Question: Question 6 1 pts Portfolio optimization involves three steps: asset allocation, security selection, and capital allocation. This question is about capital allocation. You just found

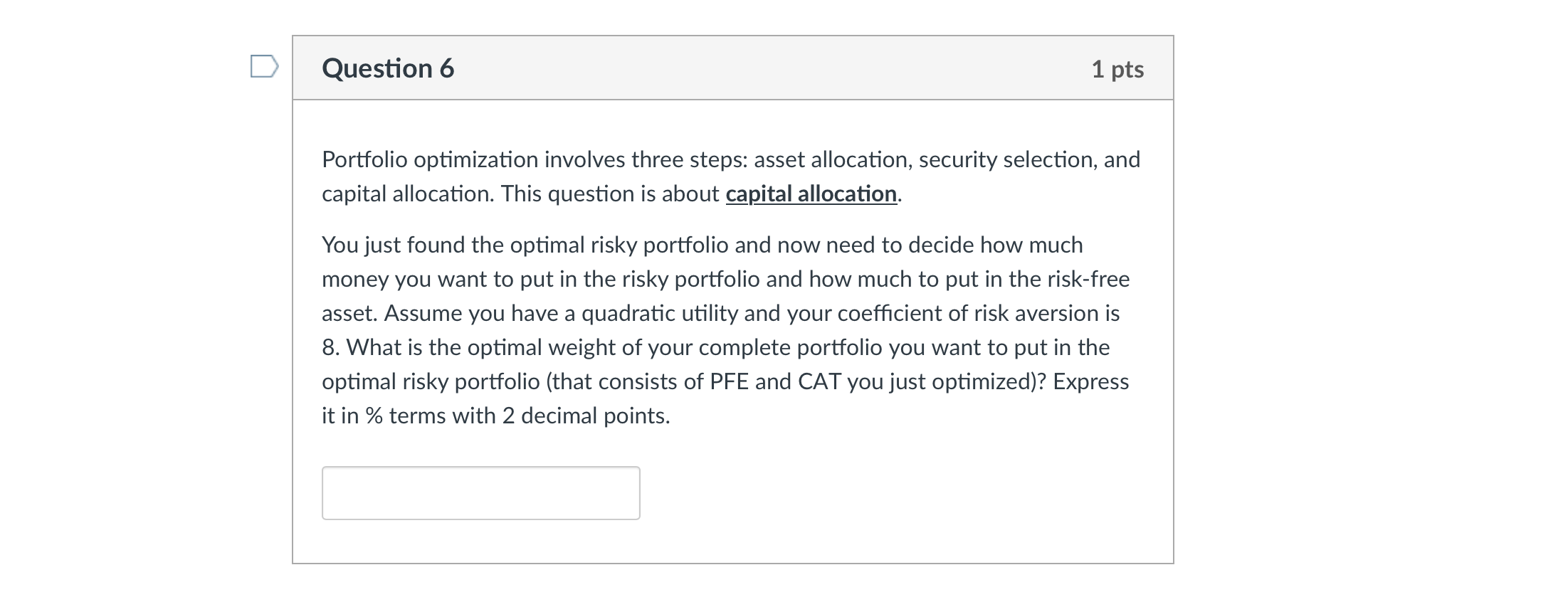

Question 6 1 pts Portfolio optimization involves three steps: asset allocation, security selection, and capital allocation. This question is about capital allocation. You just found the optimal risky portfolio and now need to decide how much money you want to put in the risky portfolio and how much to put in the risk-free asset. Assume you have a quadratic utility and your coefficient of risk aversion is 8. What is the optimal weight of your complete portfolio you want to put in the optimal risky portfolio (that consists of PFE and CAT you just optimized)? Express it in % terms with 2 decimal points. Question 6 1 pts Portfolio optimization involves three steps: asset allocation, security selection, and capital allocation. This question is about capital allocation. You just found the optimal risky portfolio and now need to decide how much money you want to put in the risky portfolio and how much to put in the risk-free asset. Assume you have a quadratic utility and your coefficient of risk aversion is 8. What is the optimal weight of your complete portfolio you want to put in the optimal risky portfolio (that consists of PFE and CAT you just optimized)? Express it in % terms with 2 decimal points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts