Question: Question 5, 9, 25 - Boeing Hedging Decisions Context (Shared for All Parts): Boeing just signed a contract to sell a Boeing 737 aircraft to

Question 5, 9, 25 - Boeing Hedging Decisions

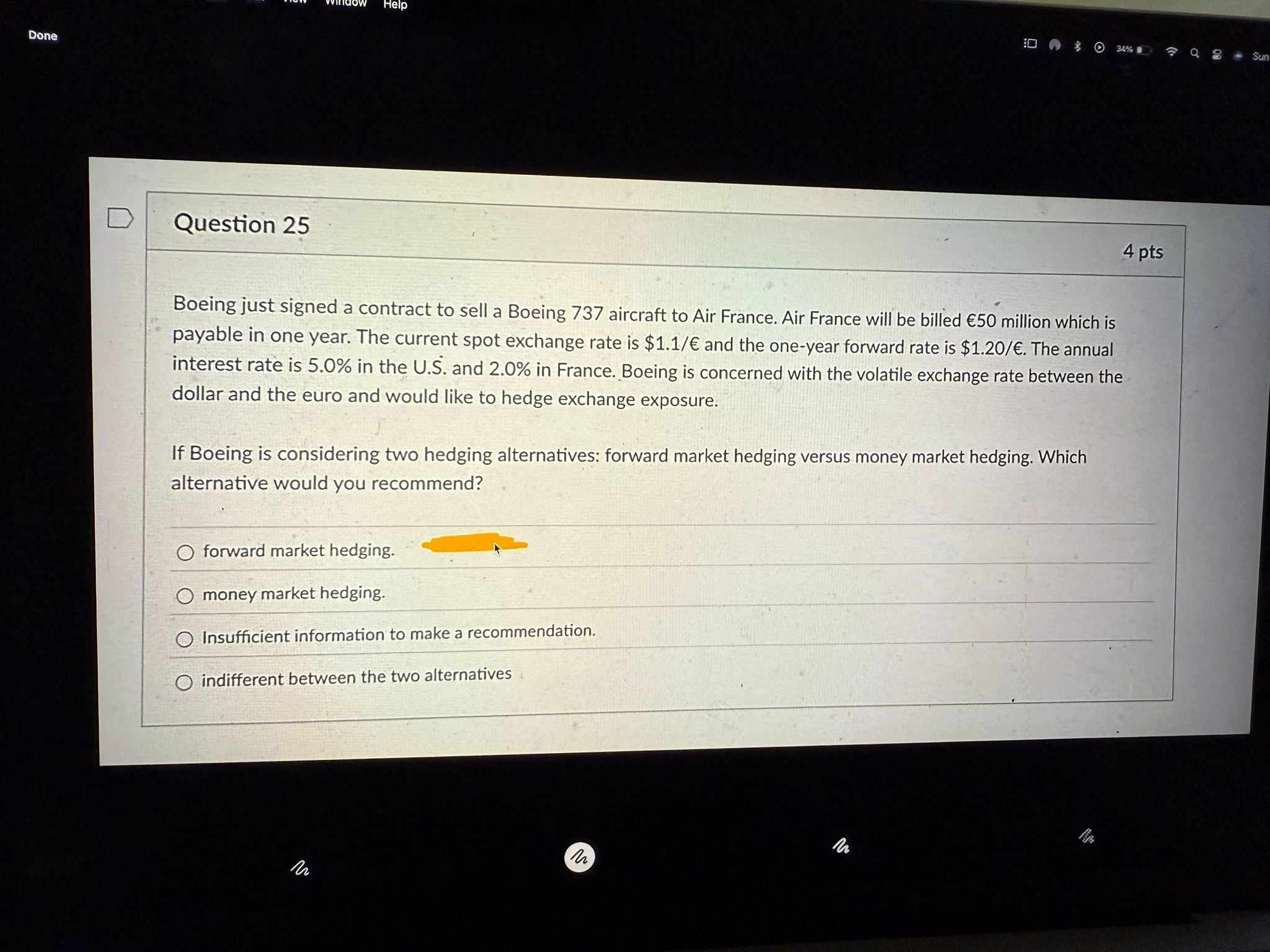

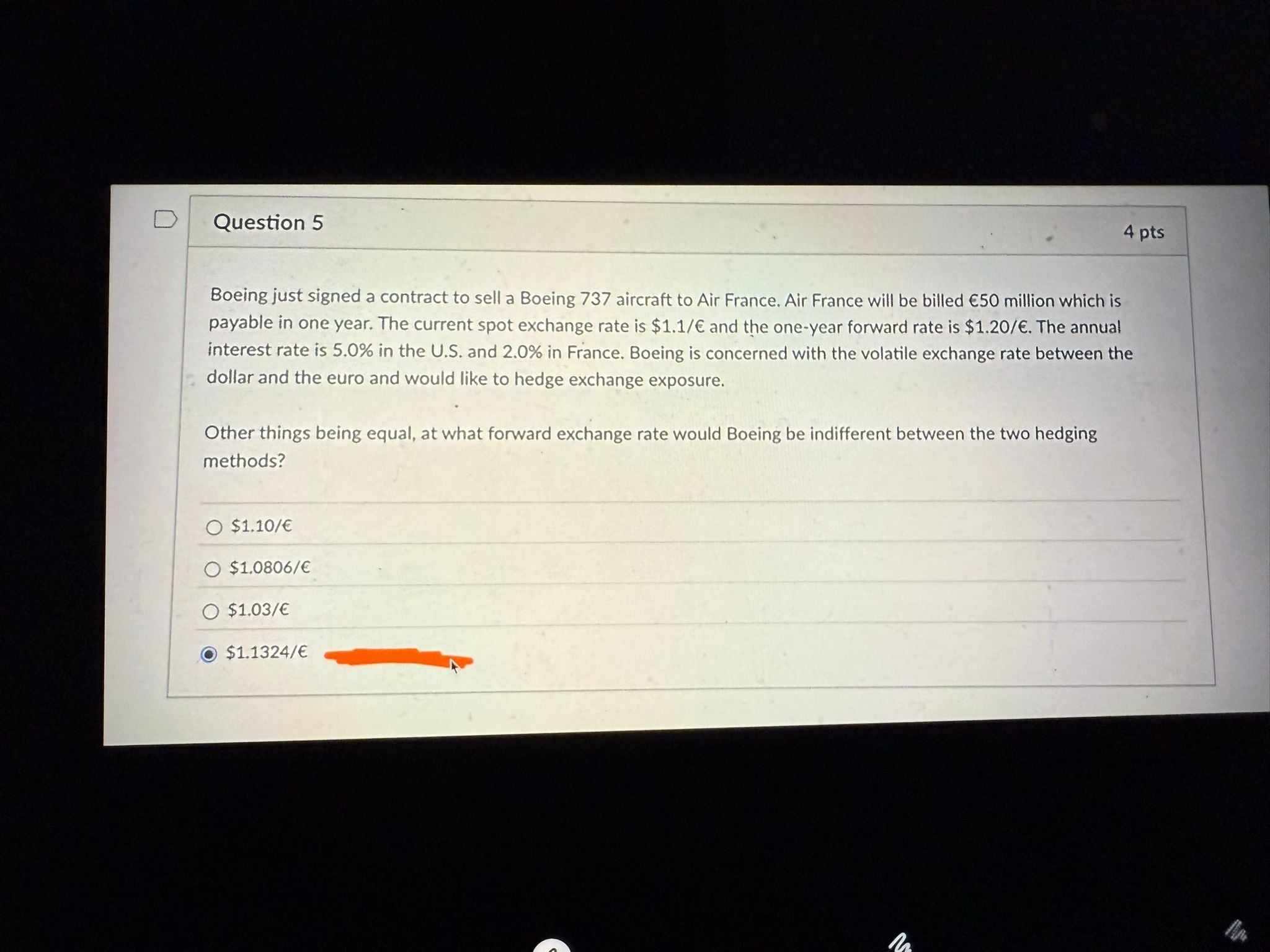

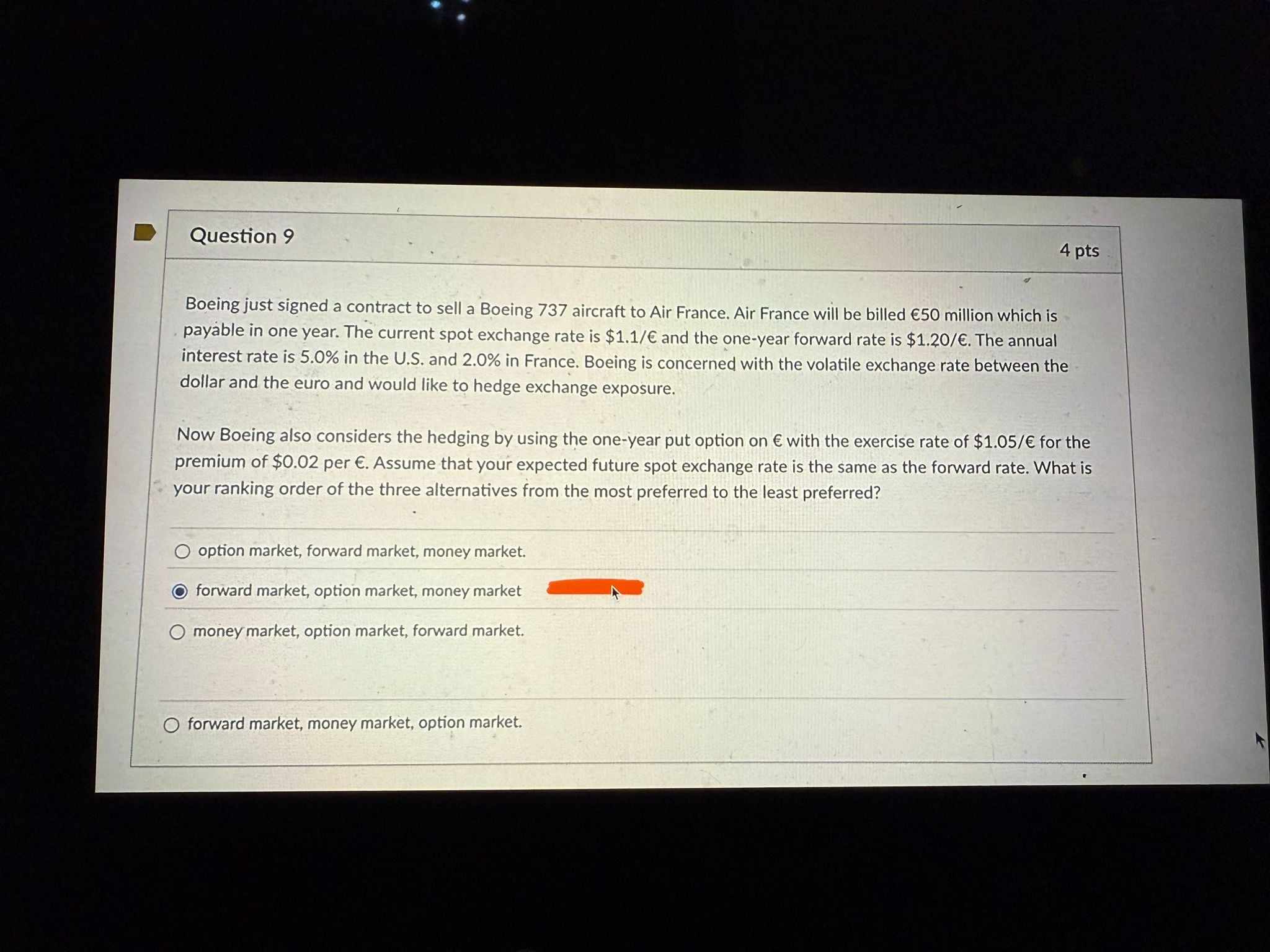

Context (Shared for All Parts): Boeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed ?50 million, payable in one year. The current spot exchange rate is $1.10/? and the one-year forward rate is $1.20/?. The annual interest rate is 5.0% in the U.S. and 2.0% in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts