Question: Question 42 (1 point) Folder A firm is considering a potential invesument project that would resurt in an immediate loss in free cash flow of

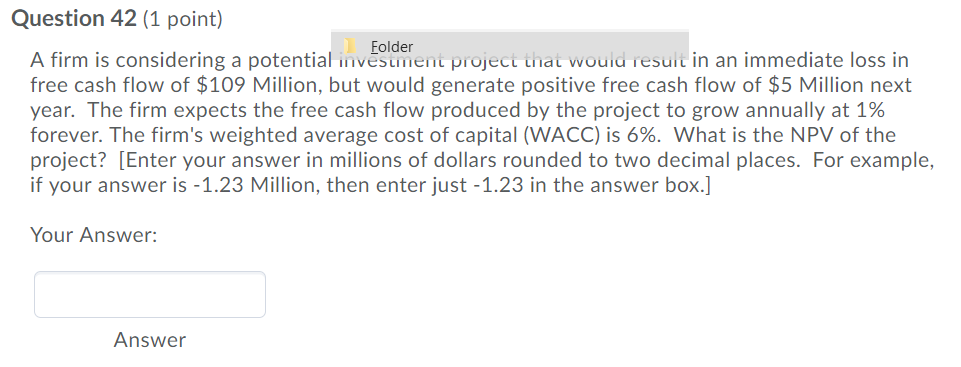

Question 42 (1 point) Folder A firm is considering a potential invesument project that would resurt in an immediate loss in free cash flow of $109 Million, but would generate positive free cash flow of $5 Million next year. The firm expects the free cash flow produced by the project to grow annually at 1% forever. The firm's weighted average cost of capital (WACC) is 6%. What is the NPV of the project? [Enter your answer in millions of dollars rounded to two decimal places. For example, if your answer is -1.23 Million, then enter just -1.23 in the answer box.] Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts