Question: Question 5 ABC Shipping is considering replacing an existing ship with a newer and more efficient one for a 5-year contract of affreightment. The existing

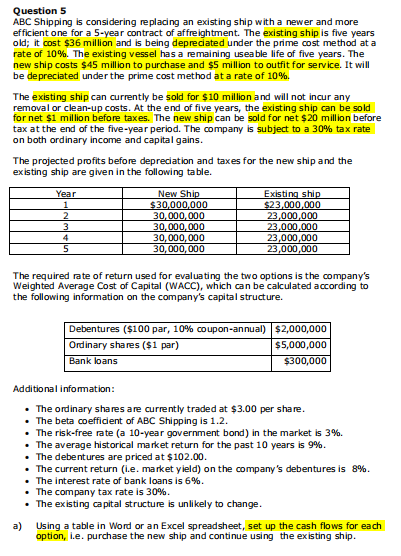

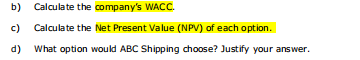

Question 5 ABC Shipping is considering replacing an existing ship with a newer and more efficient one for a 5-year contract of affreightment. The existing ship is five years old; it cost $36 million and is being depreciated under the prime cost method at a rate of 10%. The existing vessel has a remaining useable life of five years. The new ship costs $45 million to purchase and $5 million to outfit for service. It will be depreciated under the prime cost method at a rate of 10%. The existing ship can currently be sold for $10 million and will not incur any removal or clean-up costs. At the end of five years, the existing ship can be sold for net $1 million before taxes. The new ship can be sold for net $20 million before tax at the end of the five-year period. The company is subject to a 30% tax rate on both ordinary income and capital gains. The projected profits before depreciation and taxes for the new ship and the existing ship are given in the following table. Year 1 2 3 4 5 New Ship $30,000,000 30,000,000 30,000,000 30,000,000 30,000,000 Existing ship $23,000,000 23,000,000 23,000,000 23,000,000 23,000,000 The required rate of return used for evaluating the two options is the company's Weighted Average Cost of Capital (WACC), which can be calculated according to the following information on the company's capital structure. Debentures ($100 par, 10% coupon-annual) $2,000,000 Ordinary shares ($1 par) $5,000,000 Bank loans $300,000 Additional information: The ordinary shares are currently traded at $3.00 per share. The beta coefficient of ABC Shipping is 1.2. The risk-free rate (a 10-year government bond) in the market is 3%. The average historical market return for the past 10 years is 9%. The debentures are priced at $102.00. The current return (i.e. market yield) on the company's debentures is 8%. The interest rate of bank loans is 6%. The company tax rate is 30%. The existing capital structure is unlikely to change. a) Using a table in Word or an Excel spreadsheet, set up the cash flows for each option, i.e. purchase the new ship and continue using the existing ship. b) Calculate the company's WACC. c) Calculate the Net Present Value (NPV) of each option. d) What option would ABC Shipping choose? Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts