Question: question 4a and 4b to be answer 3. After some time, the bank from Question 1 was acquired by another bank and transformed into a

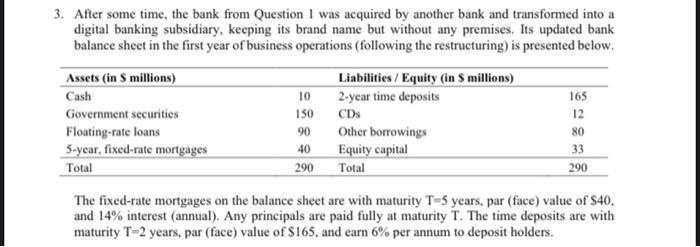

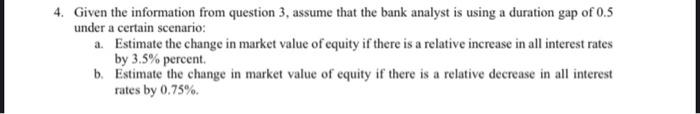

3. After some time, the bank from Question 1 was acquired by another bank and transformed into a digital banking subsidiary, keeping its brand name but without any premises. Its updated bank balance sheet in the first year of business operations (following the restructuring) is presented below. The fixed-rate mortgages on the balance sheet are with maturity T=5 years, par (face) value of $40, and 14% interest (annual). Any principals are paid fully at maturity T. The time deposits are with maturity T=2 years, par (face) value of $165, and earn 6% per annum to deposit holders. 4. Given the information from question 3 , assume that the bank analyst is using a duration gap of 0.5 under a certain scenario: a. Estimate the change in market value of equity if there is a relative increase in all interest rates by 3.5% percent. b. Estimate the change in market value of equity if there is a relative decrease in all interest rates by 0.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts