Question: Question 5 (14 marks) This question has 2 parts. Answer parts a & b below: Part a (8 marks) For each of the following situations,

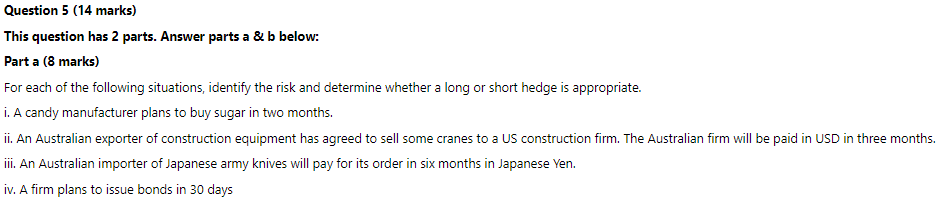

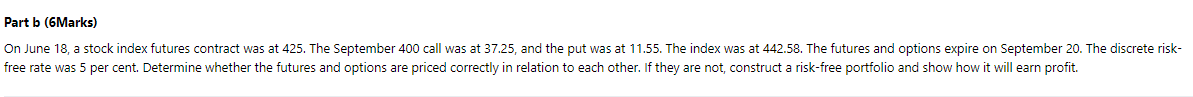

Question 5 (14 marks) This question has 2 parts. Answer parts a & b below: Part a (8 marks) For each of the following situations, identify the risk and determine whether a long or short hedge is appropriate. i. A candy manufacturer plans to buy sugar in two months. ii. An Australian exporter of construction equipment has agreed to sell some cranes to a US construction firm. The Australian firm will be paid in USD in three months. iii. An Australian importer of Japanese army knives will pay for its order in six months in Japanese Yen. iv. A firm plans to issue bonds in 30 days Part b (6Marks) On June 18, a stock index futures contract was at 425. The September 400 call was at 37.25, and the put was at 11.55. The index was at 442.58. The futures and options expire on September 20. The discrete risk- free rate was 5 per cent. Determine whether the futures and options are priced correctly in relation to each other. If they are not, construct a risk-free portfolio and show how it will earn profit. Question 5 (14 marks) This question has 2 parts. Answer parts a & b below: Part a (8 marks) For each of the following situations, identify the risk and determine whether a long or short hedge is appropriate. i. A candy manufacturer plans to buy sugar in two months. ii. An Australian exporter of construction equipment has agreed to sell some cranes to a US construction firm. The Australian firm will be paid in USD in three months. iii. An Australian importer of Japanese army knives will pay for its order in six months in Japanese Yen. iv. A firm plans to issue bonds in 30 days Part b (6Marks) On June 18, a stock index futures contract was at 425. The September 400 call was at 37.25, and the put was at 11.55. The index was at 442.58. The futures and options expire on September 20. The discrete risk- free rate was 5 per cent. Determine whether the futures and options are priced correctly in relation to each other. If they are not, construct a risk-free portfolio and show how it will earn profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts