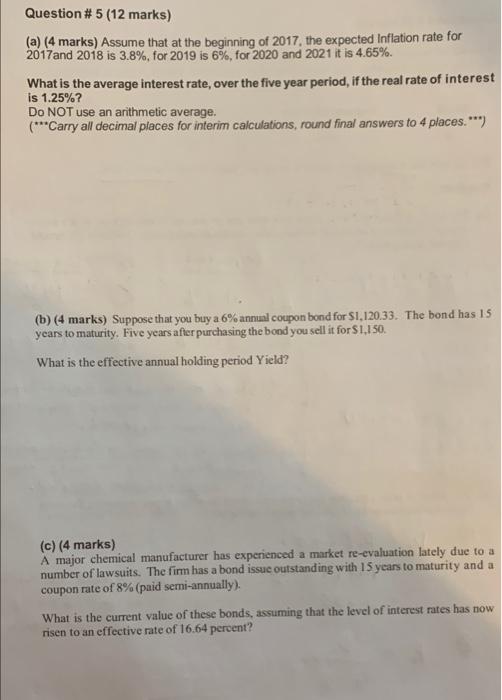

Question: Question # 5 (12 marks) (a) (4 marks) Assume that at the beginning of 2017, the expected Inflation rate for 2017 and 2018 is 3.8%,

Question # 5 (12 marks) (a) (4 marks) Assume that at the beginning of 2017, the expected Inflation rate for 2017 and 2018 is 3.8%, for 2019 is 6%, for 2020 and 2021 it is 4.65%. What is the average interest rate, over the five year period, if the real rate of interest is 1.25%? Do NOT use an arithmetic average. (***Carry all decimal places for interim calculations, round final answers to 4 places. ***) (b) (4 marks) Suppose that you buy a 6% annual coupon bond for S1,120.33. The bond has 15 years to maturity. Five years after purchasing the bond you sell it for $1.150 What is the effective annual holding period Yield? (c) (4 marks) A major chemical manufacturer has experienced a market re-evaluation lately due to a number of lawsuits. The firm has a bond issue outstanding with 15 years to maturity and a coupon rate of 8% (paid semi-annually). What is the current value of these bonds, assuming that the level of interest rates has now risen to an effective rate of 16.64 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts