Question: Question 5 (18 marks) a. Patrick, ages 30, has determined to purchase-a-life insurance policy.with.a.coverage amount of $1. million as protection for his wife. Last month.his.financial

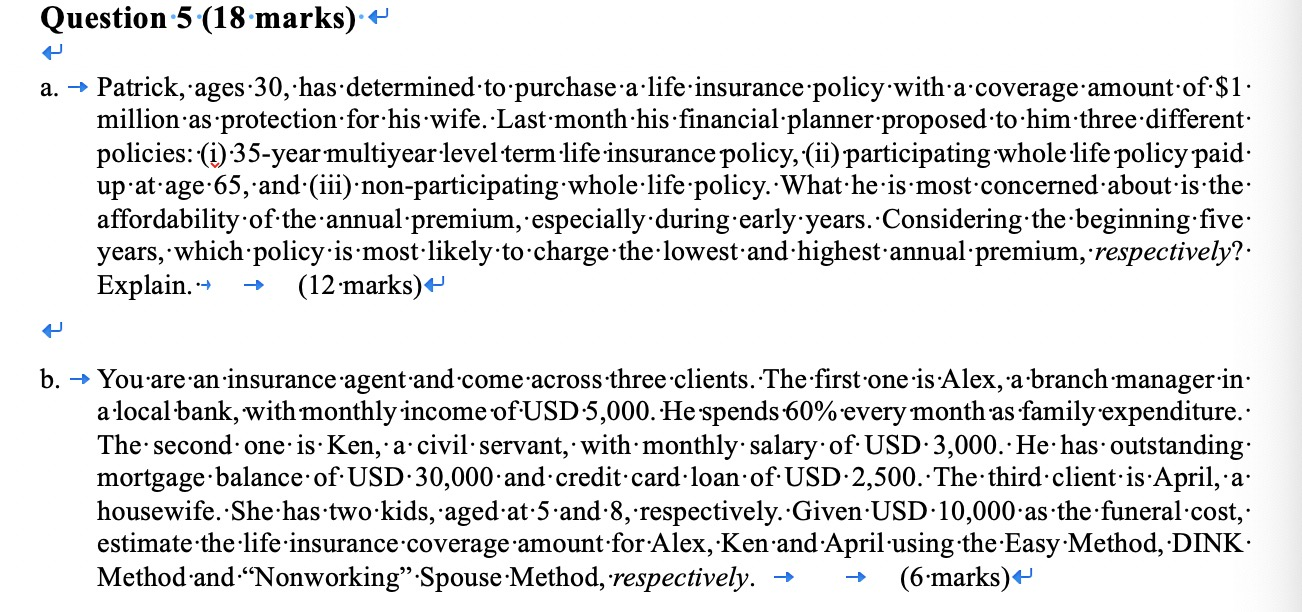

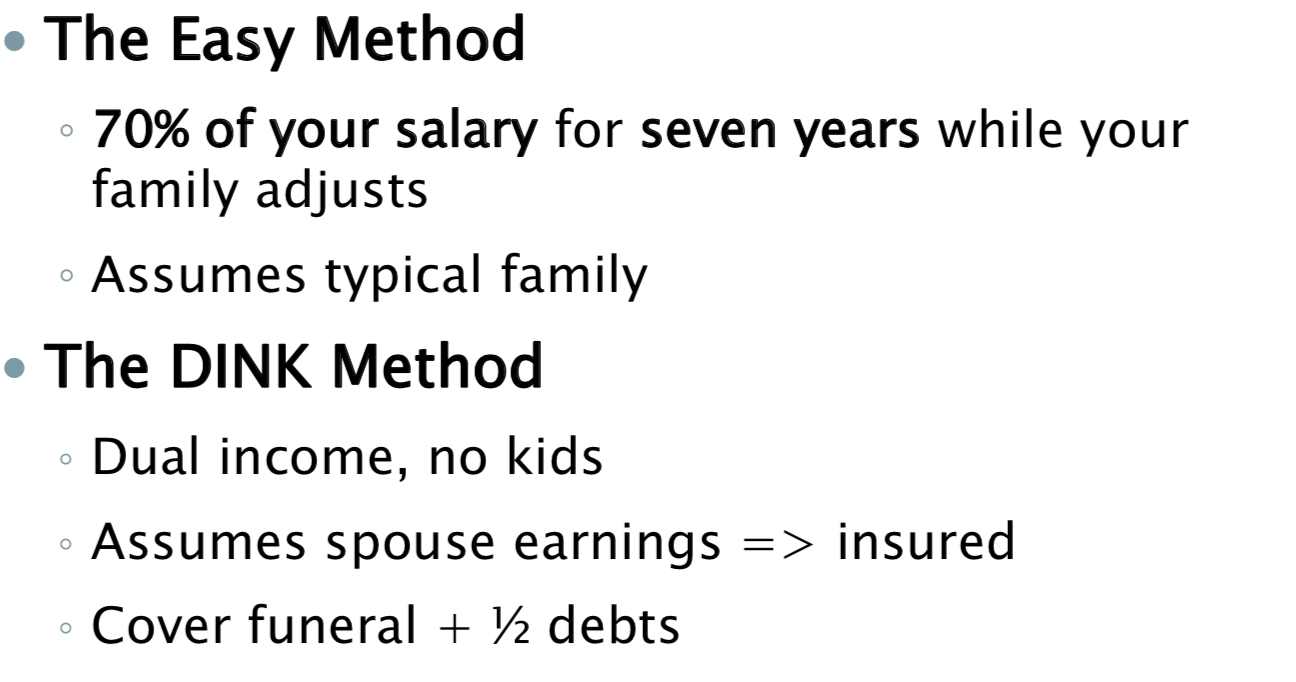

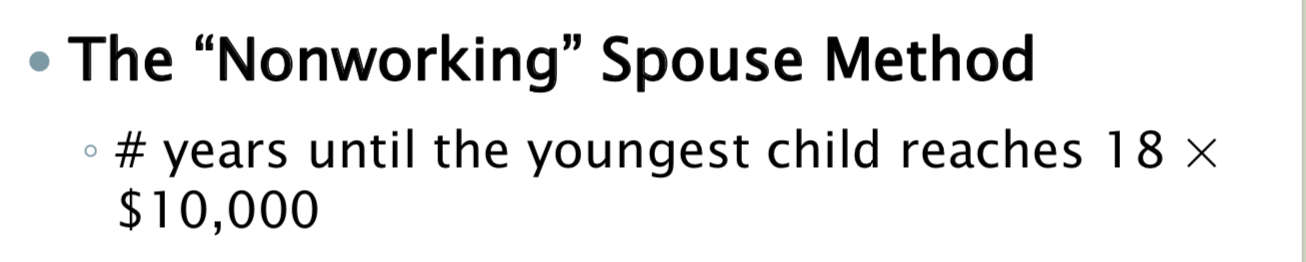

Question 5 (18 marks) a. Patrick, ages 30, has determined to purchase-a-life insurance policy.with.a.coverage amount of $1. million as protection for his wife. Last month.his.financial planner proposed to him three different. policies: (i) 35-year multiyear-level termlife insurance policy, (ii) participating whole-life policy paid. up at age.65, and (iii) non-participating whole life policy. What he is most concerned about is the affordability of the annual premium, especially during early years. Considering the beginning.five: years, which policy is most likely to charge the lowest and highest annual premium, respectively?. Explain.- (12 marks) b. You are an insurance agent and come across three clients. The first one is:Alex, a branch manager in: a local bank, with monthly income of:USD-5,000. He spends 60% every month as family expenditure. The second one is: Ken, a civil servant, with monthly salary of: USD 3,000.- He: has outstanding: mortgage balance of:USD-30,000 and credit card.loan.of:USD 2,500. The third.client.is.April, 'a: housewife. She has two kids, aged-at-5.and:8, respectively.Given:USD.10,000 as the funeral cost, estimate the life insurance coverage amountforAlex, Ken andApril'using the-Easy Method, DINK Methodand.Nonworking:Spouse-Method, respectively. (6'marks) The Easy Method 70% of your salary for seven years while your family adjusts Assumes typical family The DINK Method o Dual income, no kids Assumes spouse earnings => insured Cover funeral + 12 debts o The Nonworking" Spouse Method # years until the youngest child reaches 18 x $10,000 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts