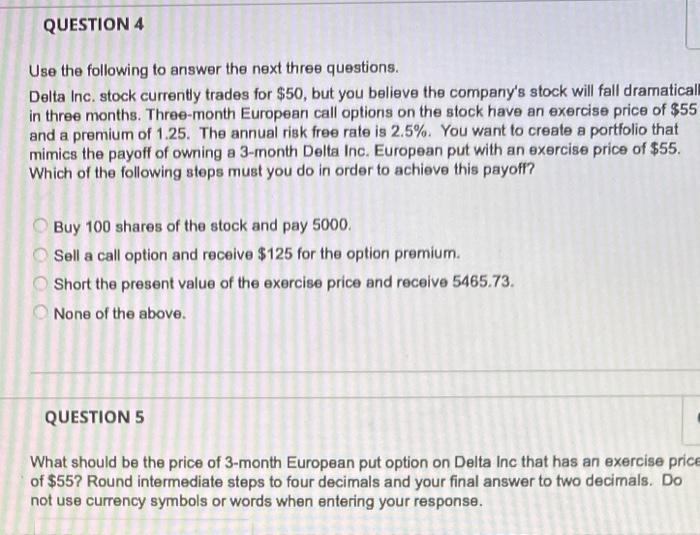

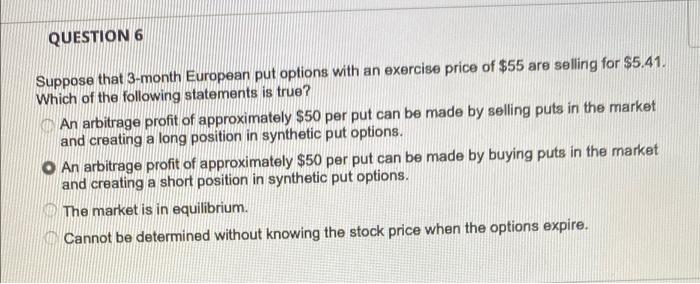

QUESTION 4 Use the following to answer the next three questions. Delta Inc. stock currently trades for $50, but you believe the company's stock will fall dramatical in three months. Three-month European call options on the stock have an exercise price of $55 and a premium of 1.25. The annual risk free rate is 2.5%. You want to create a portfolio that mimics the payoff of owning a 3-month Delta Inc. European put with an exercise price of $55. Which of the following steps must you do in order to achieve this payoff? Buy 100 shares of the stock and pay 5000, Sell a call option and receive $125 for the option premium Short the present value of the exercise price and receive 5465.73. None of the above. QUESTION 5 What should be the price of 3-month European put option on Delta Inc that has an exercise price of $55? Round intermediate steps to four decimals and your final answer to two decimals. Do not use currency symbols or words when entering your response. QUESTION 6 Suppose that 3-month European put options with an exercise price of $55 are selling for $5.41. Which of the following statements is true? An arbitrage profit of approximately $50 per put can be made by selling puts in the market and creating a long position in synthetic put options. O An arbitrage profit of approximately $50 per put can be made by buying puts in the market and creating a short position in synthetic put options. The market is in equilibrium. Cannot be determined without knowing the stock price when the options expire

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts