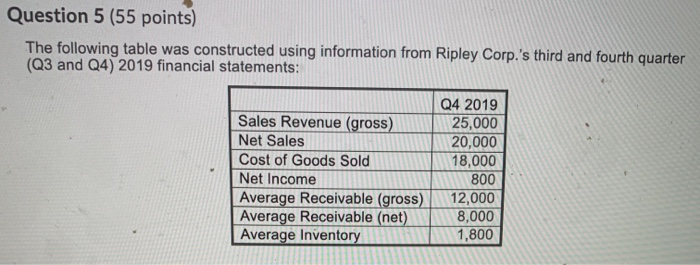

Question: Question 5 (55 points) The following table was constructed using information from Ripley Corp.'s third and fourth quarter (Q3 and 24) 2019 financial statements: Sales

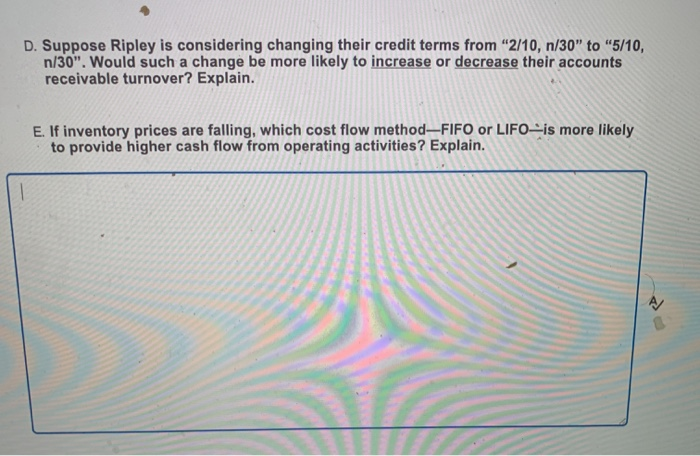

Question 5 (55 points) The following table was constructed using information from Ripley Corp.'s third and fourth quarter (Q3 and 24) 2019 financial statements: Sales Revenue (gross) Net Sales Cost of Goods Sold Net Income Average Receivable (gross) Average Receivable (net) Average Inventory Q4 2019 25,000 20,000 18,000 800 12,000 8,000 1,800 D. Suppose Ripley is considering changing their credit terms from "2/10, n/30" to "5/10, n/30". Would such a change be more likely to increase or decrease their accounts receivable turnover? Explain. E. If inventory prices are falling, which cost flow method-FIFO or LIFO is more likely to provide higher cash flow from operating activities? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts