Question: Question 4 Why did Joyson follow a two-step process (first a joint venture, then an acquisition) to expand internationally? Why did Joyson pursue an acquisition

Question 4 Why did Joyson follow a two-step process (first a joint venture, then an acquisition) to expand internationally? Why did Joyson pursue an acquisition instead of being satisfied with a joint venture with Preh?

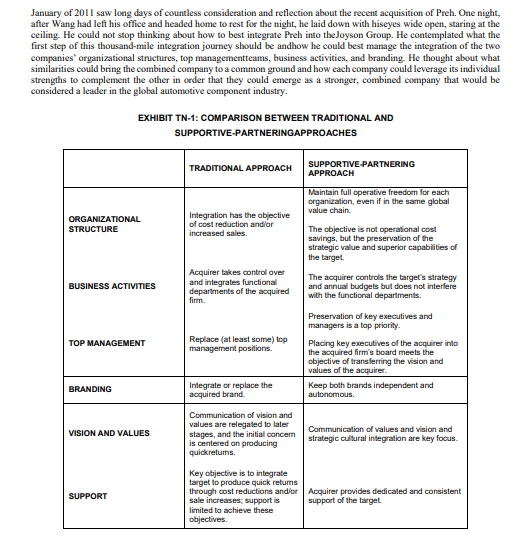

In January 2011, Wang Jiafeng (Jeff Wang), the chief executive officer (CEO) of the Chinese Joyson Group (Joyson), closed his eyes to savor the moment. Years of relationship building, careful planning, and an unwavering commitment to his strategic vision had at last come to fruition. Joyson was poised to become the transnational automotive supply company Wang had dreamt about. The company was set to acquire Preh GmbH (Preh), a first-tier German automotive supplier twice Joyson's size. Together, Joyson and Prehcould be powerful players in the global automotive parts supply market. The acquisition by Joyson would also provide Preh with financial resources and access to the lucrative Chinese automotive market, but onlyif the Chinese and German companies could be integrated successfully. The problem would be determininghow to make such an integration work when the buying firm had much lower capabilities in terms of management and soft skills, such as marketing and human resources management, but also lower technicalcapabilities compared to the firm it was acquiring. JOYSON GROUP: AMBITION, VISION, AND SHREWD STRATEGY Jeff Wang had lived and breathed the automotive components market from an early age: his family startedand had run an automotive supply firm since the 1970s. The family business focused on manufacturing simple components, and, following the early death of Wang's father, it experienced low growth for many years. Jeff Wang returned to the family The University of the West Indies Course Code: MGMT 3037 2022/ 04/011 page 3 business after a brief period working as a middle-school teacherin the 1980s, and with his help, the company began to grow. By the mid-1990s, the firm had become an established low-end component manufacturer in Ningbo. In 1995, the family sold 70 per cent of the US automotive systems supplier TRW Automotive Holdings Corp. (TRW), and at TRW's request, Wang stayed on as general manager until 2001. However, Wang was not happy with a role that he could not fully control, and in 2004, his entrepreneurialspirit led him to start Ningbo Joyson Company Ltd., later Joyson Company Ltd., in the high-tech zone of the Chinese city of Ningbo, Zhejiang Province. As its founder, CEO, and major shareholder, Wang had an ambitious vision for the company. he aimed to build a first-tier, transnational automotive supply fimm. Thecompany had humble beginnings, focusing first on real estate and the manufacturing of automotive parts forthe low-end segment of the Chinese automotive component market. It commenced operations in 2004, and by the end of 2005, Joyson had produced its first automotive components products out of a small factory in Ningbo. These components were synchronously developed with the Chinese automotive assemblers CheryAutomobile Co. Ltd. (Chery) and Huachen Automotive Group Holdings Co. Ltd. Joyson then began to targettransnational assemblers with operations in China. a At the time, other transnational assemblers did not consider Joyson to be a viable supplier due to its lack ofproduction and engineering capabilities and its limited research and development (R&D) resources, they also had concerns over its quality control. Years of experience in the industry had taught Wang that Joyson'sproducts, which were in the low end of the automotive components market could be easily imitated by other Chinese competitors. To be successful, Joyson needed to address transnational assemblers' concerns and pre-empt its local competitors. To achieve these goals, Joyson began increasing production and buildingeconomies of scale by setting up a new factory and headquarters in Ningbo, in 2008, and an additional factory in Changchun, in 2009. These investments paid off: by the end of 2008, Joyson had become a qualified, first-tier local supplier for Volkswagen GmbH (VW) and a global supplier for the General Motors Company (GM) for the Chinese market. The First Acquisition While building production capacity was invaluable, growing organically and gradually developing advanced internal resources and capabilities would not be enough to enable Joyson to gain a significant market share in China. To achieve the CEO's transnational vision, the company would need to build its scale quickly. Wang was acutely aware of this and noted at the time that, after increasing its internal capacity, the company's first step was horizontal development through mergers and acquisitions to save time and to make the resources integration and allocation all over China."! The right opportunity to achieve the horizontal development arose later in 2009, when Joyson successfully bidfor Huade Plastics Corporation Ltd. (Huade)ata public auction. This was a bold move. Huade was an automotivecomponents producer that generated two and half times Joyson's revenue (approximately US$110 million) andhad twice as many employees (800 workers). Joyson's bid to purchase Huade for 1.8 billion, using financialresources generated from its real estate business, was successful. With this purchase, Joyson had acquired anautomotive supplier with similar product lines but better industry recognition and a very favorable reputationas a local original equipment manufacturer (OEM) supplier for such companies as Mercedes-Benz (Mercedes). Toyota Motor Corporation, and VW. The integration of Huade and Joyson was rapid, with Joyson fully integrating Huade operationally and functionally and replacing all of the company's board members.* Acquiring Huade improved Joyson's reputation and increased its product range, production capacity, and economies of scale. However, Joyson still needed a source of sustainable competitive advantage as Huadewas also in the low end of the automotive components supplier market. In late 2009 and early 2010, Joyson'ssenior management team began to consider supplying components to China's growing market for high-end automotive products, particularly in the electronics segment of the industry. At the time, car manufacturers 'demand for advanced electronic parts was increasing considerably in response to customer concerns for comfort and safety, and Joyson decided that successfully competing in the electronic components segmentwould drive significant company growth and become a source of sustainable higher profits. Daniel Rong and Rul Torres de Oliveira, "international Expansion of Chinese Emerging Market Multinational Corporations to Developed Markets: A Qualitative Analysis of Post-Acquisition and Integration Strategies." in Chinese Acquisitions in Developed Countries, ed Alessandra Vecchi (Cham Springer, 2019), 37-53, 44 Rul Torres de Oliveira and Daniel Rottig, "Managing Emerging Market Acquisitions in Europe: Integrating the Acquisition of the German Preh GmbH by the Chinese Jayson Group," in Doing Business in Europe, 3rd ed., ed. Gabriele Suder and Johan Lindeque (Los Angeles, Sage Publications 2018). (462); Rul Torres de Oliveira, The Emergence of Strategic Capabilities in a South-North Cross-Border M&A and their post Acquisition Process (DBA thesis, Alliance Business School, University of Manchester 2017). 146. Torres de Oliveira and Rottig. Managing Emerging Market Acquisitions in Europe." 462; * = RMB = Chinese yuan renminbi; *1 = US$0.152 on January 1, 2011 Torres de Oliveira and Rottig. "Managing Emerging Market Acquisitions in Europe." 462. However, developing the know-how and capabilities to become a key player in this segment internally would take too long and require capabilities and resources that Wang knew would be very difficult and risky to build and develop. Wang and Jinhong Fan, the company's chair and chief financial officer, discussed the problem repeatedly, always reaching the same conclusion: Joyson needed to acquire high-technology industrial capabilities rather than build them organically. However, they were unable to find a company with such capabilities in China and knew that achieving their objective would require a cross-border merger or acquisition. Consequently, Wang packed his bags and visited a country famous for the business systems with all the characteristics necessary to help him build and develop the company he had always wanted Joyson to become: Germany. After visiting a number of local fimms, Wang determined the perfect target: Preh GmbH (Preh), a first-tier German automotive electronics supplier. Preh GmbH Preh was founded in 1919 in Bad Neustadt an der Saale, approximately 200 kilometers (125 miles) east of Frankfurt am Main. The company initially produced wireless radios, and later television parts, and was known for its high-quality products. In 1988, Preh began producing automotive electronics including air-conditioning control systems. The business continued to grow, and by 2000, Preh employed 1,970 people. The private equity firm Deutsche Beteiligungs AG (DBAG) acquired Preh in 2003 and grew the companyrapidly through expansion to the United States and the establishment of production facilities in Portugal, Mexico, and Romania. With support from DBAG, Preh managed two profitable business units, one focusedon "products related to interactions between humans and machines and the other, on "e-mobility, such asbatteries for electric and hybrid vehicles." By 2007, Preh was under increasing pressure to establish a presence in Asia to service the Chinese, Korean,and Japanese markets, so it opened up a representative sales office in Shanghai. Preh's management soon realized that operating an office in China was very different from establishing a sales office in the United States or a manufacturing facility in Mexico. China was far more complex than they had anticipated. Preh'smanagement realized that it needed a local partner to support both sales and production, and the company began a search for a local company with which to establish an international joint venture. During a trip to Germany in 2007, Wang visited Preh as a potential investor. The visit left a very positive impact; Wang was impressed with Preh's efficient automotive operations and its facilities, which producedhigh-quality parts for the world's most recognized car manufacturers, including Bayerische Motoren Werke(BMW) AG and Mercedes-Benz AG. Preh was particularly well known for its consistent quality, high-technology car accessories for e-mobility applications, navigation systems, infotainment, and connectivitysolutions. At the time, Joyson had proposed a joint venture with Preh to produce electronic parts for VW in China. Preh rejected the proposal based on Joyson's lack of important capabilities and resources. At the time, Preh's CEO noted that his company was skeptical and remarked, So that was our first visit we have with Joyson The company was 3 years old, very young, and Jeff had a lot of dreams when we met. [There was an empty land] and he showed me nice CAD pictures about the factory that he was dreaming] but every Chinese company has nice CAD pictures. All the area was empty space.? Rui Torres de Oliveira, 'The Emergence of Strategic Capabilities in a South-North Cross-Border M&A and their post. Acquisition Process" (DBA thesis, Alliance Business School University of Manchester, 2017). Rui Torres de Oliveira, Sreevas Sahasranamam. Sandra Figueira and Justin Paul. "Upgrading without Formal Integration in M&A: The Role of Social Integration Global Strategy Journal 10, no. 3 (2020): 619-652,629 Torres de Oliveira, Sahasranamam, Figueira, and Paul, Upgrading without Formal Integration in M&A, 633; Torres de Oliveira, 'The Emergence of Strategic Capabilities in a South-North Cross-Border M&A 155. I think at that time he [Wang] said the company made a hundred million. We [didn't] believe that at the time. So we said, "Hey, not interesting for us..... --[You] have some basics, but it's not for us." Nonetheless, the companies remained in communication, and Preh's management visited Joyson in Chinain 2009 as Preh continued to explore partners that could assist it in its efforts to gain a foothold in the lucrative Chinese automotive market. It was during that visit when Preh realized Joyson lived up to everything it had planned, promised, and projected. GOING INTERNATIONAL Rapid economic growth in China since the economic reform of the late 1970s, along with the opening of the Chinese GOING INTERNATIONAL Rapid economic growth in China since the economic reform of the late 1970s, along with the opening of the Chinese economy to inbound interational investment, provided the Chinese government and local multinational corporations (MNCs) with the capital and confidence to embrace outward foreign direct investment (OFDI). Since 1999, the Chinese government encouraged OFDI to help propel China from developing to developed country status. This political focus on OFDI led to a proliferation of Chinese MNCspursuing international acquisitions, yet with only meagre success. As a result, the Chinese government adjusted its OFDI policy and regulations in 2007. These changes were aimed at ensuring that Chinese firms had built and developed the managerial capacity and experience necessary to undertake such internationalacquisitions prior to undertaking such transactions. This policy made it a prerequisite for both private and state-owned Chinese companies seeking government approval for OFDI to demonstrate that they had both well- developed business plans and adequate managerial and mergers and acquisitions (M&A) integration skills for any proposed international acquisitions. Joyson was in a good position to meet these approval requirements as the company had built its managerialexpertise while successfully integrating Huade in 2009. More importantly, Joyson had a carefully developed business plan with a clear path to growth and segment upgrading. If Joyson could acquire Preh, it would moveaway from targeting the low-end automotive supplier segment and become a successful player in the high-end electronics segment of the market. In so doing, Joyson The University of the West Indies Course Code: MGMT 3037 2022/ 04/011 page 5 could acquire superior capabilities that would allow it to appeal to a higher-end market segment something the Chinese government encouraged firms todo. In addition, Joyson would also benefit from Preh's network of European and US offices, which wouldfacilitate a global expansion of its operations. Hence, acquiring Preh became Wang's priority. The Long Road to Partnership The global financial crisis in 2008 created difficult conditions for European automotive supply companies and the private equity firm DBAG, which owned Preh, sought to exit the company. DBAG's focus was onsecuring a quick sale to a strategic buyer, and Wang was convinced that Preh was the ideal target for an acquisition. However, Preh's management team had significant concems. Preh's managers remained cautiousand skeptical of Joyson's capabilities despite Wang's enthusiasm and ambition for combining the companies. Years of gradual relationship building came to fruition in early 2010, when Joyson and Preh began formaltalks about starting a partnership. Even though Joyson aimed for full control, it initially had to accept the formation of an international joint venture to convince Preh to move forward in August 2010. The joint venture focused on producing parts and components exclusively for the Chinese market; this helped Preh'smanagement team develop confidence in Joyson and increased their trust in Wang. However, Wang was not satisfied, but remained committed to gaining full ownership of Preh. As discussions between the two companies continued, DBAG and Preh's management team began to acknowledge the strategic benefits of an acquisition by Joyson Group. An acquisition by Joyson would provide Preh with ready access both to the necessary capital for innovations and R&D and to China, the world's largest automotive market. Preh had a representative office in China but had struggled to overcomethe various facets of its "liability of foreignness in the country; these included language barriers and cultural problems as well as a lack of experience in dealing with the local government and adjusting to different and constantly changing rules and regulations and a lack of knowledge about local customers andbusiness partners. For Joyson, acquiring Preh would provide the capabilities needed to fulfil Wang's vision of becoming a superior transnational automotive supply firm and would also give the company access to the European and US markets. Negotiations culminated in Joyson agreeing to acquire 74.9 per cent of Prehin April 20112 After listing the company on the Shanghai Stock Exchange in 2012 to raise capital, Joysonacquired the remaining 25.1 per cent of Preh. Years of building trust and confidence had finally paid off, but Wang knew that his global vision would only come to fruition with a successful post-acquisition integration of Preh into the Joyson Group. The Integration, or Lack Thereof Joyson had gained post-acquisition integration experience when it implemented the purchase of Huade, a low-end Chinese automotive components producer, which it fully integrated. Wang and Fan knew, however, that integrating a high-end Western European automotive components producer with superior managerial skills and engineering capabilities was a very different proposition. Aware of the many failed acquisitions of other Chinese companies in developed markets." Wang and Fan also knew that internationalacquisitions often failed during integration due to cultural clashes and a lack of managerial skills and capabilities needed to integrate foreign firms. Wang and Fan had repeatedly asked themselves how a low-capability company like Joyson could effectively manage and successfully integrate a firm from Germany with superior managerial and engineering skills and capabilities. When reviewing common approaches to post-acquisition integration, they noticed that examples tended to focus on acquisitions by companies from developed markets (primarily by US and Western European firmsacquiring targets in developed or emerging markets). These provided guidelines for post-acquisition integration for Westem firms acquiring companies with either equivalent or inferior managerial and technicalskills and capabilities, and the dominant perspective was that such acquirers should quickly replace key executives in the acquired company and integrate business operations and functional departments in the combined company to achieve economies of scope and scale to produce quick returns. Wang and Fan, however, questioned whether such an approach would be in the best interest of both Joyson and the acquired acquisitions by companies from developed markets (primarily by US and Western European firmsacquiring targets in developed or emerging markets). These provided guidelines for post-acquisition integration for Westem fimms acquiring companies with either equivalent or inferior managerial and technicalskills and capabilities, and the dominant perspective was that such acquirers should quickly replace key executives in the acquired company and integrate business operations and functional departments in the combined company to achieve economies of scope and scale to produce quick returns. Wang and Fan, however, questioned whether such an approach would be in the best interest of both Joyson and the acquired company, and they were particularly concerned about how best to integrate the two companies' organizationalstructures, top management teams, and business activities, how to brand the combined company's products, and how and when to develop and communicate the combined company's vision and values. Organizational Structure Preh GmbH possessed a well-designed organizational structure that supported its innovative organizational culture and efficient operations. All parts of the organization worked in concert to support the company's research and development activities, efficient manufacturing, and quality control processes in order to maintain a competitive advantage over its rivals. In fact, Preh's organizational structure was one of the corecompetencies the company had built over decades, based on its experience and operation in the very The University of the West Indies Course Code: MGMT 3037 2022/04/011 page 6 "Torres de Oliveira, Sahasranamam, Figueira, and Paul. "Upgrading without Formal Integration in MBA 638 1a Torres de Oliveira, Sahasranamam, Figueira, and Paul, Upgrading without Formal Integration in M&A,"629. 1a Figueira, Torres de Oliveira, Rottig, and Spigarell, "Lessons on a novel Integration approach of emerging market acquisitions indeveloped countries." International Journal of Emerging Markets 16, no. 4 (2021) 545-673. competitive German high-end automotive supplier market. Joyson's organizational structure, however, wasmore aligned with the mass production of low-end automotive components, it focused less on research anddevelopment activities and more on cost savings. In addition, Preh's strength and expertise was situated in the electronics segment of the high-end automotive supplier marketa segment in which Joyson had neither experience nor capabilities and Preh's sophisticated organizational structure allowed it not only to create cutting-edge innovations in this segmentbut also to realize them by producing novel components efficiently and introducing them to the market ahead of its competition. Wang, therefore, was determined to keep Preh's focus on electronics in the industry and to foster its innovative organizational culture and efficient organizational structure and processes. As a result, he was hesitant to follow a conventional integration approach that would integrate the organizational structures of the two companies with the objective of reducing costs and standardizing processes, and he repeatedly called Fan to discuss how they could best combine and manage the organizational structures of the two companies post-acquisition. Top Management Preh's top management team was renowned in the industry as it comprised highly qualified executives withextensive experience in the highly competitive German high-end automotive components segment. Indeed,Preh's executives were highly regarded both internally, for their superior managerial skills and technical understanding of the company's products and processes, and externally, for their industry knowledge and experience and the many connections they had built upstream and downstream in the firm's value chain. Theirdownstream connections and relationships with customers (i.e., the high-end German car manufacturers towhich Preh delivered OEM products) were particularly invaluable to Joyson. Wang had a realistic view ofJoyson's managerial capabilities, which were inferior by far to those of Preh's top management team. Wangwas particularly concerned about the risk of losing key senior managers and technical personnel if the company followed a conventional integration approach of replacing at least some top managers. Wang recalled the many conversations with Fan, who constantly reminded him that many international acquisitions he researched had failed because of changes in the key management personnel of the acquired companies. Fan even mentioned that mere rumors that the acquirer would replace those in key positions often led key managers and executives of target companiesespecially those who were attractive to othercompanies to leave voluntarily. Wang knew that Preh's key managers, executives, and engineers had impeccable reputations in the industryand so were quite marketable and would likely be offered positions at competing companies in Germany's high-end automotive components industry once the acquisition of Preh by Joyson was announced to the public. Furthermore, Wang remembered the painstaking relationship-building efforts he had undertaken since 2007, when he first visited Preh GmbH in Germany and started to build a good relationship and rapport withthe company's top managers and key personnel. Wang called Fan to explore how best to integrate the top management teams from both and how to avoid losing key top-level managers and senior personnel, who heconsidered to be Preh's most valuable assets. Business Activities Preh's business activities from R&D and procurement processes to the production, distribution, and servicingof high-end components were not only sophisticated on their own but also integrated like a well-oiled machine. All business activities across the company's supply chain were coordinated and aligned with the company's production, marketing, sales, and service operations. For example, Preh's procurement processes optimized thehighly specific purchasing requirements that the company needed to maintain in order to produce reliable high-end components and so also supported the marketing, sales, distribution, and servicing end of the business (e.g.by ensuring the lowest default rates of its components and so setting the standard within the industry). Preh's financing activities were aligned with industry standards and individual agreements the company had with high- end automotive manufacturers in Germany. And the company's R&D processes were focused on state-of-the-art innovation and an environment in which the most creative engineers could takerisks and experiment, creating path- breaking concepts and novel components that would revolutionize theindustry. In fact, Wang remembered the remark of a Preh executive, who said that the company could be even more innovative and further reduce the R&D cycle for new components if it had additional funds, which the company would most certainly allocate toward more research and development activities. Vision and Values Traditional acquisition integration approaches, which focused on short-term cost reductions and on creatingsynergy by integrating organizational structures and functional departments, consolidating business activities, and combining workforces, typically relegated the development and communication of a combined vision andvalues to later stages in the process. This focus was often rooted in pressures from shareholders, investors, and financial analysts, who wanted to see quick results and tangible benefits in order to achieve rapid returson their investments and view the acquisition and combined company favorably. Wang, who was bom and raised in China (which arguably had the longest continuous history of any countryin the world, with more than 3.500 years of written history), had a different perspective on when and how to communicate a vision and mission for the combined company. Wang understood that the Chinese and German cultures were different, and he was quite aware that Joyson's and Preh's organizational cultures had little in common. He was aware that integrating the two companies would be complex and time consuming, but he remembered an old Chinese proverb that said, "A joumey of a thousand miles begins with a single step." As an interested student of Western culture, Wang also remembered a quote that is commonly attributed to the US novelist Tom Robbins: "Our similarities bring us to a common ground; our differences allow us to be fascinated by each other." The University of the West Indies Course Code: MGMT 3037 2022/04/011 page 8 Clearly, Wang was fascinated by Preh's superior managerial skills and engineering capabilities, its highly qualified and experienced top management team, its superior image and reputation, and its highly sophisticatedand integrated business activities and processes. However, he was also proud of the family business he haddeveloped into a leading automotive supplier in China, which had been able to acquire one of the world's mostreputable, high-end component manufacturers. He knew that Jayson had much to offer to Prelfrom potentiallyopening the vast Chinese market for the company to infusing financial resources that would make Preh stronger more innovative, and so even more competitive within the high-end segment of the automotive componentsindustry. He also envisioned the amazing potential, for Joyson, of leaming from Preh how to produce high-endcomponents and so become a major automotive supplier not only in China but globally. January of 2011 saw long days of countless consideration and reflection about the recent acquisition of Preh. One night, after Wang had left his office and headed home to rest for the night, he laid down with hiseyes wide open, staring at the ceiling. He could not stop thinking about how to best integrate Preh into the Joyson Group. He contemplated what the first step of this thousand-mile integration journey should be andhow he could best manage the integration of the two companies' organizational structures, top managementteams, business activities, and branding. He thought about what similarities could bring the combined company to a common ground and how each company could leverage its individual strengths to complement the other in order that they could emerge as a stronger, combined company that would be a considered a leader in the global automotive component industry, January of 2011 saw long days of countless consideration and reflection about the recent acquisition of Preh. One night, after Wang had left his office and headed home to rest for the night, he laid down with hiseyes wide open, staring at the ceiling. He could not stop thinking about how to best integrate Preh into the Joyson Group. He contemplated what the first step of this thousand-mile integration journey should be andhow he could best manage the integration of the two companies' organizational structures, top managementteams, business activities, and branding. He thought about what similarities could bring the combined company to a common ground and how each company could leverage its individual strengths to complement the other in order that they could emerge as a stronger, combined company that would be considered a leader in the global automotive component industry, EXHIBIT TN-1: COMPARISON BETWEEN TRADITIONAL AND SUPPORTIVE-PARTNERINGAPPROACHES TRADITIONAL APPROACH SUPPORTIVE PARTNERING APPROACH Maintain full operative freedom for each organization, even if in the same global value chain ORGANIZATIONAL STRUCTURE Integration has the objective of cost reduction and/or increased sales. The objective is not operational cost savings, but the preservation of the strategic value and superior capabilities of the target The acquirer controls the target's strategy and annual budgets but does not interfere with the functional departments. BUSINESS ACTIVITIES Acquirer takes control over and integrates functional departments of the acquired firm. TOP MANAGEMENT Replace (at least some) top management positions. Preservation of key executives and managers is a top priority Placing key executives of the acquirer into the acquired firm's board meets the objective of transferring the vision and values of the acquirer. Keep both brands independent and autonomous BRANDING Integrate or replace the acquired brand. VISION AND VALUES Communication of vision and values are relegated to later stages, and the initial concern is centered on producing quickreturns. Communication of values and vision and strategic cultural integration are key focus. SUPPORT Key objective is to integrate target to produce quick retums through cost reductions and/or Acquirer provides dedicated and consistent sale increases, support is support of the target limited to achieve these objectivesStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts