Question: QUESTION 5 A. B. Roxy Ltd, a Scottish company from United Kingdom has made a sale of corn oil supplies to Cherish & Co

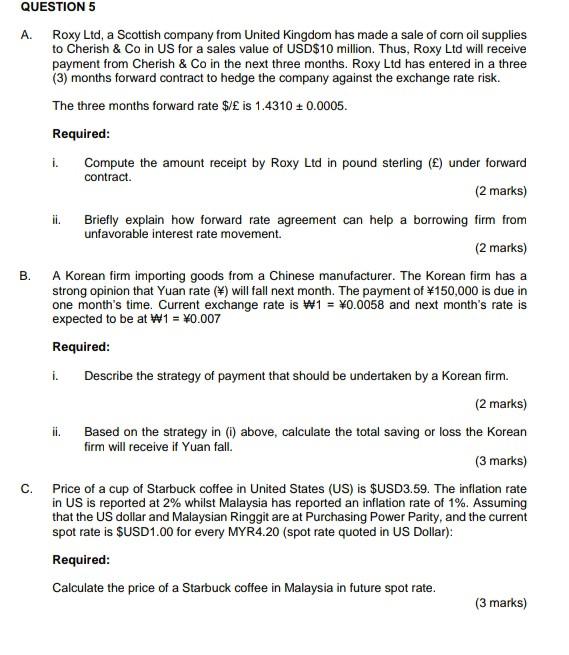

QUESTION 5 A. B. Roxy Ltd, a Scottish company from United Kingdom has made a sale of corn oil supplies to Cherish & Co in US for a sales value of USD$10 million. Thus, Roxy Ltd will receive payment from Cherish & Co in the next three months. Roxy Ltd has entered in a three (3) months forward contract to hedge the company against the exchange rate risk. The three months forward rate $/ is 1.4310 0.0005. Required: i. ii. Compute the amount receipt by Roxy Ltd in pound sterling () under forward (2 marks) contract. Briefly explain how forward rate agreement can help a borrowing firm from unfavorable interest rate movement. (2 marks) A Korean firm importing goods from a Chinese manufacturer. The Korean firm has a strong opinion that Yuan rate () will fall next month. The payment of 150,000 is due in one month's time. Current exchange rate is W1 = 0.0058 and next month's rate is expected to be at W1 = 0.007 Required: i. Describe the strategy of payment that should be undertaken by a Korean firm. C. (2 marks) ii. Based on the strategy in (i) above, calculate the total saving or loss the Korean firm will receive if Yuan fall. (3 marks) Price of a cup of Starbuck coffee in United States (US) is $USD3.59. The inflation rate in US is reported at 2% whilst Malaysia has reported an inflation rate of 1%. Assuming that the US dollar and Malaysian Ringgit are at Purchasing Power Parity, and the current spot rate is $USD1.00 for every MYR4.20 (spot rate quoted in US Dollar): Required: Calculate the price of a Starbuck coffee in Malaysia in future spot rate. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts