Question: QUESTION 5 5 points Save Answer What is the price of a 10-year bond paying 10% annual coupons with a face (par) value of $1,000

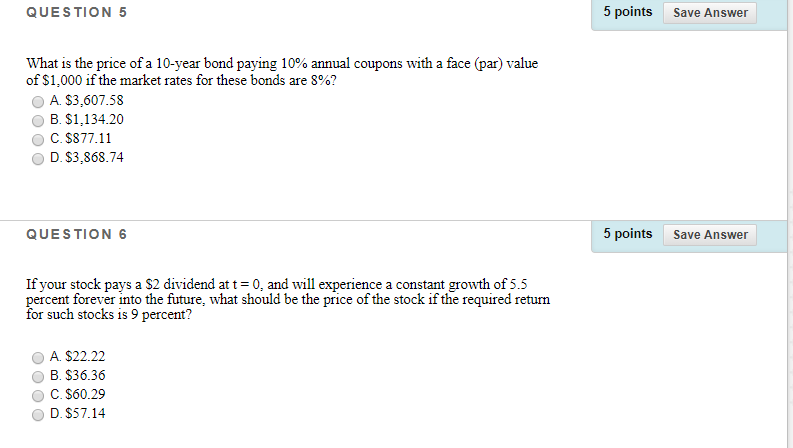

QUESTION 5 5 points Save Answer What is the price of a 10-year bond paying 10% annual coupons with a face (par) value of $1,000 if the market rates for these bonds are 8%? O A $3.607.58 B. $1,134.20 C. $877.11 D. $3,868.74 QUESTION 6 5 points Save Answer If your stock pays a $2 dividend at t=0, and will experience a constant growth of 5.5 percent forever into the future, what should be the price of the stock if the required return for such stocks is 9 percent? A. $22.22 B. $36.36 C. $60.29 OD. $57.14

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock