Question: Question 4 You are planning to attend an master level Program that will require payment of ( $ 1 2 , 0 0

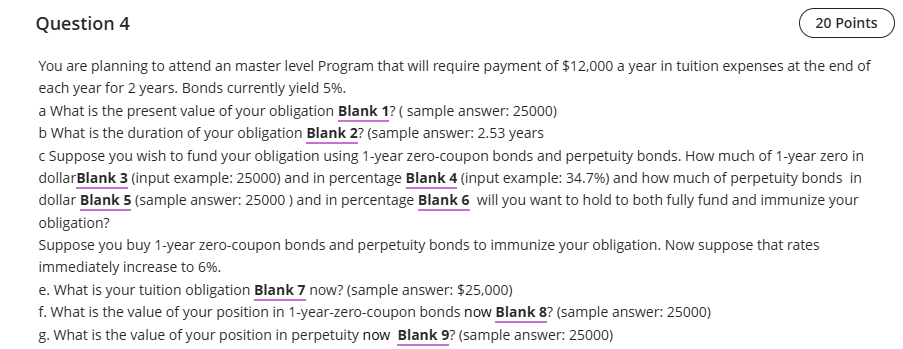

Question You are planning to attend an master level Program that will require payment of $ a year in tuition expenses at the end of each year for years. Bonds currently yield a What is the present value of your obligation Blank sample answer: b What is the duration of your obligation Blank sample answer: years c Suppose you wish to fund your obligation using year zerocoupon bonds and perpetuity bonds. How much of year zero in dollarBlank input example: and in percentage Blank input example: and how much of perpetuity bonds in dollar Blank sample answer: and in percentage Blank will you want to hold to both fully fund and immunize your obligation? Suppose you buy year zerocoupon bonds and perpetuity bonds to immunize your obligation. Now suppose that rates immediately increase to e What is your tuition obligation Blank now? sample answer: $ f What is the value of your position in yearzerocoupon bonds now Blank sample answer: g What is the value of your position in perpetuity now Blank sample answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock