Question: Question 5 A. Mr Wu decided to apply for a credit card from a bank in Canada and the clerk informed him that the bank

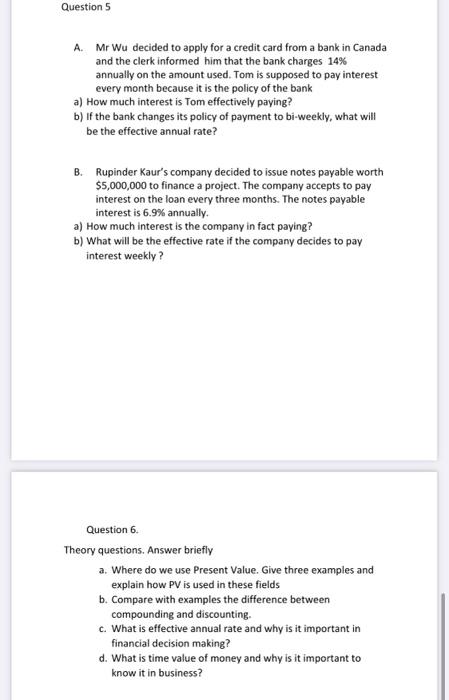

Question 5 A. Mr Wu decided to apply for a credit card from a bank in Canada and the clerk informed him that the bank charges 14% annually on the amount used. Tom is supposed to pay interest every month because it is the policy of the bank a) How much interest is Tom effectively paying? b) If the bank changes its policy of payment to bi-weekly, what will be the effective annual rate? B. Rupinder Kaur's company decided to issue notes payable worth $5,000,000 to finance a project. The company accepts to pay interest on the loan every three months. The notes payable interest is 6.9% annually a) How much interest is the company in fact paying? b) What will be the effective rate if the company decides to pay interest weekly? Question 6 Theory questions. Answer briefly a. Where do we use Present Value. Give three examples and explain how PV is used in these fields b. Compare with examples the difference between compounding and discounting. c. What is effective annual rate and why is it important in financial decision making? d. What is time value of money and why is it important to know it in business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts