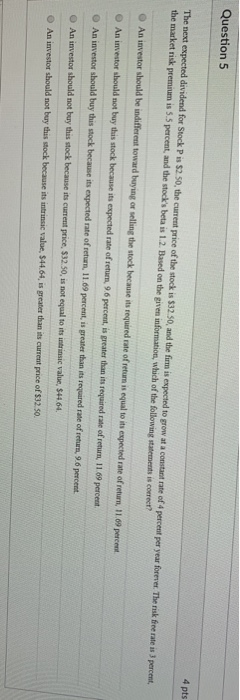

Question: Question 5 4 pts The next expected dividend for Stock P is $2.50, the current price of the stock is $32 S0, and the firm

Question 5 4 pts The next expected dividend for Stock P is $2.50, the current price of the stock is $32 S0, and the firm is expected t to grow at a constant rate of 4 percent per year forever. The risk free rate is 3 percent, the market risk premium is 5.5 percent, and the stock's beta is 1.2. Based on the given information, which of the following statemests is coreet? O An investor should be indifferent toward buying a selling the stock because its required rate of return is equal to its expected rate of return, O An investor should not buy this stock because its expected rate of return, 96 percent, is greater than its required rate of return, 11.69 percest 09 percent 11.69 percent An inestor should buy this ock because its expected rate of return, 11.69 percent, is greater than its requred rate of return, 96 percent. O An investor should not buy this stock because its curent price, $32.50, is not equal to its intrinsic value, $44 64 O An investor should not buy this stock because its intrinsic value, $44.64, is greater than its current price of $32 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts