Question: Question 5 Apex Ltd will require $ 1 8 million in capital in order to be viable and produce $ 3 million annual cash flows

Question

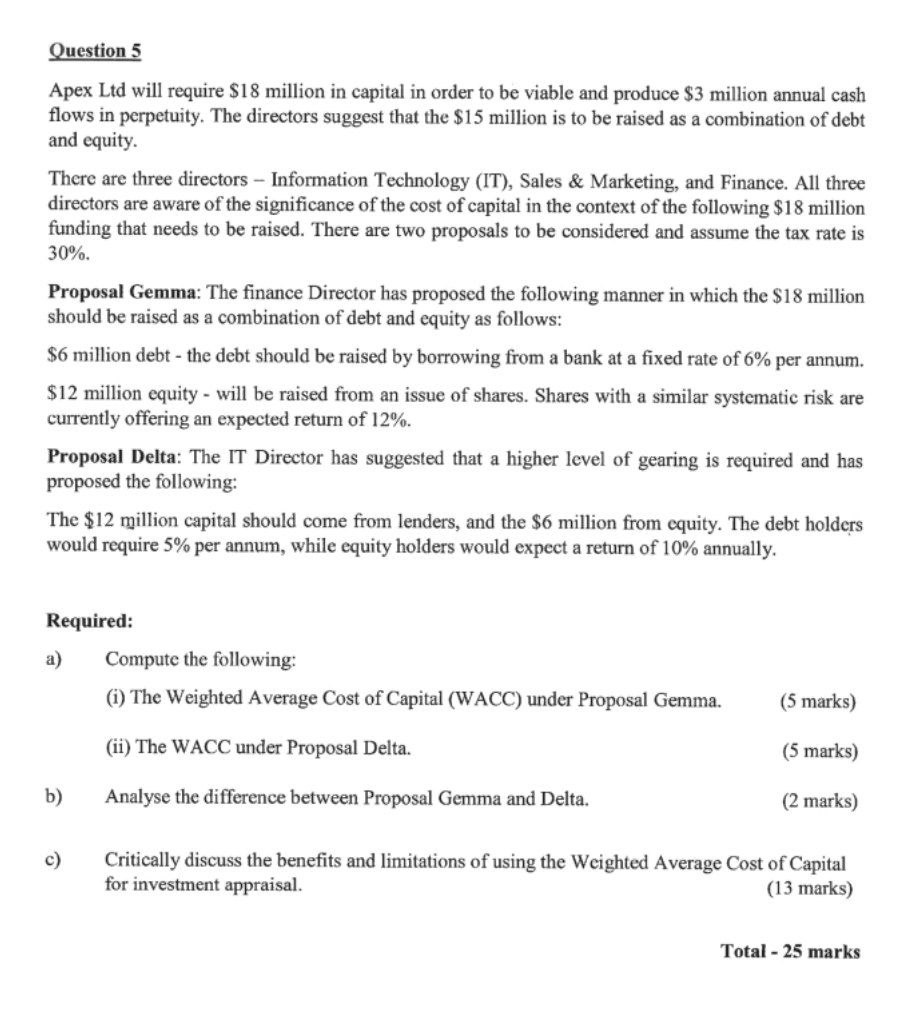

Apex Ltd will require $ million in capital in order to be viable and produce $ million annual cash

flows in perpetuity. The directors suggest that the $ million is to be raised as a combination of debt

and equity.

There are three directors Information Technology IT Sales & Marketing, and Finance. All three

directors are aware of the significance of the cost of capital in the context of the following $ million

funding that needs to be raised. There are two proposals to be considered and assume the tax rate is

Proposal Gemma: The finance Director has proposed the following manner in which the $ million

should be raised as a combination of debt and equity as follows:

$ million debt the debt should be raised by borrowing from a bank at a fixed rate of per annum.

$ million equity will be raised from an issue of shares. Shares with a similar systematic risk are

currently offering an expected return of

Proposal Delta: The IT Director has suggested that a higher level of gearing is required and has

proposed the following:

The $ million capital should come from lenders, and the $ million from equity. The debt holders

would require per annum, while equity holders would expect a return of annually.

Required:

a Compute the following:

i The Weighted Average Cost of Capital WACC under Proposal Gemma.

marks

ii The WACC under Proposal Delta.

marks

b Analyse the difference between Proposal Gemma and Delta.

marks

c Critically discuss the benefits and limitations of using the Weighted Average Cost of Capital

for investment appraisal.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock