Question: QUESTION 5 [7 marks] Mouna established an RRSP in 2013. As of January 1, 2019, Mouna had no unused deduction room and no undeducted

![QUESTION 5 [7 marks] Mouna established an RRSP in 2013. As of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/02/65c33ed749ae3_42365c33ed720b1f.jpg)

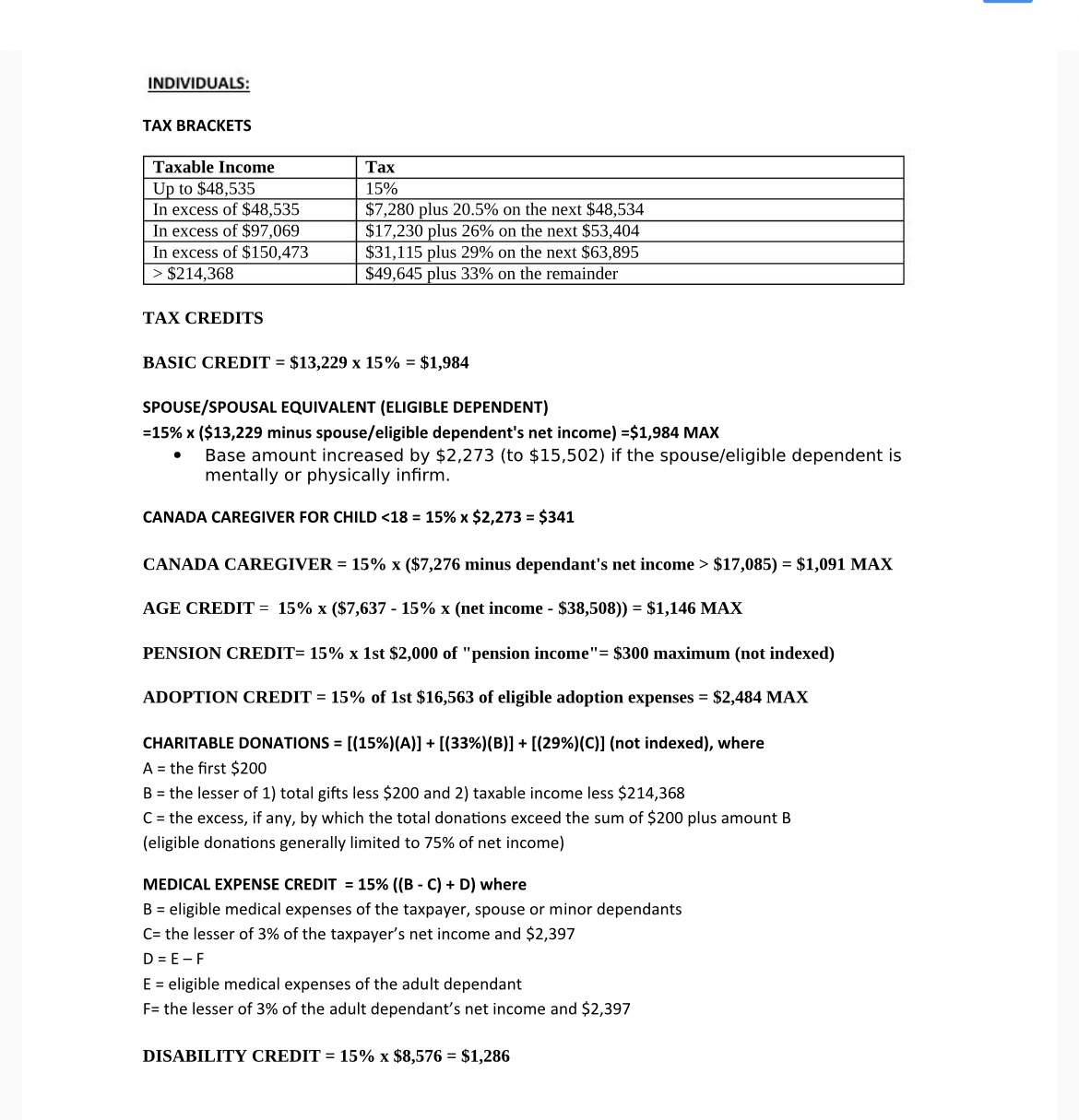

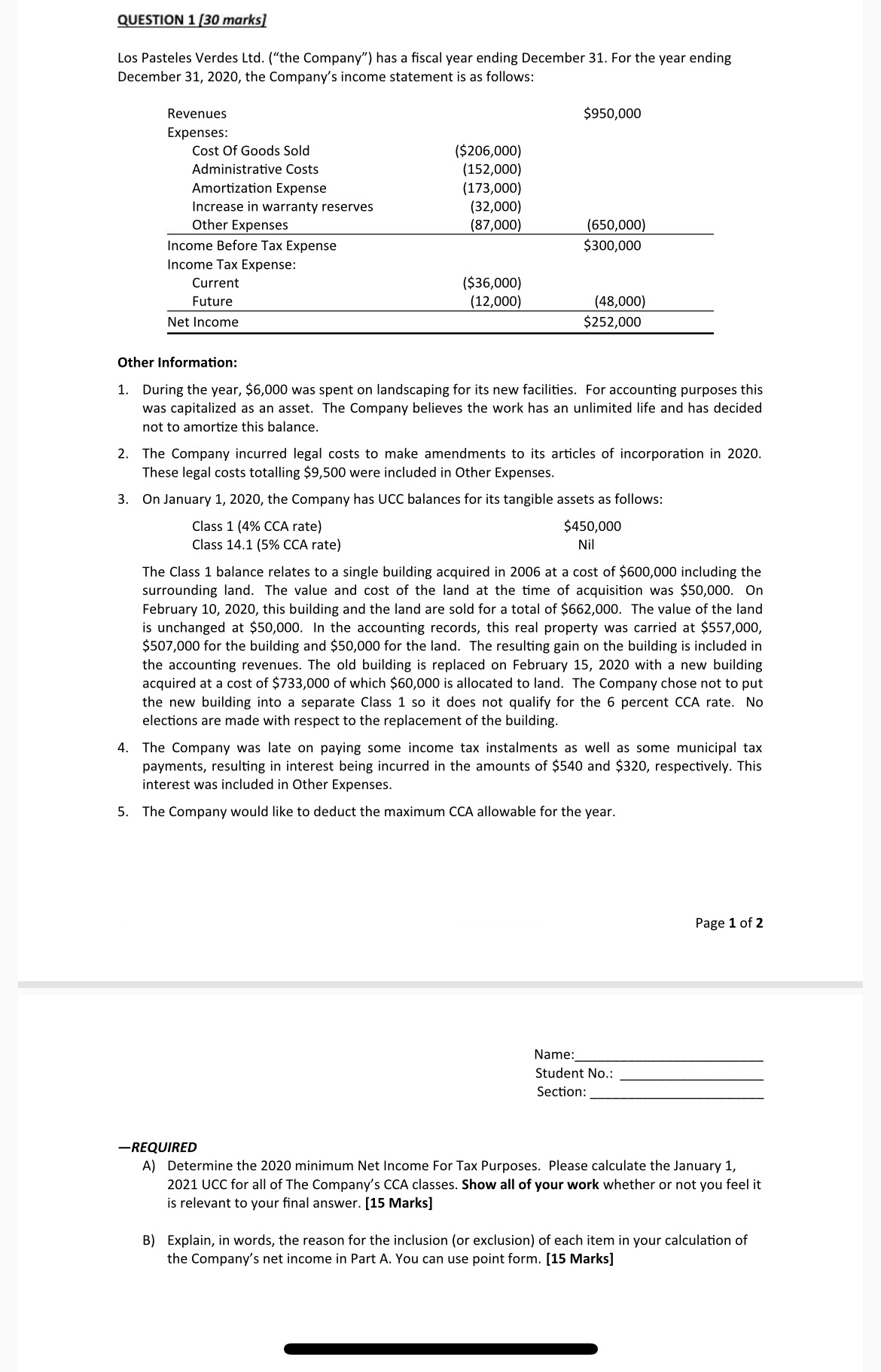

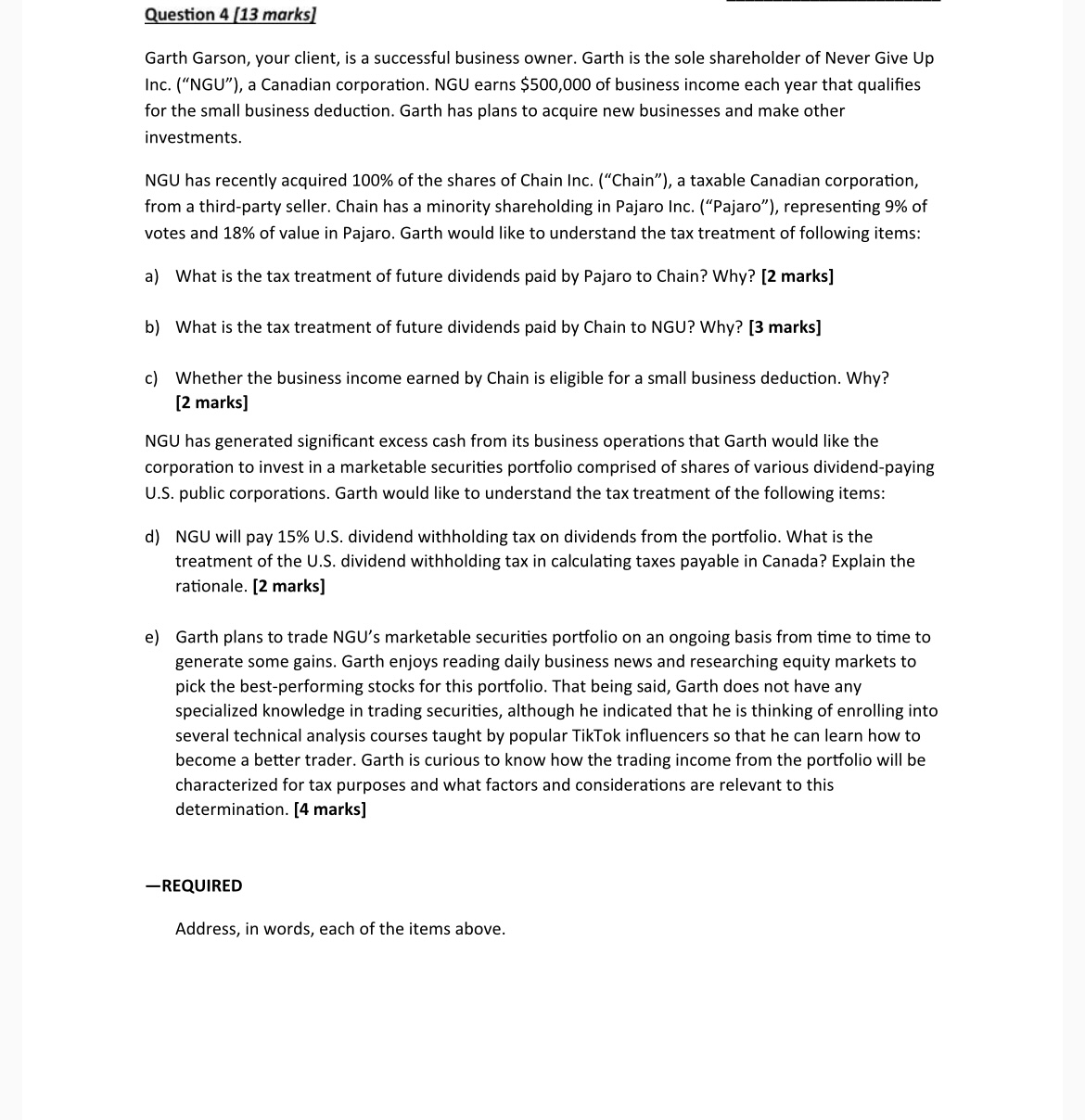

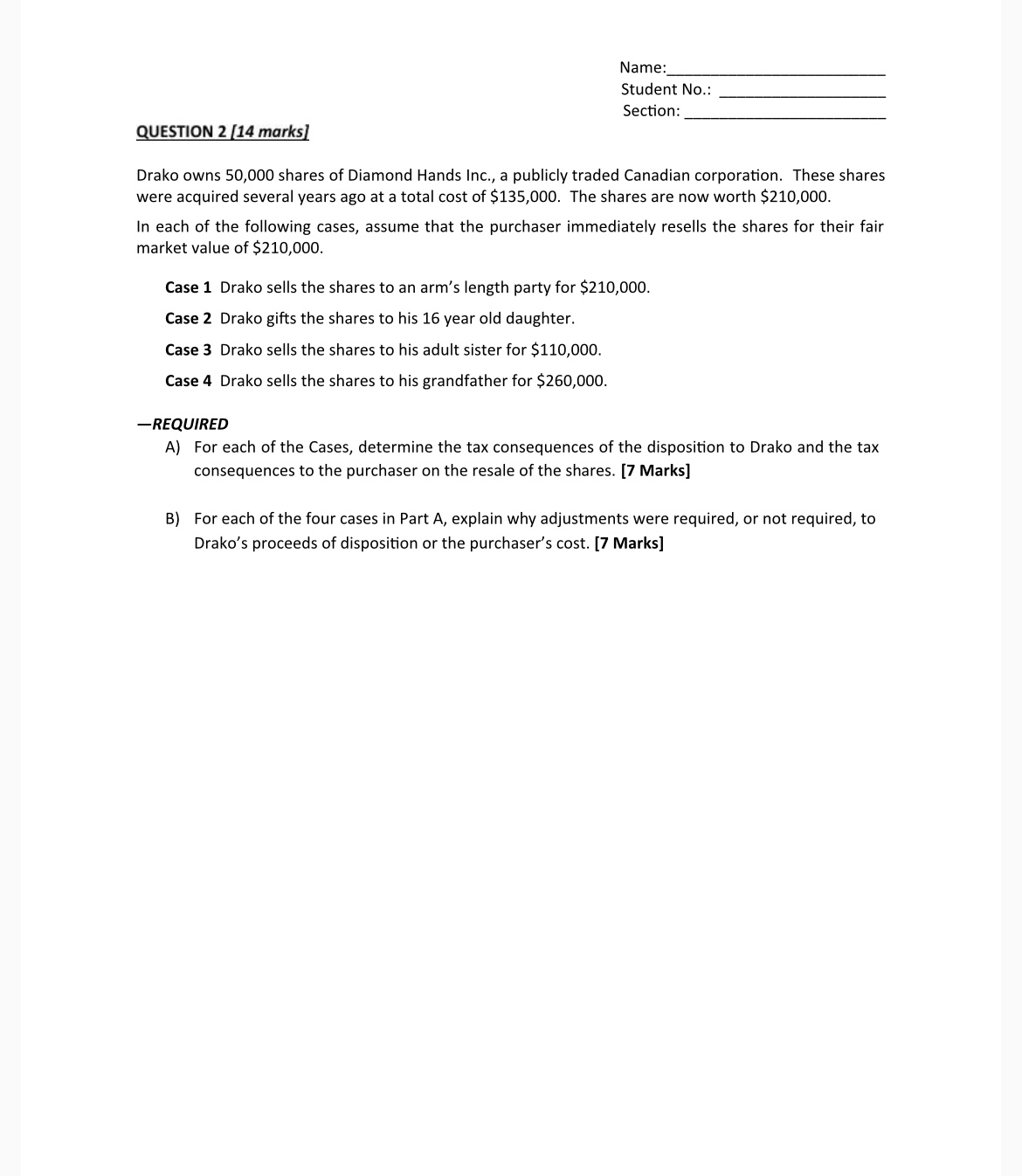

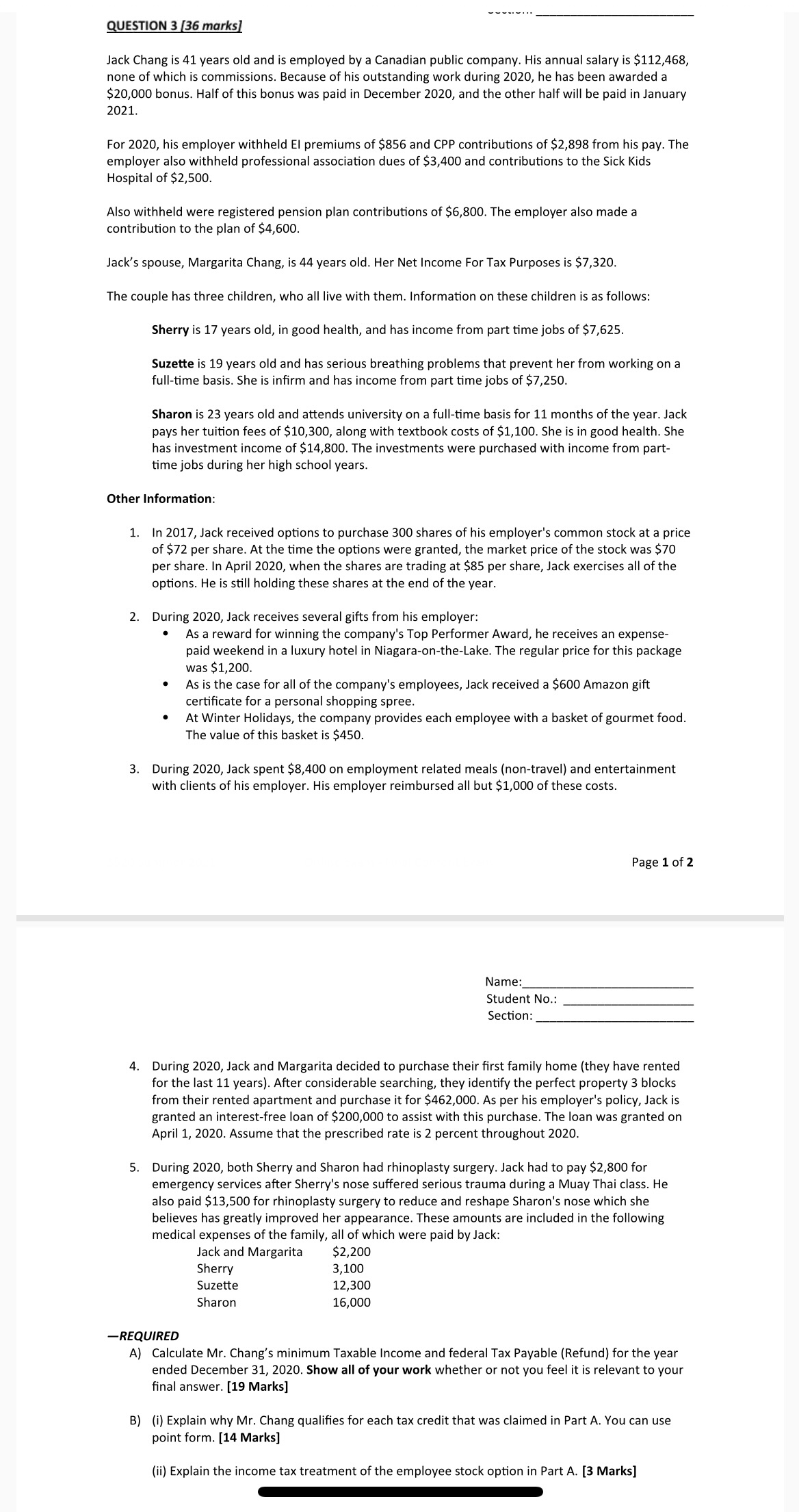

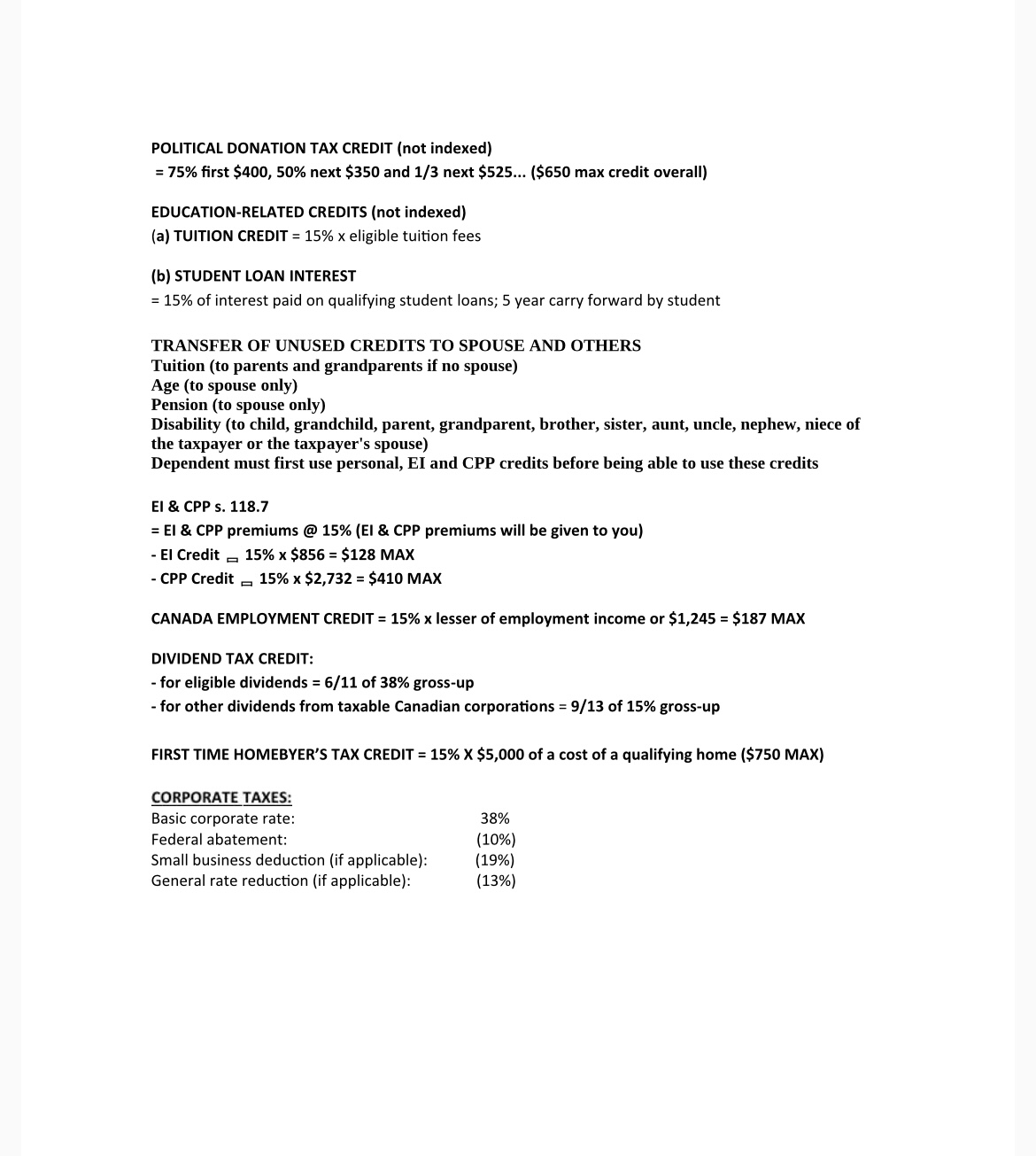

QUESTION 5 [7 marks] Mouna established an RRSP in 2013. As of January 1, 2019, Mouna had no unused deduction room and no undeducted contributions. Her 2018 earned income was sufficient for her to make the maximum 2019 contribution of $26,500. However, as she acquired a new home during 2019, she made no contributions to her RRSP that year. With the new home and furnishing purchases behind her and the receipt of a sizable inheritance from her father's estate, she has sufficient funds to maximize her contribution in 2020. She would like you to advise her as to the maximum contribution that she can make in 2020. Her 2019 earned income was $185,000. Her 2019 net income was $240,000. Mouna's spouse Bob had 2019 earned income and net income of $30,000. Bob will likely have less income than Mouna in their retirement. The RRSP dollar limits are $26,500 for 2019 and $27,230 for 2020. -REQUIRED A) Calculate the maximum 2020 RRSP contribution that Mouna can make. Show your work. [3 marks] B) Should Mouna consider making some of the 2020 contribution to Bob's RRSP? Explain. [2 marks] C) How and why would your answer to A) change if Mouna was part of a registered pension plan (RPP) in 2019 and her employer contributed to the RPP in 2019? [2 marks] INDIVIDUALS: TAX BRACKETS Taxable Income Up to $48,535 In excess of $48,535 In excess of $97,069 In excess of $150,473 > $214,368 TAX CREDITS Tax 15% $7,280 plus 20.5% on the next $48,534 $17,230 plus 26% on the next $53,404 $31,115 plus 29% on the next $63,895 $49,645 plus 33% on the remainder BASIC CREDIT = $13,229 x 15% = $1,984 SPOUSE/SPOUSAL EQUIVALENT (ELIGIBLE DEPENDENT) -15% x ($13,229 minus spouse/eligible dependent's net income) =$1,984 MAX Base amount increased by $2,273 (to $15,502) if the spouse/eligible dependent is mentally or physically infirm. CANADA CAREGIVER FOR CHILD

Step by Step Solution

There are 3 Steps involved in it

A Calculate the maximum 2020 RRSP contribution that Mouna can make To calculate Mounas maximum 2020 RRSP contribution we need to determine her 2019 RRSP deduction limit Since she made no contributions ... View full answer

Get step-by-step solutions from verified subject matter experts