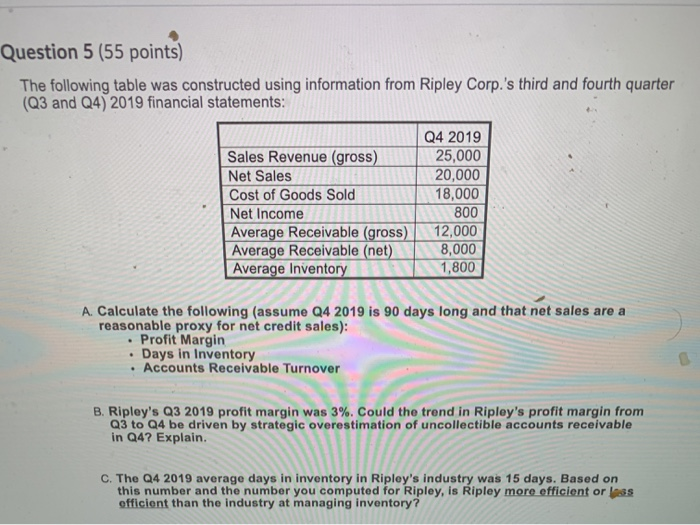

Question: Question 5 (55 points) The following table was constructed using information from Ripley Corp.'s third and fourth quarter (Q3 and Q4) 2019 financial statements: Sales

Question 5 (55 points) The following table was constructed using information from Ripley Corp.'s third and fourth quarter (Q3 and Q4) 2019 financial statements: Sales Revenue (gross) Net Sales Cost of Goods Sold Net Income Average Receivable (gross) Average Receivable (net) Average Inventory Q4 2019 25,000 20,000 18,000 800 12,000 8,000 1,800 A. Calculate the following (assume Q4 2019 is 90 days long and that net sales are a reasonable proxy for net credit sales): Profit Margin Days in Inventory Accounts Receivable Turnover B. Ripley's Q3 2019 profit margin was 3%. Could the trend in Ripley's profit margin from Q3 to Q4 be driven by strategic overestimation of uncollectible accounts receivable in Q4? Explain. C. The Q4 2019 average days in inventory in Ripley's industry was 15 days. Based on this number and the number you computed for Ripley, is Ripley more efficient or loss efficient than the industry at managing inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts