Question: Question 5 1 points Save Answer On 1 August 2020, a fire caused by an angry (previously dismissed) employee damaged three industrial ovens at the

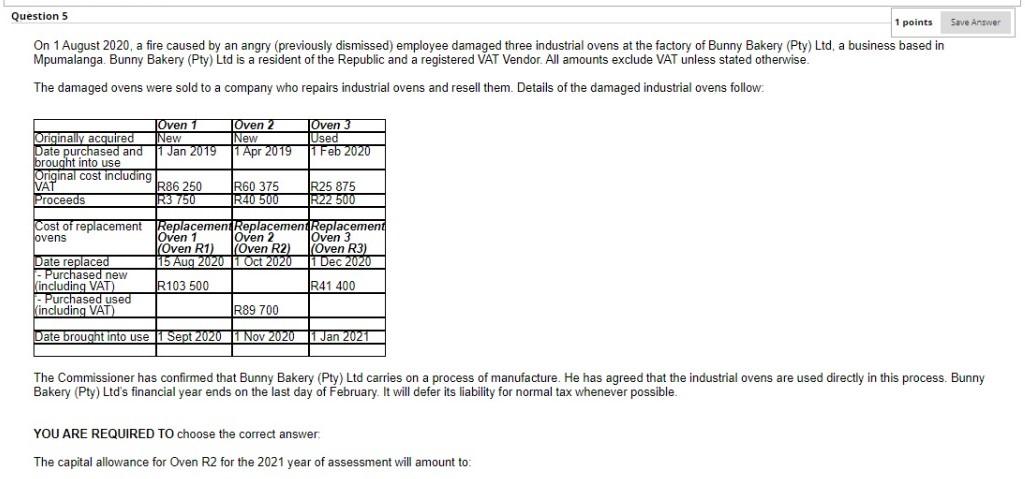

Question 5 1 points Save Answer On 1 August 2020, a fire caused by an angry (previously dismissed) employee damaged three industrial ovens at the factory of Bunny Bakery (Pty) Ltd a business based in Mpumalanga Bunny Bakery (Pty) Ltd is a resident of the Republic and a registered VAT Vendor. All amounts exclude VAT unless stated otherwise The damaged ovens were sold to a company who repairs industrial ovens and resell them. Details of the damaged industrial ovens follow Oven Used 1 Feb 2020 Oven 1 TOven 2 Originally acquired New New Date purchased and 1 Jan 2019 1 Apr 2019 brought into use Original cost including VAT R86 250 R60 375 Proceeds TR3750 R40 500 R25 875 R22 500 Cost of replacement Replacement Replacement Replacement jovens Oven 1 JOven 2 Oven 3 Oven R1) Oven R2) (Oven R3) Date replaced 115 Aug 2020 1 Oct 2020 1 Dec 2020 - Purchased new including VAT) R103 500 R41 400 - Purchased used including VAT) R89 700 Date brought into use 1 Sept 2020 1 Nov 2020 1 Jan 2021 The Commissioner has confirmed that Bunny Bakery (Pty) Ltd carries on a process of manufacture. He has agreed that the industrial ovens are used directly in this process. Bunny Bakery (Pty) Ltd's financial year ends on the last day of February. It will defer its liability for normal tax whenever possible YOU ARE REQUIRED TO choose the correct answer The capital allowance for Oven R2 for the 2021 year of assessment will amount to: Question 5 1 points Save Answer On 1 August 2020, a fire caused by an angry (previously dismissed) employee damaged three industrial ovens at the factory of Bunny Bakery (Pty) Ltd a business based in Mpumalanga Bunny Bakery (Pty) Ltd is a resident of the Republic and a registered VAT Vendor. All amounts exclude VAT unless stated otherwise The damaged ovens were sold to a company who repairs industrial ovens and resell them. Details of the damaged industrial ovens follow Oven Used 1 Feb 2020 Oven 1 TOven 2 Originally acquired New New Date purchased and 1 Jan 2019 1 Apr 2019 brought into use Original cost including VAT R86 250 R60 375 Proceeds TR3750 R40 500 R25 875 R22 500 Cost of replacement Replacement Replacement Replacement jovens Oven 1 JOven 2 Oven 3 Oven R1) Oven R2) (Oven R3) Date replaced 115 Aug 2020 1 Oct 2020 1 Dec 2020 - Purchased new including VAT) R103 500 R41 400 - Purchased used including VAT) R89 700 Date brought into use 1 Sept 2020 1 Nov 2020 1 Jan 2021 The Commissioner has confirmed that Bunny Bakery (Pty) Ltd carries on a process of manufacture. He has agreed that the industrial ovens are used directly in this process. Bunny Bakery (Pty) Ltd's financial year ends on the last day of February. It will defer its liability for normal tax whenever possible YOU ARE REQUIRED TO choose the correct answer The capital allowance for Oven R2 for the 2021 year of assessment will amount to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts