Question: Question 5 (10 marks) You are evaluating Project Comfy Shoes for manufacturing comfort shoes for the elderly. The project requires an initial expenditure of $10,000

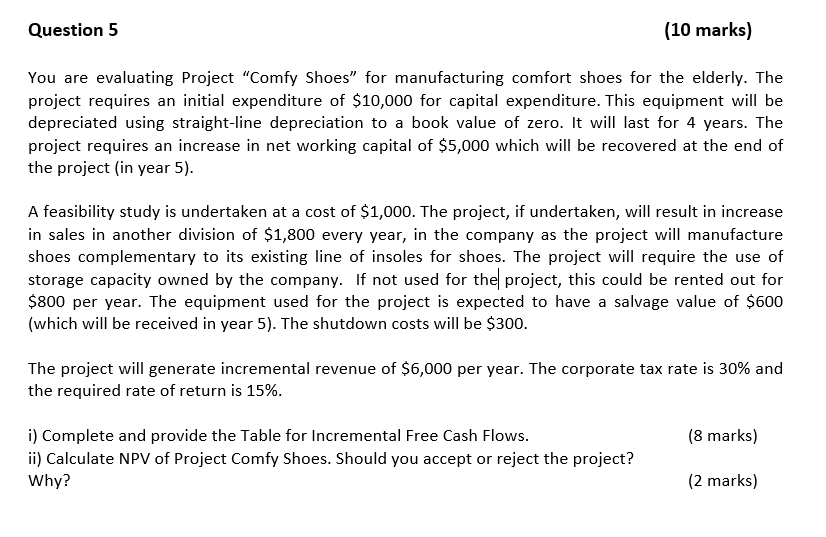

Question 5 (10 marks) You are evaluating Project "Comfy Shoes for manufacturing comfort shoes for the elderly. The project requires an initial expenditure of $10,000 for capital expenditure. This equipment will be depreciated using straight-line depreciation to a book value of zero. It will last for 4 years. The project requires an increase in net working capital of $5,000 which will be recovered at the end of the project (in year 5). A feasibility study is undertaken at a cost of $1,000. The project, if undertaken, will result in increase in sales in another division of $1,800 every year, in the company as the project will manufacture shoes complementary to its existing line of insoles for shoes. The project will require the use of storage capacity owned by the company. If not used for the project, this could be rented out for $800 per year. The equipment used for the project is expected to have a salvage value of $600 (which will be received in year 5). The shutdown costs will be $300. The project will generate incremental revenue of $6,000 per year. The corporate tax rate is 30% and the required rate of return is 15%. (8 marks) i) Complete and provide the Table for Incremental Free Cash Flows. ii) Calculate NPV of Project Comfy Shoes. Should you accept or reject the project? Why? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts