Question: Question 5 10 pts Suppose that a developer has total costs of $16.5 million to construct a Publix- anchored shopping center. Publix leases 45,000 SF

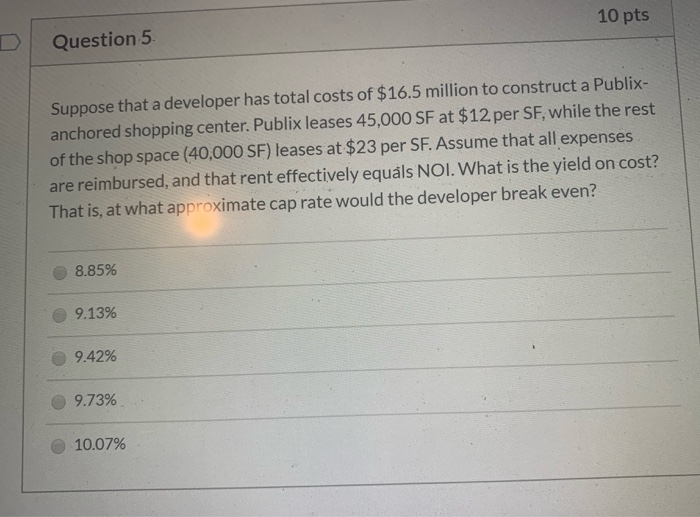

Question 5 10 pts Suppose that a developer has total costs of $16.5 million to construct a Publix- anchored shopping center. Publix leases 45,000 SF at $12 per SE, while the rest of the shop space (40,000 SF) teases at $23 per SF. Assume that all expenses are reimbursed, and that rent effectively equals NOI. What is the yield on cost? That is, at what approximate cap rate would the developer break even? 8.85% 9.13% 9.42% 9.73% 10.07%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts