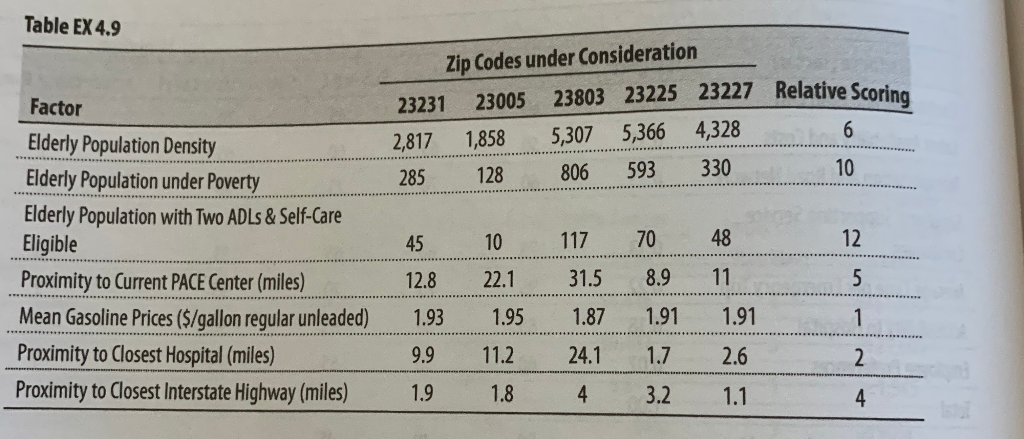

Question: question 4.9 all sections, please. Table EX 4.9 Zip Codes under consideration 23231 23005 2380323225 23227 Relative Scoring 2,817 1,858 5,307 5,366 4,328 6 285

question 4.9 all sections, please.

Table EX 4.9 Zip Codes under consideration 23231 23005 2380323225 23227 Relative Scoring 2,817 1,858 5,307 5,366 4,328 6 285 128 806 593 330 Factor Elderly Population Density Elderly population under Poverty Elderly Population with Two ADLs & Self-Care Eligible Proximity to Current PACE Center (miles) Mean Gasoline Prices ($/gallon regular unleaded) Proximity to Closest Hospital (miles) Proximity to Closest Interstate Highway (miles) 45 12.8 1.93 9.9 1.9 10 22.1 1.95 11.2 1.8 117 31.5 1.87 24.1 4 70 8.9 1.91 1.7 .2 48 11 1.91 2.6 1.1 3 c. Choose a location based on cost-volume analysis. f. After all the analyses above, which location would you support, and why? 4.9 Last year, Old Dominion Health System opened its second Program of All-Inclusive Care for the Elderly (PACE) Center in Richmond, Virginia, with a service area covering the majority of central Virginia. However, after two months of operation, management at Old Dominion is concerned that the Richmond PACE Center will not be able to meet the demand of its large service area. Forecasts indicate that the center will be at full capacity by year end and that another PACE Center in the Richmond metropolitan area is neces sary to meet community demand. Based on a preliminary analysis, management has narrowed down cations to five zip codes: 23231, 23005, 23803, 23225, and 23227. The of PACE has determined the factors to be considered in establishing including demand factors such as elderly population density and that a PACE Center should be easily accessible to community-based nursing facilities, and other complementary services, travel and dist also included. This data are displayed in Table EX 4.9. The potentie The executive ditto e a new PNCE.Cat od poverty levels ed providers, bei distance factors Table LX 49 Zip Codes under consideration 3121123005 2380323225 21227 Relative 2817 18 $30753660323 25 12 306 59330 Factor Elderly population Druty Elderly population unter Poverty Elderly Population with two ADLS & Sal-Gart big ble Proximity to C ent PICE Center Inled! Mean Gasoline Prices 15 galegular unleaded Punity to closest Hospitales Pradinity to closest estate Highway umies) 45 0917 704 128 22.1 315 29 11 193 195 187 1.91 1.91 99112 24. 11 .7 26 1.9 8 1. 4 3.2 1.1 a. Calculate the weight of each factor, and then determine the new location for a PACE Center based on the composite factor scores. Assume that the most desirable come is the largest value for the elderly population demographic factors, and the smallest value for proximity factors and gasoline prices. Assume that for the location selected in part (a), management must determine if PACE Center is financially feasible. Initial fixed costs for this location include $500,000 for investment in new equipment, $500,000 for transportation, and $75,000 for an annual building lease. Annual salary expense for full-time staff is estimated at $700,930. The cost for part-time staff members, including physical therapists, chaplains, and diedlans, semivariable. This expense is $80,724 until enrollment in the PACE Center exceeds sic members, at which time the cost will increase to $141,924. Variable costs are estimated at $3,500 per member per month and include costs for medical services, home care audes medications, van drivers, gas, and food. Combined Medicaid/Medicare leverde timated at $5,000 per member per month. The PACE Center is considered capacity with one hundred forty members. ered to be at til b. Construct a table that calculates the total costs, revenues, and profits to Center for enrollment levels of twenty to one hundred forty members, profits for a new MACE menibers, in increments of twenty. c. What is the break-even enrollment level for the first year of operation IMG_5011. HEIC @ Q Search Assume that in year 2 of the PACE Center's operations, fixed costs will be $75,000 for a building lease, $80,000 in miscellaneous equipment maintenance, and S714,950 in full- time salaries (adjusted for intlation). The semivariable costs for part-time staff should also be adjusted for a 2 percent inflation rate. As coordination of care improves, the cost per member per month is expected to decrease by S200, and the combined Medicaid/ Medicare per member per month rate is expected to fall to $4,500. d. Construct a new table that calculates the total costs, revenues, and profits for the PACE Center in year 2 for enrollment levels of twenty to one hundred lorty mem- bers, in increments of twenty: e. What is the break-even enrollment level for the second year of operation? f. Based on this analysis, would you support opening a PACE Center in the selected location? Why? What other data may be helpful in making this decision? luulord promoted a multichain hospital to sider and Table EX 4.9 Zip Codes under consideration 23231 23005 2380323225 23227 Relative Scoring 2,817 1,858 5,307 5,366 4,328 6 285 128 806 593 330 Factor Elderly Population Density Elderly population under Poverty Elderly Population with Two ADLs & Self-Care Eligible Proximity to Current PACE Center (miles) Mean Gasoline Prices ($/gallon regular unleaded) Proximity to Closest Hospital (miles) Proximity to Closest Interstate Highway (miles) 45 12.8 1.93 9.9 1.9 10 22.1 1.95 11.2 1.8 117 31.5 1.87 24.1 4 70 8.9 1.91 1.7 .2 48 11 1.91 2.6 1.1 3 c. Choose a location based on cost-volume analysis. f. After all the analyses above, which location would you support, and why? 4.9 Last year, Old Dominion Health System opened its second Program of All-Inclusive Care for the Elderly (PACE) Center in Richmond, Virginia, with a service area covering the majority of central Virginia. However, after two months of operation, management at Old Dominion is concerned that the Richmond PACE Center will not be able to meet the demand of its large service area. Forecasts indicate that the center will be at full capacity by year end and that another PACE Center in the Richmond metropolitan area is neces sary to meet community demand. Based on a preliminary analysis, management has narrowed down cations to five zip codes: 23231, 23005, 23803, 23225, and 23227. The of PACE has determined the factors to be considered in establishing including demand factors such as elderly population density and that a PACE Center should be easily accessible to community-based nursing facilities, and other complementary services, travel and dist also included. This data are displayed in Table EX 4.9. The potentie The executive ditto e a new PNCE.Cat od poverty levels ed providers, bei distance factors Table LX 49 Zip Codes under consideration 3121123005 2380323225 21227 Relative 2817 18 $30753660323 25 12 306 59330 Factor Elderly population Druty Elderly population unter Poverty Elderly Population with two ADLS & Sal-Gart big ble Proximity to C ent PICE Center Inled! Mean Gasoline Prices 15 galegular unleaded Punity to closest Hospitales Pradinity to closest estate Highway umies) 45 0917 704 128 22.1 315 29 11 193 195 187 1.91 1.91 99112 24. 11 .7 26 1.9 8 1. 4 3.2 1.1 a. Calculate the weight of each factor, and then determine the new location for a PACE Center based on the composite factor scores. Assume that the most desirable come is the largest value for the elderly population demographic factors, and the smallest value for proximity factors and gasoline prices. Assume that for the location selected in part (a), management must determine if PACE Center is financially feasible. Initial fixed costs for this location include $500,000 for investment in new equipment, $500,000 for transportation, and $75,000 for an annual building lease. Annual salary expense for full-time staff is estimated at $700,930. The cost for part-time staff members, including physical therapists, chaplains, and diedlans, semivariable. This expense is $80,724 until enrollment in the PACE Center exceeds sic members, at which time the cost will increase to $141,924. Variable costs are estimated at $3,500 per member per month and include costs for medical services, home care audes medications, van drivers, gas, and food. Combined Medicaid/Medicare leverde timated at $5,000 per member per month. The PACE Center is considered capacity with one hundred forty members. ered to be at til b. Construct a table that calculates the total costs, revenues, and profits to Center for enrollment levels of twenty to one hundred forty members, profits for a new MACE menibers, in increments of twenty. c. What is the break-even enrollment level for the first year of operation IMG_5011. HEIC @ Q Search Assume that in year 2 of the PACE Center's operations, fixed costs will be $75,000 for a building lease, $80,000 in miscellaneous equipment maintenance, and S714,950 in full- time salaries (adjusted for intlation). The semivariable costs for part-time staff should also be adjusted for a 2 percent inflation rate. As coordination of care improves, the cost per member per month is expected to decrease by S200, and the combined Medicaid/ Medicare per member per month rate is expected to fall to $4,500. d. Construct a new table that calculates the total costs, revenues, and profits for the PACE Center in year 2 for enrollment levels of twenty to one hundred lorty mem- bers, in increments of twenty: e. What is the break-even enrollment level for the second year of operation? f. Based on this analysis, would you support opening a PACE Center in the selected location? Why? What other data may be helpful in making this decision? luulord promoted a multichain hospital to sider andStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock