Question: Question 5 10 pts Suppose that you are analyzing a REIT, and that you expect the company to have $2,450,000 in reportable net earnings. You

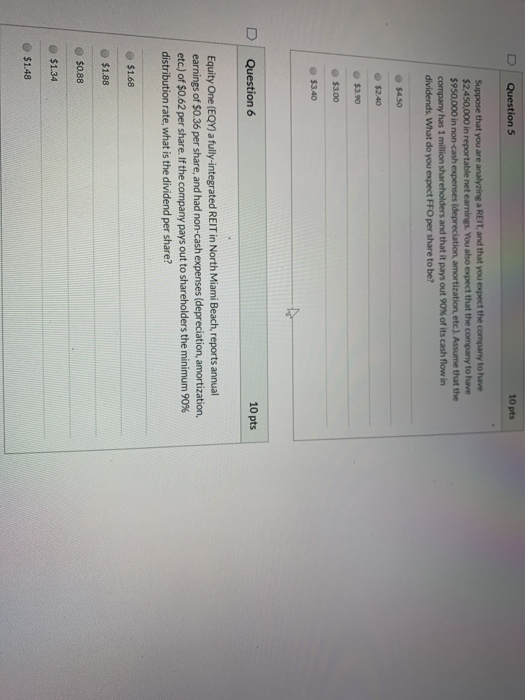

Question 5 10 pts Suppose that you are analyzing a REIT, and that you expect the company to have $2,450,000 in reportable net earnings. You also expect that the company to have $950,000 in non-cash expenses (depreciation, amortization, etc). Assume that the company has 1 million shareholders and that it pays out 90 % of its cash flow in dividends. What do you expect FFO per share to be? $4.50 $2.40 $3.90 $3.00 $3.40 Question 6 10 pts Equity One (EQY) a fully-integrated REIT in North Miami Beach, reports annual earnings of $0.36 per share, and had non-cash expenses (depreciation, amortization, etc.) of $0.62 per share. If the company pays out to shareholders the minimum 90 % distribution rate, what is the dividend per share? $1.68 $1.88 $0.88 $1.34 $1.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts