Question: Question 41 (1 point) One difference between the double-declining-balance method and the straight-line method is that the double-declining-balance method: uses book value instead of depreciable

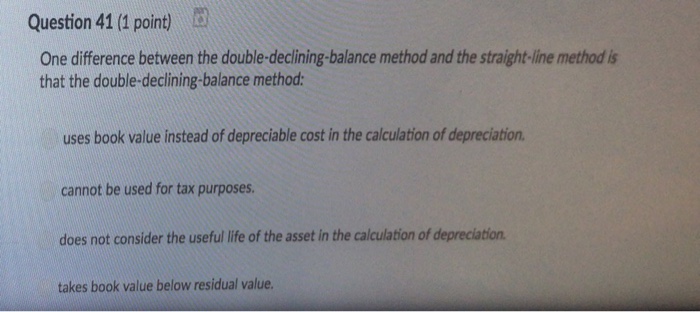

Question 41 (1 point) One difference between the double-declining-balance method and the straight-line method is that the double-declining-balance method: uses book value instead of depreciable cost in the calculation of depreciation cannot be used for tax purposes does not consider the useful life of the asset in the calculation of depreciation takes book value below residual value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock