Question: Question 5: (10 marks) TFP Inc. has decided to launch a new product. The product will have a life of 5 years. The company expects

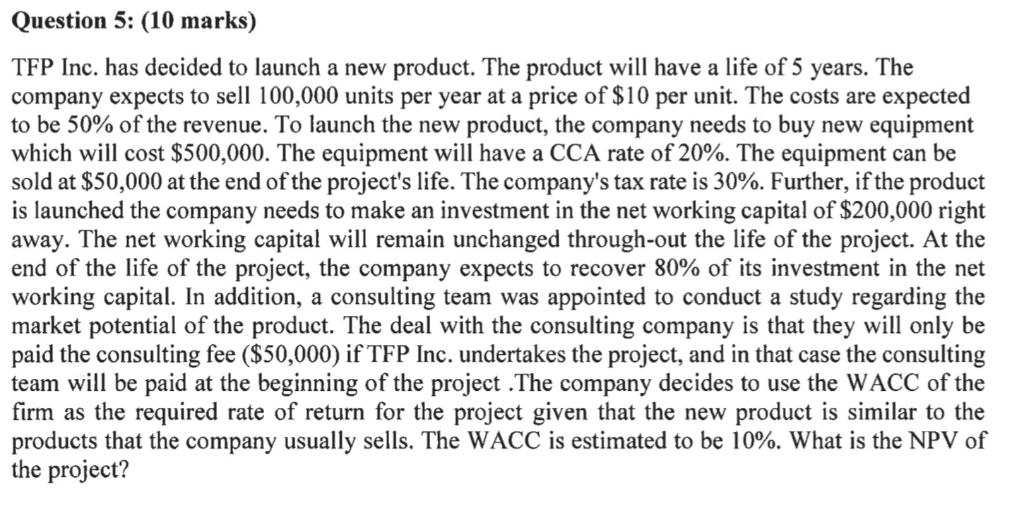

Question 5: (10 marks) TFP Inc. has decided to launch a new product. The product will have a life of 5 years. The company expects to sell 100,000 units per year at a price of $10 per unit. The costs are expected to be 50% of the revenue. To launch the new product, the company needs to buy new equipment which will cost $500,000. The equipment will have a CCA rate of 20%. The equipment can be sold at $50,000 at the end ofthe project's life. The company's tax rate is 30%. Further, ifthe product is launched the company needs to make an investment in the net working capital of $200,000 right away. The net working capital will remain unchanged through-out the life of the project. At the end of the life of the project, the company expects to recover 80% of its investment in the net working capital. In addition, a consulting team was appointed to conduct a study regarding the market potential of the product. The deal with the consulting company is that they will only be paid the consulting fee ($50,000) if TFP Inc. undertakes the project, and in that case the consulting team will be paid at the beginning of the project .The company decides to use the WACC of the firm as the required rate of return for the project given that the new product is similar to the products that the company usually sells. The WACC is estimated to be 10%. What is the NPV of the project? Question 5: (10 marks) TFP Inc. has decided to launch a new product. The product will have a life of 5 years. The company expects to sell 100,000 units per year at a price of $10 per unit. The costs are expected to be 50% of the revenue. To launch the new product, the company needs to buy new equipment which will cost $500,000. The equipment will have a CCA rate of 20%. The equipment can be sold at $50,000 at the end ofthe project's life. The company's tax rate is 30%. Further, ifthe product is launched the company needs to make an investment in the net working capital of $200,000 right away. The net working capital will remain unchanged through-out the life of the project. At the end of the life of the project, the company expects to recover 80% of its investment in the net working capital. In addition, a consulting team was appointed to conduct a study regarding the market potential of the product. The deal with the consulting company is that they will only be paid the consulting fee ($50,000) if TFP Inc. undertakes the project, and in that case the consulting team will be paid at the beginning of the project .The company decides to use the WACC of the firm as the required rate of return for the project given that the new product is similar to the products that the company usually sells. The WACC is estimated to be 10%. What is the NPV of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts