Question: Question 5 1 pts Portfolio optimization involves three steps: asset allocation, security selection, and capital allocation. This question is about security selection. To simply the

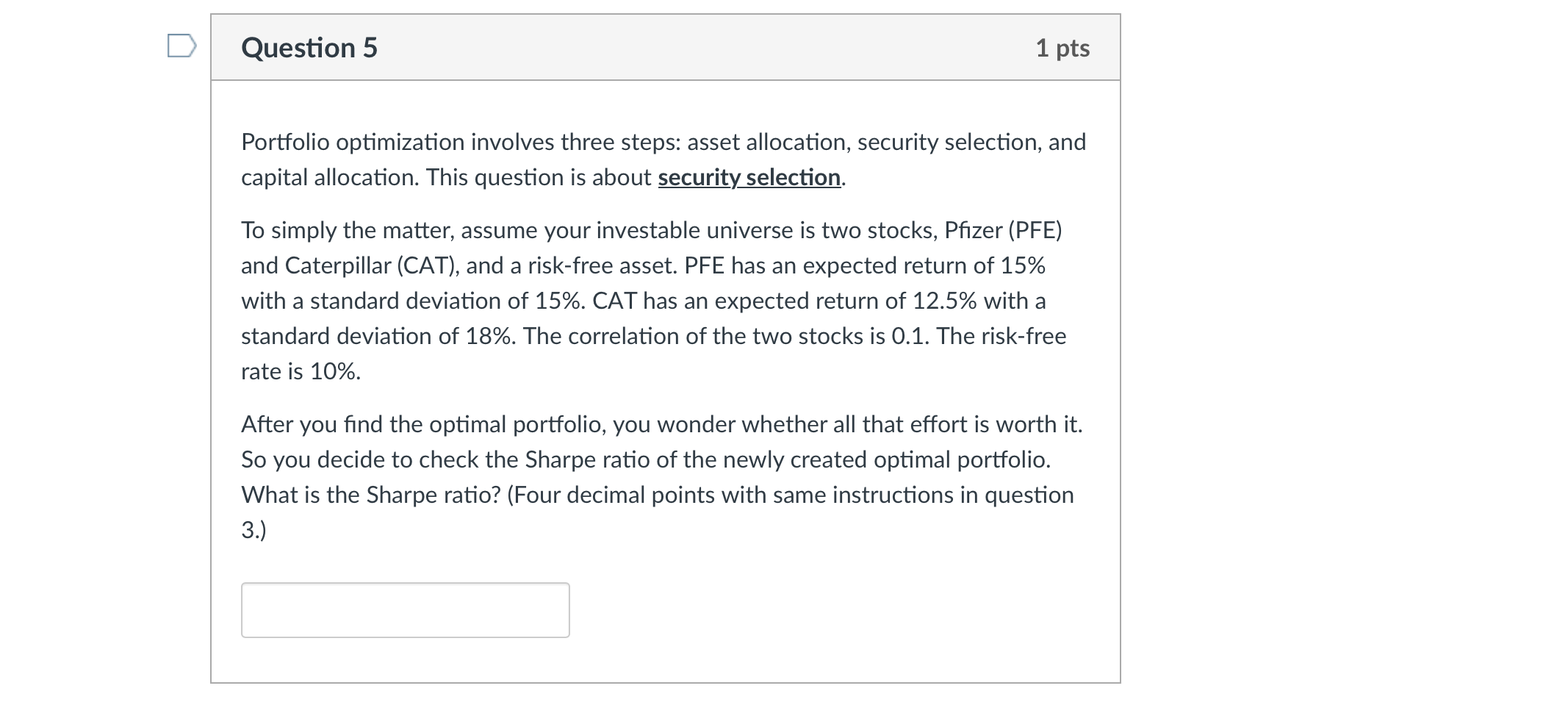

Question 5 1 pts Portfolio optimization involves three steps: asset allocation, security selection, and capital allocation. This question is about security selection. To simply the matter, assume your investable universe is two stocks, Pfizer (PFE) and Caterpillar (CAT), and a risk-free asset. PFE has an expected return of 15% with a standard deviation of 15%. CAT has an expected return of 12.5% with a standard deviation of 18%. The correlation of the two stocks is 0.1. The risk-free rate is 10%. After you find the optimal portfolio, you wonder whether all that effort is worth it. So you decide to check the Sharpe ratio of the newly created optimal portfolio. What is the Sharpe ratio? (Four decimal points with same instructions in question 3.) Question 5 1 pts Portfolio optimization involves three steps: asset allocation, security selection, and capital allocation. This question is about security selection. To simply the matter, assume your investable universe is two stocks, Pfizer (PFE) and Caterpillar (CAT), and a risk-free asset. PFE has an expected return of 15% with a standard deviation of 15%. CAT has an expected return of 12.5% with a standard deviation of 18%. The correlation of the two stocks is 0.1. The risk-free rate is 10%. After you find the optimal portfolio, you wonder whether all that effort is worth it. So you decide to check the Sharpe ratio of the newly created optimal portfolio. What is the Sharpe ratio? (Four decimal points with same instructions in question 3.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts