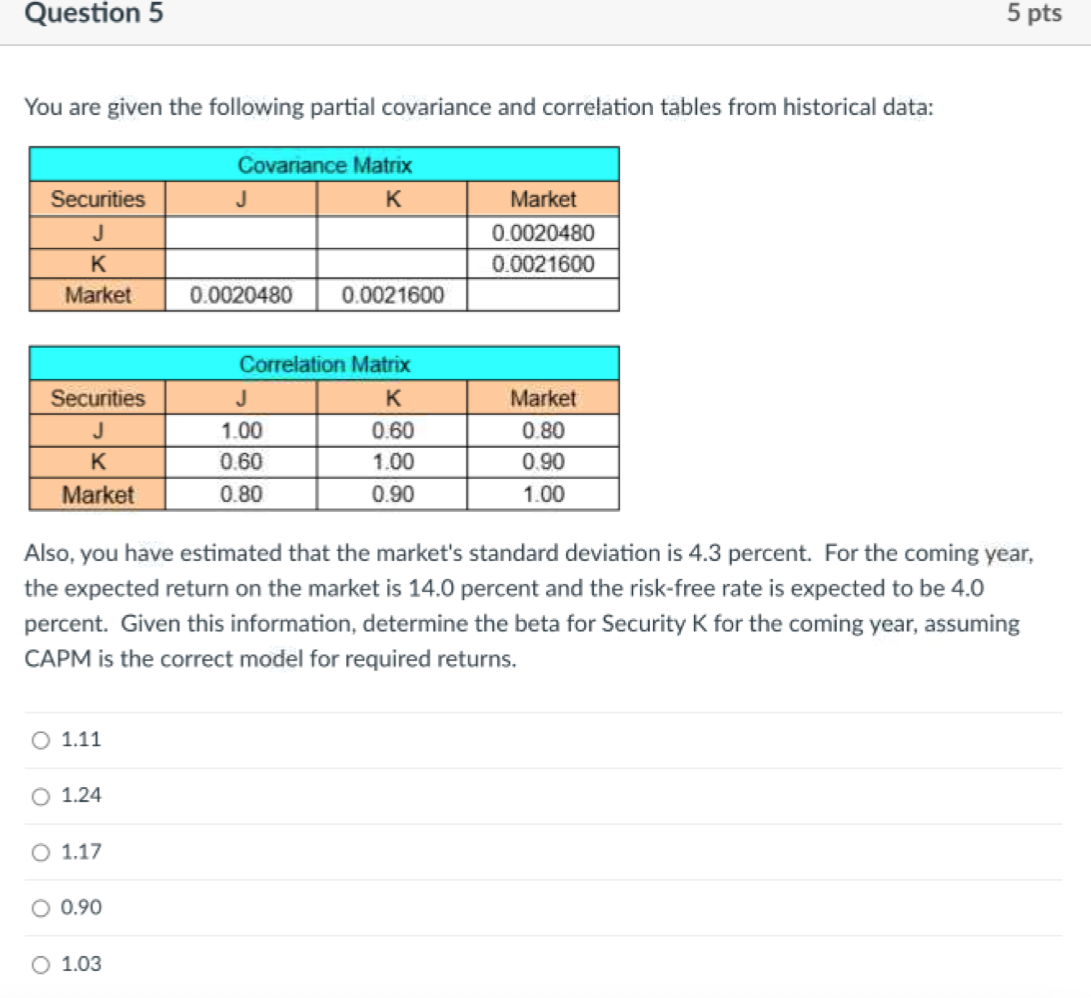

Question: Question 5 5 pts You are given the following partial covariance and correlation tables from historical data: Covariance Matrix J Securities J Market Market 0.0020480

Question 5 5 pts You are given the following partial covariance and correlation tables from historical data: Covariance Matrix J Securities J Market Market 0.0020480 0.0021600 0.0020480 0.0021600 Securities J K Market Correlation Matrix J 1.00 0.60 0.60 1.00 0.80 0.90 Market 0.80 0.90 1.00 Also, you have estimated that the market's standard deviation is 4.3 percent. For the coming year, the expected return on the market is 14.0 percent and the risk-free rate is expected to be 4.0 percent. Given this information, determine the beta for Security K for the coming year, assuming CAPM is the correct model for required returns. 01.11 01.24 O 1.17 0.90 O 1.03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts