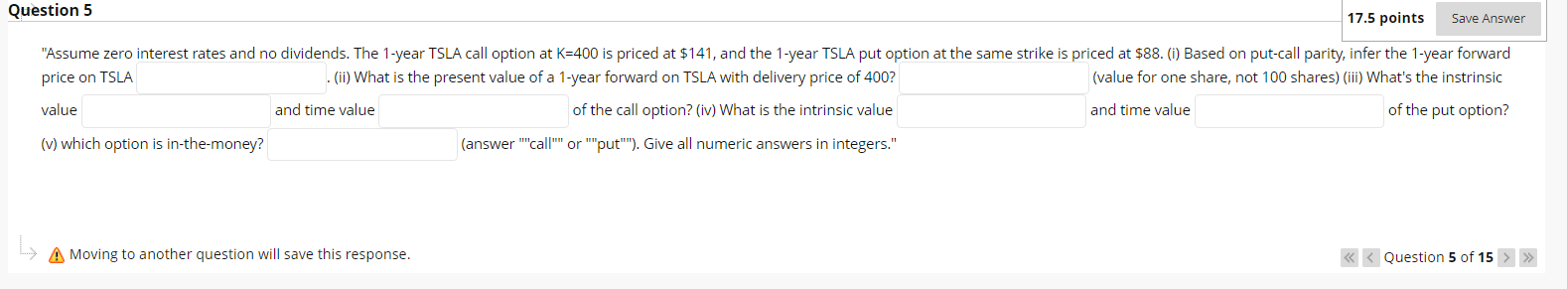

Question: Question 5 17.5 points Save Answer Assume zero interest rates and no dividends. The 1-year TSLA call option at K-400 is priced at $141, and

Question 5 17.5 points Save Answer "Assume zero interest rates and no dividends. The 1-year TSLA call option at K-400 is priced at $141, and the 1-year TSLA put option at the same strike is priced at $88. (1) Based on put-call parity, infer the 1-year forward price on TSLA (ii) What is the present value of a 1-year forward on TSLA with delivery price of 400? (value for one share, not 100 shares) (iii) What's the instrinsic value and time value of the call option? (iv) What is the intrinsic value and time value of the put option? (v) which option is in-the-money? (answer "call" or ""put"'). Give all numeric answers in integers." A Moving to another question will save this response.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts