Question: Question 5 33 Points (a) What are the main principles of (Markowitz) portfolio theory? How does the risk-free lending and borrowing extend the range of

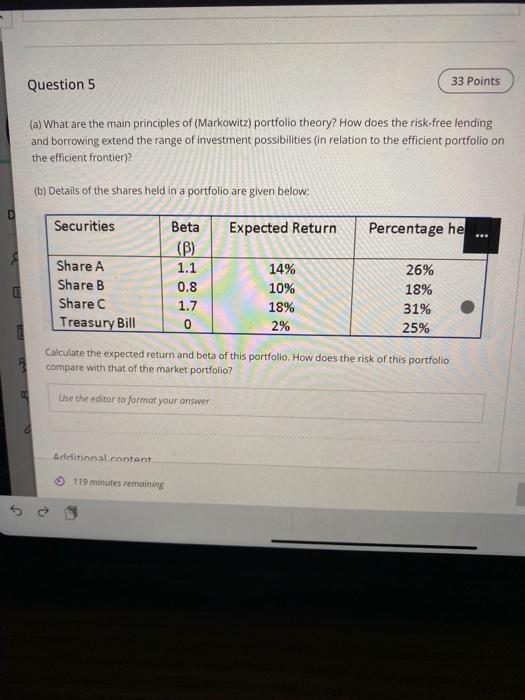

Question 5 33 Points (a) What are the main principles of (Markowitz) portfolio theory? How does the risk-free lending and borrowing extend the range of investment possibilities (in relation to the efficient portfolio on the efficient frontier)? (6) Details of the shares held in a portfolio are given below: D Securities Beta Expected Return Percentage he ... (B) Share A 1.1 14% 26% Share B 0.8 10% 18% Share C 1.7 18% 31% Treasury Bill 0 2% 25% Calculate the expected return and beta of this portfolio How does the risk of this portfolio compare with that of the market portfolio? Use the editor to format your answer Additional content 119 minutes remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts