Question: Question 5 10 pts Suppose that a developer has total costs of $15 million to construct a Publix-anchored shopping center. Publix leases 45,000 SF at

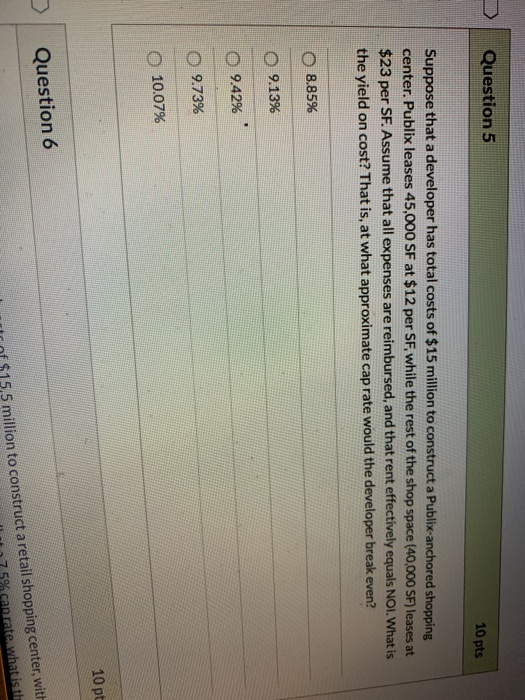

Question 5 10 pts Suppose that a developer has total costs of $15 million to construct a Publix-anchored shopping center. Publix leases 45,000 SF at $12 per SF, while the rest of the shop space (40,000 SF) leases at $23 per SF. Assume that all expenses are reimbursed, and that rent effectively equals NOI. What is the yield on cost? That is, at what approximate cap rate would the developer break even? 8.85% 09.13% O 9.42% 9.73% 10.07% 10 p Question 6 Inn $15.5 million to construct a retail shopping center, wit cabrate what is the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts