Question: Question 5 (10 marks) Consider options written on the same underlying stock with the same expiry in exactly one year. Assume that the contract size

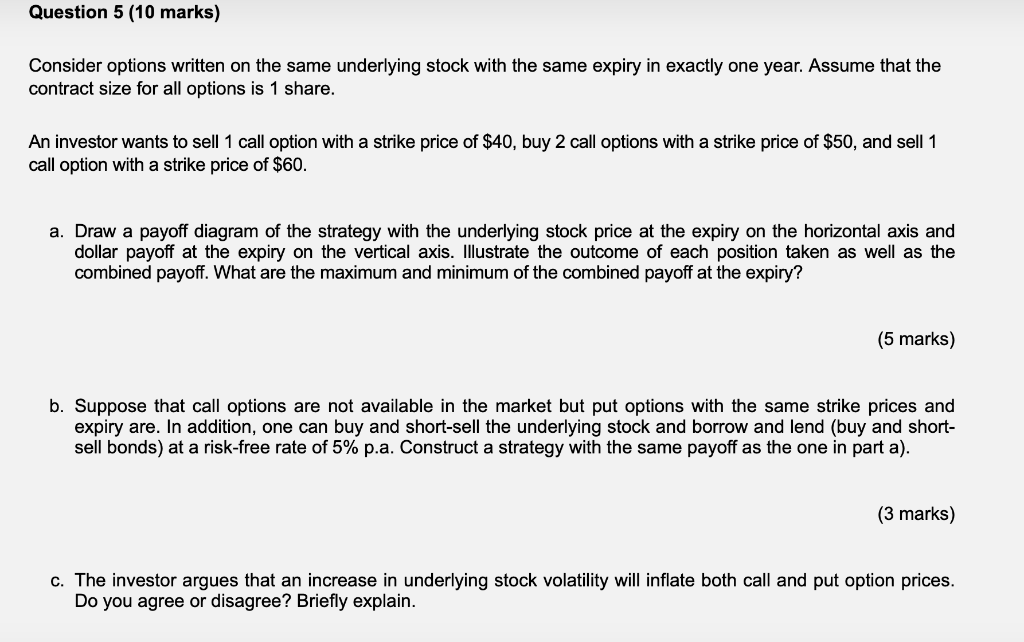

Question 5 (10 marks) Consider options written on the same underlying stock with the same expiry in exactly one year. Assume that the contract size for all options is 1 share. An investor wants to sell 1 call option with a strike price of $40, buy 2 call options with a strike price of $50, and sell 1 call option with a strike price of $60. a. Draw a payoff diagram of the strategy with the underlying stock price at the expiry on the horizontal axis and dollar payoff at the expiry on the vertical axis. Illustrate the outcome of each position taken as well as the combined payoff. What are the maximum and minimum of the combined payoff at the expiry? (5 marks) b. Suppose that call options are not available in the market but put options with the same strike prices and expiry are. In addition, one can buy and short-sell the underlying stock and borrow and lend (buy and short- sell bonds) at a risk-free rate of 5% p.a. Construct a strategy with the same payoff as the one in part a). (3 marks) c. The investor argues that an increase in underlying stock volatility will inflate both call and put option prices. Do you agree or disagree? Briefly explain. Question 5 (10 marks) Consider options written on the same underlying stock with the same expiry in exactly one year. Assume that the contract size for all options is 1 share. An investor wants to sell 1 call option with a strike price of $40, buy 2 call options with a strike price of $50, and sell 1 call option with a strike price of $60. a. Draw a payoff diagram of the strategy with the underlying stock price at the expiry on the horizontal axis and dollar payoff at the expiry on the vertical axis. Illustrate the outcome of each position taken as well as the combined payoff. What are the maximum and minimum of the combined payoff at the expiry? (5 marks) b. Suppose that call options are not available in the market but put options with the same strike prices and expiry are. In addition, one can buy and short-sell the underlying stock and borrow and lend (buy and short- sell bonds) at a risk-free rate of 5% p.a. Construct a strategy with the same payoff as the one in part a). (3 marks) c. The investor argues that an increase in underlying stock volatility will inflate both call and put option prices. Do you agree or disagree? Briefly explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts