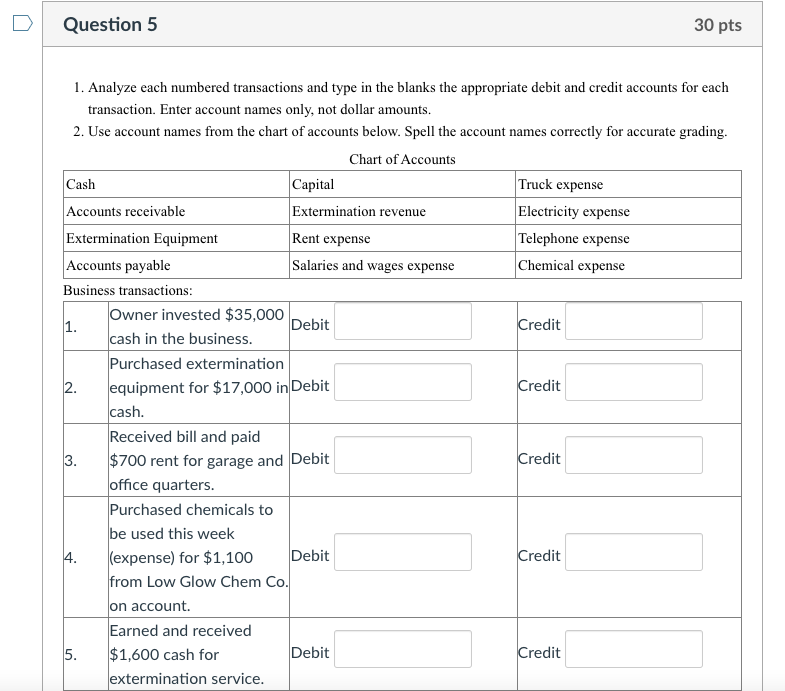

Question: Question 5 30 pts 1. Analyze each numbered transactions and type in the blanks the appropriate debit and credit accounts for each transaction. Enter account

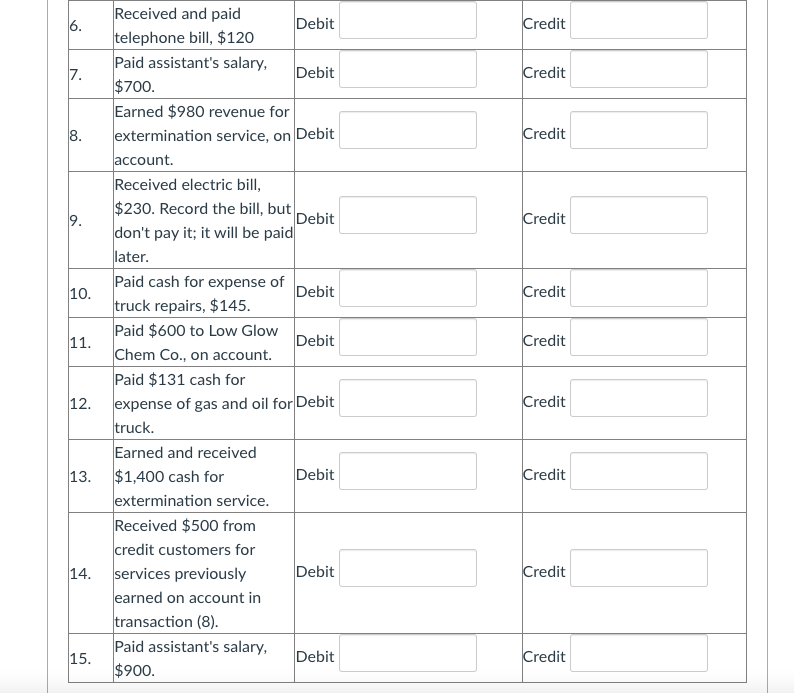

Question 5 30 pts 1. Analyze each numbered transactions and type in the blanks the appropriate debit and credit accounts for each transaction. Enter account names only, not dollar amounts. 2. Use account names from the chart of accounts below. Spell the account names correctly for accurate grading. Chart of Accounts Cash Capital Truck expense Accounts receivable Extermination revenue Electricity expense Extermination Equipment Rent expense Telephone expense Accounts payable Salaries and wages expense Chemical expense Business transactions: Owner invested $35,000 1. Debit Credit cash in the business. Purchased extermination 2 equipment for $17,000 in Debit Credit cash. Received bill and paid 3. $700 rent for garage and Debit Credit office quarters. Purchased chemicals to be used this week 4. (expense) for $1,100 Debit Credit from Low Glow Chem Co. on account Earned and received 5. $1,600 cash for Debit Credit extermination service. 2. 6. Credit 7. Credit 8. Credit 9. Credit 10. Credit 11. Received and paid Debit telephone bill, $120 Paid assistant's salary, Debit $700. Earned $980 revenue for extermination service, on Debit account. Received electric bill, $230. Record the bill, but Debit don't pay it; it will be paid later. Paid cash for expense of Debit truck repairs, $145. Paid $600 to Low Glow Debit Chem Co., on account. Paid $131 cash for expense of gas and oil for Debit truck. Earned and received $1,400 cash for Debit extermination service. Received $500 from credit customers for services previously Debit earned on account in transaction (8). Paid assistant's salary, Debit $900. Credit 12. Credit 13. Credit 14. Credit 15. Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts