Question: Question 5 (25 marks) The table below illustrates the performance of returns of three (3) funds managed by three (3) different fund managers. The funds

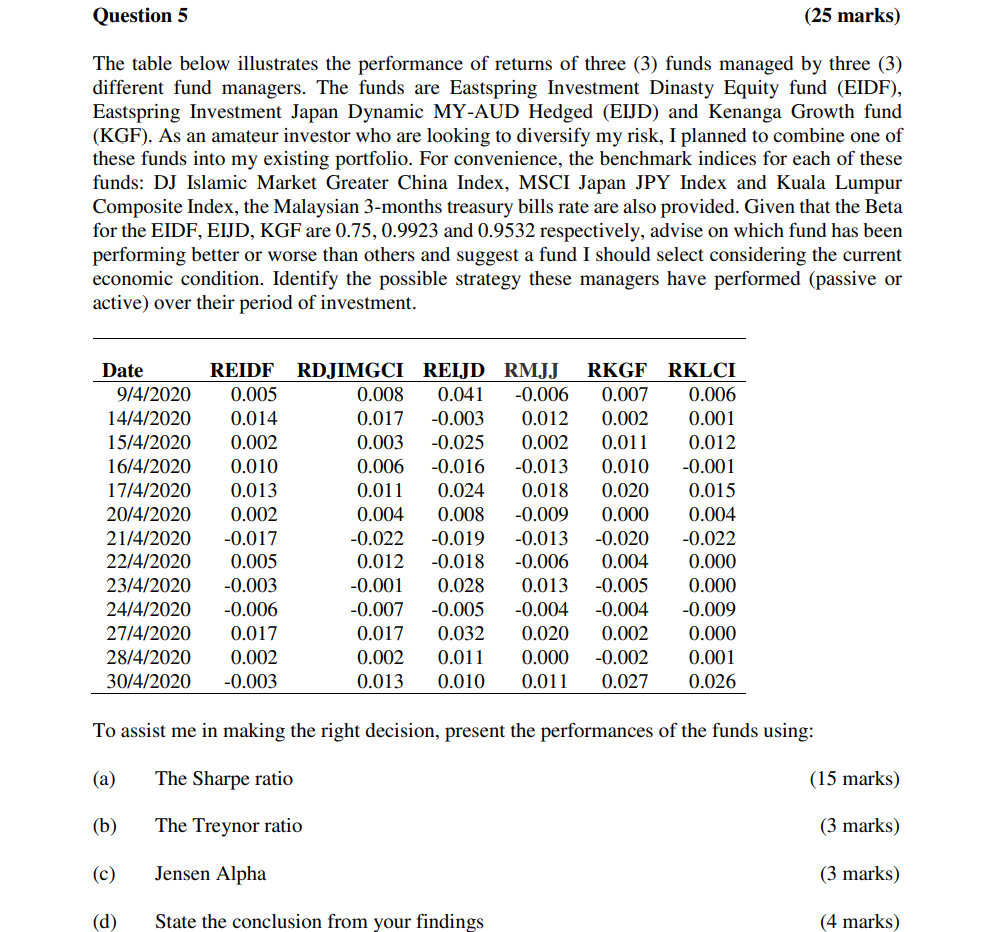

Question 5 (25 marks) The table below illustrates the performance of returns of three (3) funds managed by three (3) different fund managers. The funds are Eastspring Investment Dinasty Equity fund (EIDF), Eastspring Investment Japan Dynamic MY-AUD Hedged (EIJD) and Kenanga Growth fund (KGF). As an amateur investor who are looking to diversify my risk, I planned to combine one of these funds into my existing portfolio. For convenience, the benchmark indices for each of these funds: DJ Islamic Market Greater China Index, MSCI Japan JPY Index and Kuala Lumpur Composite Index, the Malaysian 3-months treasury bills rate are also provided. Given that the Beta for the EIDF, EIJD, KGF are 0.75, 0.9923 and 0.9532 respectively, advise on which fund has been performing better or worse than others and suggest a fund I should select considering the current economic condition. Identify the possible strategy these managers have performed (passive or active) over their period of investment. Date 9/4/2020 14/4/2020 15/4/2020 16/4/2020 17/4/2020 20/4/2020 21/4/2020 22/4/2020 23/4/2020 24/4/2020 27/4/2020 28/4/2020 30/4/2020 REIDF RDJIMGCI REIJD RMJJ 0.005 0.008 0.041 -0.006 0.014 0.017 -0.003 0.012 0.002 0.003 -0.025 0.002 0.010 0.006 -0.016 -0.013 0.013 0.011 0.024 0.018 0.002 0.004 0.008 -0.009 -0.017 -0.022 -0.019 -0.013 0.005 0.012 -0.018 -0.006 -0.003 -0.001 0.028 0.013 -0.006 -0.007 -0.005 -0.004 0.017 0.017 0.032 0.020 0.002 0.002 0.011 0.000 -0.003 0.013 0.010 0.011 RKGF RKLCI 0.007 0.006 0.002 0.001 0.011 0.012 0.010 -0.001 0.020 0.015 0.000 0.004 -0.020 -0.022 0.004 0.000 -0.005 0.000 -0.004 -0.009 0.002 0.000 -0.002 0.001 0.027 0.026 To assist me in making the right decision, present the performances of the funds using: (a) The Sharpe ratio (15 marks) (b) The Treynor ratio (3 marks) (c) Jensen Alpha (3 marks) (d) State the conclusion from your findings (4 marks) Question 5 (25 marks) The table below illustrates the performance of returns of three (3) funds managed by three (3) different fund managers. The funds are Eastspring Investment Dinasty Equity fund (EIDF), Eastspring Investment Japan Dynamic MY-AUD Hedged (EIJD) and Kenanga Growth fund (KGF). As an amateur investor who are looking to diversify my risk, I planned to combine one of these funds into my existing portfolio. For convenience, the benchmark indices for each of these funds: DJ Islamic Market Greater China Index, MSCI Japan JPY Index and Kuala Lumpur Composite Index, the Malaysian 3-months treasury bills rate are also provided. Given that the Beta for the EIDF, EIJD, KGF are 0.75, 0.9923 and 0.9532 respectively, advise on which fund has been performing better or worse than others and suggest a fund I should select considering the current economic condition. Identify the possible strategy these managers have performed (passive or active) over their period of investment. Date 9/4/2020 14/4/2020 15/4/2020 16/4/2020 17/4/2020 20/4/2020 21/4/2020 22/4/2020 23/4/2020 24/4/2020 27/4/2020 28/4/2020 30/4/2020 REIDF RDJIMGCI REIJD RMJJ 0.005 0.008 0.041 -0.006 0.014 0.017 -0.003 0.012 0.002 0.003 -0.025 0.002 0.010 0.006 -0.016 -0.013 0.013 0.011 0.024 0.018 0.002 0.004 0.008 -0.009 -0.017 -0.022 -0.019 -0.013 0.005 0.012 -0.018 -0.006 -0.003 -0.001 0.028 0.013 -0.006 -0.007 -0.005 -0.004 0.017 0.017 0.032 0.020 0.002 0.002 0.011 0.000 -0.003 0.013 0.010 0.011 RKGF RKLCI 0.007 0.006 0.002 0.001 0.011 0.012 0.010 -0.001 0.020 0.015 0.000 0.004 -0.020 -0.022 0.004 0.000 -0.005 0.000 -0.004 -0.009 0.002 0.000 -0.002 0.001 0.027 0.026 To assist me in making the right decision, present the performances of the funds using: (a) The Sharpe ratio (15 marks) (b) The Treynor ratio (3 marks) (c) Jensen Alpha (3 marks) (d) State the conclusion from your findings (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts