Question: Question 4C, could i get the answer both with values and in coding formal for the excell spreadsheet Question Q1a Q1b Q1c Q1d Q1e Q1f

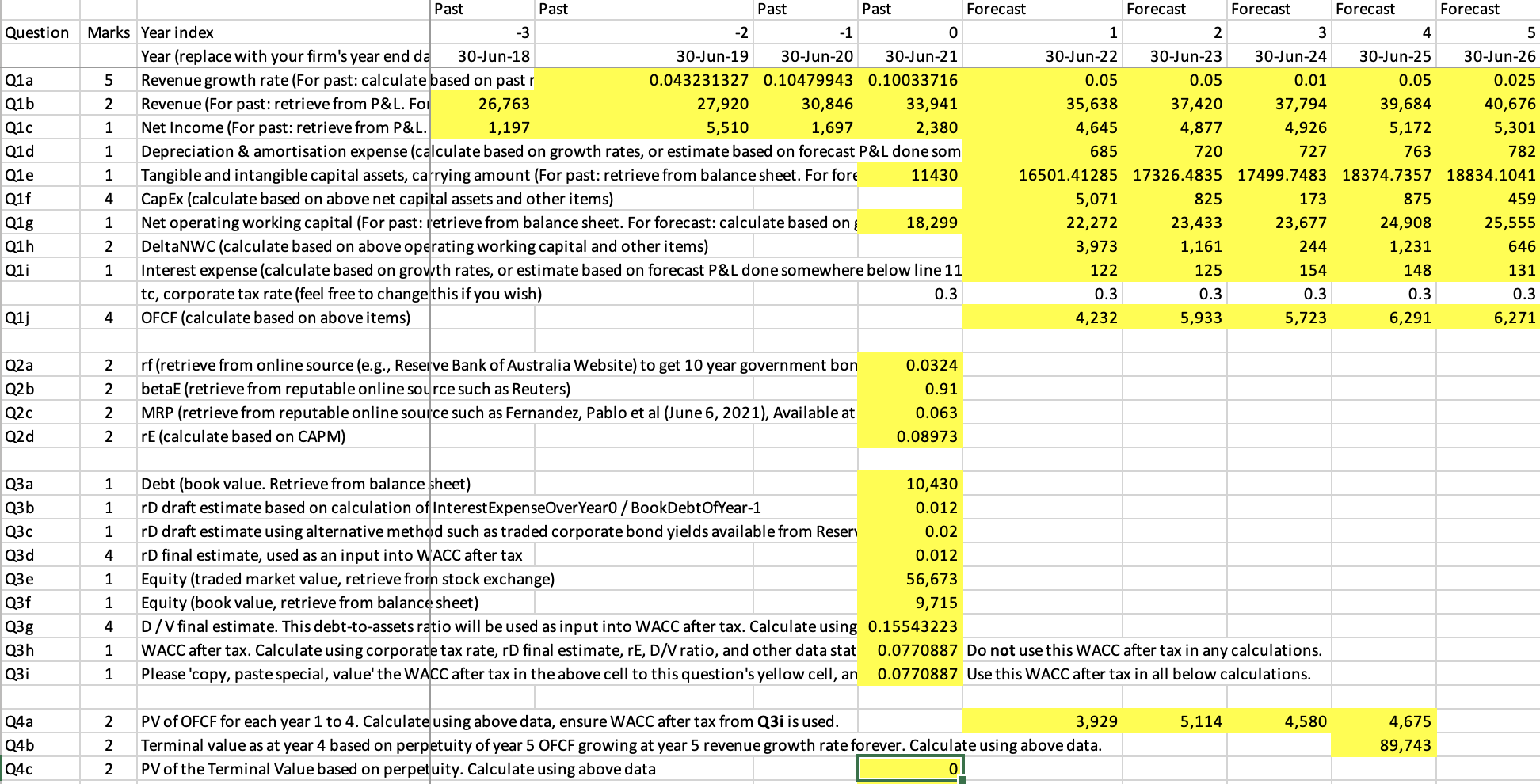

Question 4C, could i get the answer both with values and in coding formal for the excell spreadsheet

Question 4C, could i get the answer both with values and in coding formal for the excell spreadsheet

Question Q1a Q1b Q1c Q1d Q1e Q1f Q1g Q1h Q1i Past Past Past Past Forecast Forecast Forecast Forecast Forecast Marks Year index -3 -2 -1 0 1 2 3 4 5 Year (replace with your firm's year end da 30-Jun-18 30-Jun-19 30-Jun-20 30-Jun-21 30-Jun-22 30-Jun-23 30-Jun-24 30-Jun-25 30-Jun-26 5 Revenue growth rate (For past: calculate based on pastr 0.043231327 0.10479943 0.10033716 0.05 0.05 0.01 0.05 0.025 2 Revenue (For past: retrieve from P&L. For 26,763 27,920 30,846 33,941 35,638 37,420 37,794 39,684 40,676 1 Net Income (For past: retrieve from P&L. 1,197 5,510 1,697 2,380 4,645 4,877 4,926 5,172 5,301 1 Depreciation & amortisation expense (calculate based on growth rates, or estimate based on forecast P&L done som 685 720 727 763 782 1 Tangible and intangible capital assets, carrying amount (For past: retrieve from balance sheet. For fore 11430 16501.41285 17326.4835 17499.7483 18374.7357 18834.1041 4 CapEx (calculate based on above net capital assets and other items) 5,071 825 173 875 459 1 Net operating working capital (For past: retrieve from balance sheet. For forecast: calculate based on { 18,299 22,272 23,433 23,677 24,908 25,555 2 DeltaNWC (calculate based on above operating working capital and other items) 3,973 1,161 244 1,231 646 1 Interest expense (calculate based on growth rates, or estimate based on forecast P&L done somewhere below line 11 122 125 154 148 131 tc, corporate tax rate (feel free to change this if you wish) 0.3 0.3 0.3 0.3 0.3 0.3 4 OFCF (calculate based on above items) 4,232 5,933 5,723 6,291 6,271 Q1j 2 2 Q2a Q2b Q2c Q2d M M rf (retrieve from online source (e.g., Reserve Bank of Australia Website) to get 10 year government bon betaE (retrieve from reputable online source such as Reuters) MRP (retrieve from reputable online source such as Fernandez, Pablo et al (June 6, 2021), Available at rE (calculate based on CAPM) 0.0324 0.91 0.063 0.08973 2 2 1 1 1 4 Q Q3b Q3c Q3d Q Q3f Q3g Q3h Q3i 1 Debt (book value. Retrieve from balance sheet) 10,430 rD draft estimate based on calculation of Interest ExpenseOver Yearo / BookDebtOfYear-1 0.012 rD draft estimate using alternative method such as traded corporate bond yields available from Resery 0.02 rD final estimate, used as an input into WACC after tax 0.012 Equity (traded market value, retrieve frorn stock exchange) 56,673 Equity (book value, retrieve from balance sheet) 9,715 D/V final estimate. This debt-to-assets ratio will be used as input into WACC after tax. Calculate using 0.15543223 WACC after tax. Calculate using corporate tax rate, rd final estimate, rE, DN ratio, and other data stat 0.0770887 Do not use this WACC after tax in any calculations. Please 'copy, paste special, value' the WACC after tax in the above cell to this question's yellow cell, an 0.0770887 Use this WACC after tax in all below calculations. 1 4 1 1 2 5,114 4,580 Q4a Q4b Q4c NNN PV of OFCF for each year 1 to 4. Calculate using above data, ensure WACC after tax from Q3i is used. 3,929 Terminal value as at year 4 based on perpetuity of year 5 OFCF growing at year 5 revenue growth rate forever. Calculate using above data. PV of the Terminal Value based on perpetuity. Calculate using above data 0 4,675 89,743 2 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts