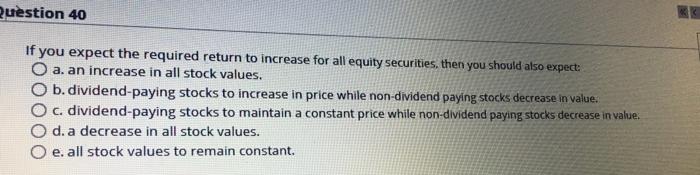

Question: Question 40 If you expect the required return to increase for all equity securities, then you should also O a. an increase in all stock

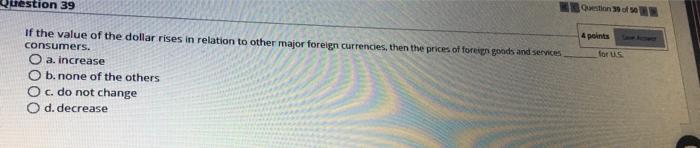

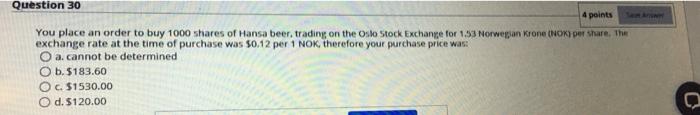

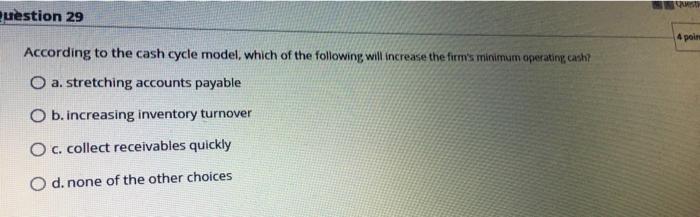

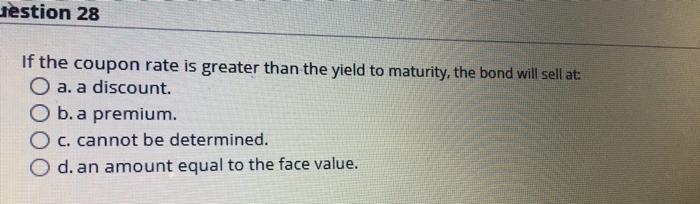

Question 40 If you expect the required return to increase for all equity securities, then you should also O a. an increase in all stock values. expect: O b. dividend-paying stocks to increase in price while non-dividend paying stocks decrease in value. O c. dividend-paying stocks to maintain a constant price while non-dividend paying stocks decrease in value. O d. a decrease in all stock values. O e. all stock values to remain constant. Question 39 Question 4 points for us If the value of the dollar rises in relation to other major foreign currencies, then the prices of foreign goods and services consumers. O a. increase b. none of the others O c. do not change O d. decrease Question 30 4 points You place an order to buy 1000 shares of Hansa beer, trading on the Oslo Stock Exchange for 153 Norwepan Krone (NOK per Share the exchange rate at the time of purchase was 50.12 per 1 NOK, therefore your purchase price was: O a. cannot be determined O b. 5183.60 C. $1530.00 O d. $120.00 o uestion 29 4 point According to the cash cycle model, which of the following will increase the firm's minimum operating cash? O a. stretching accounts payable O b.increasing inventory turnover O c. collect receivables quickly O d. none of the other choices Jestion 28 If the coupon rate is greater than the yield to maturity, the bond will sell at: O a. a discount. b. a premium. O c. cannot be determined. d. an amount equal to the face value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts