Question: QUESTION 5 A . Consider three 3 0 - year bonds with annual coupon payments. One bond has a 1 0 % coupon rate, one

QUESTION

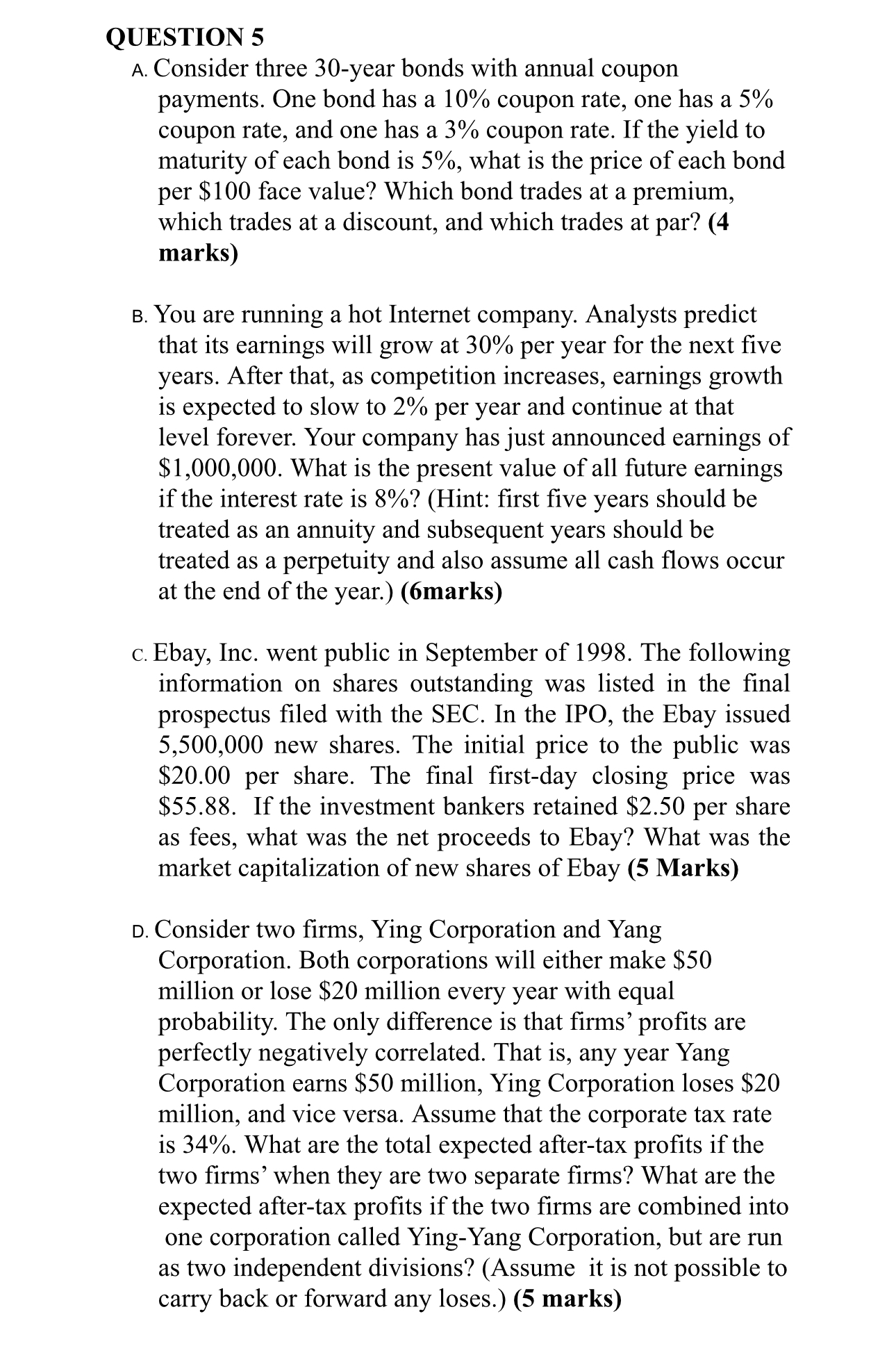

A Consider three year bonds with annual coupon payments. One bond has a coupon rate, one has a coupon rate, and one has a coupon rate. If the yield to maturity of each bond is what is the price of each bond per $ face value? Which bond trades at a premium, which trades at a discount, and which trades at par? marks

B You are running a hot Internet company. Analysts predict that its earnings will grow at per year for the next five years. After that, as competition increases, earnings growth is expected to slow to per year and continue at that level forever. Your company has just announced earnings of $ What is the present value of all future earnings if the interest rate is Hint: first five years should be treated as an annuity and subsequent years should be treated as a perpetuity and also assume all cash flows occur at the end of the year.marks

c Ebay, Inc. went public in September of The following information on shares outstanding was listed in the final prospectus filed with the SEC. In the IPO, the Ebay issued new shares. The initial price to the public was $ per share. The final firstday closing price was $ If the investment bankers retained $ per share as fees, what was the net proceeds to Ebay? What was the market capitalization of new shares of Ebay Marks

D Consider two firms, Ying Corporation and Yang Corporation. Both corporations will either make $ million or lose $ million every year with equal probability. The only difference is that firms' profits are perfectly negatively correlated. That is any year Yang Corporation earns $ million, Ying Corporation loses $ million, and vice versa. Assume that the corporate tax rate is What are the total expected aftertax profits if the two firms' when they are two separate firms? What are the expected aftertax profits if the two firms are combined into one corporation called YingYang Corporation, but are run as two independent divisions? Assume it is not possible to carry back or forward any loses. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock