Question: QUESTION 5 1 points Save Answer Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate (xt) at time

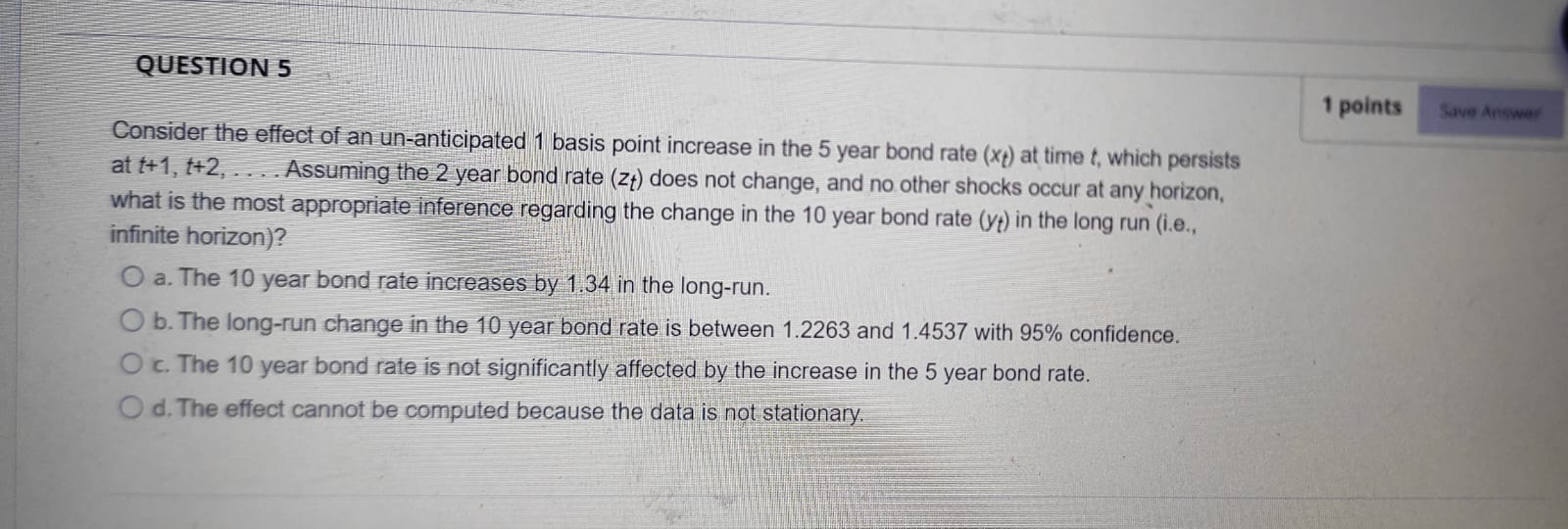

QUESTION 5 1 points Save Answer Consider the effect of an un-anticipated 1 basis point increase in the 5 year bond rate (xt) at time t, which persists at t+1, t+2, . ... Assuming the 2 year bond rate (z+) does not change, and no other shocks occur at any horizon, what is the most appropriate inference regarding the change in the 10 year bond rate (yt) in the long run (i.e., infinite horizon)? O a. The 10 year bond rate increases by 1.34 in the long-run. O b. The long-run change in the 10 year bond rate is between 1.2263 and 1.4537 with 95% confidence. O c. The 10 year bond rate is not significantly affected by the increase in the 5 year bond rate. O d. The effect cannot be computed because the data is not stationary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts