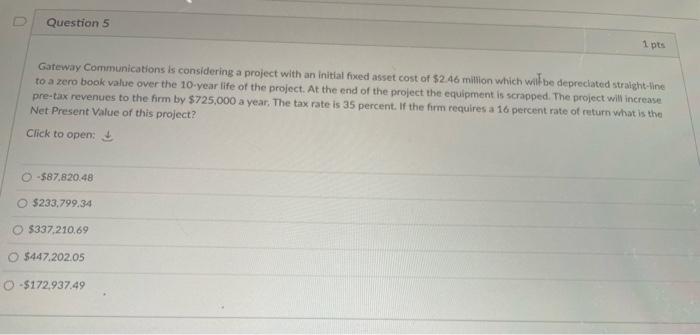

Question: Question 5 1 pts Gateway Communications is considering a project with an initial fixed asset cost of $2.46 million which will be depreciated straight-line to

Question 5 1 pts Gateway Communications is considering a project with an initial fixed asset cost of $2.46 million which will be depreciated straight-line to a zero book value over the 10-year life of the project. At the end of the project the equipment is scrapped. The project will increase pre-tax revenues to the firm by $725,000 a year. The tax rate is 35 percent. If the firm requires a 16 percent rate of return what is the Net Present Value of this project? Click to open: -587.820.48 O $233,799.34 O $337,210,69 $447.202.05 0-$172,937.49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts