Question: QUESTION 5 (20 marks) i. How many years would it take for James to accumulate a total of $1,000,000 for retirement if he could deposit

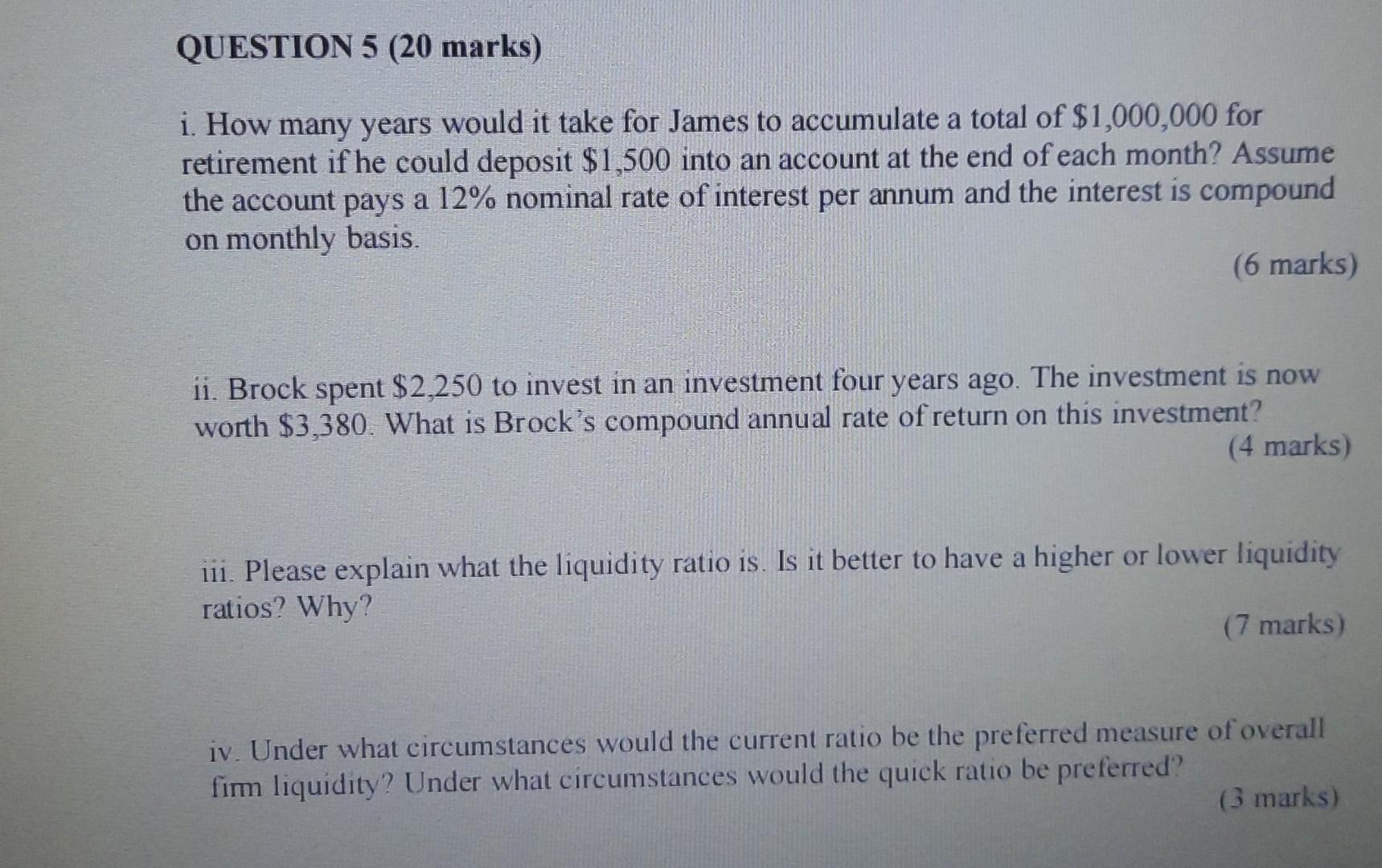

QUESTION 5 (20 marks) i. How many years would it take for James to accumulate a total of $1,000,000 for retirement if he could deposit $1,500 into an account at the end of each month? Assume the account pays a 12% nominal rate of interest per annum and the interest is compound on monthly basis. (6 marks) ii. Brock spent $2,250 to invest in an investment four years ago. The investment is now worth $3,380. What is Brock's compound annual rate of return on this investment? (4 marks) 111. Please explain what the liquidity ratio is. Is it better to have a higher or lower liquidity ratios? Why? (7 marks) iv. Under what circumstances would the current ratio be the preferred measure of overall fimm liquidity? Under what circumstances would the quick ratio be preferred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts