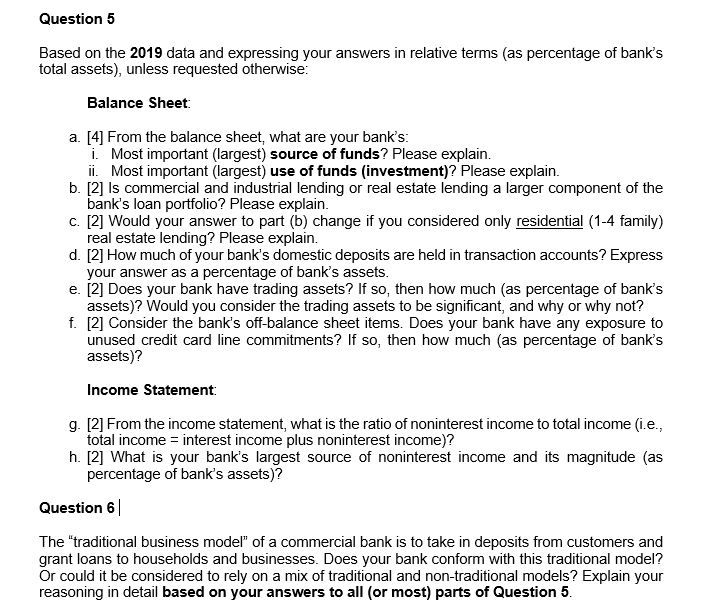

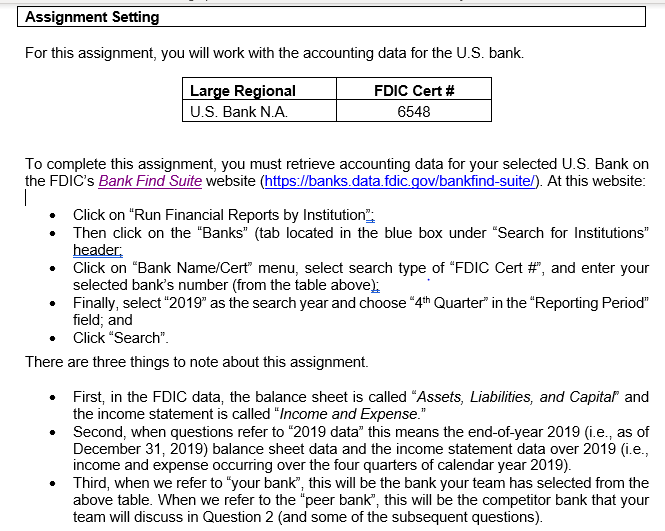

Question: Question 5 Based on the EMS data and expressing your answers in relatiye terms {as percentage of bank's total assets}, unless requested otherwise: Balance Sheet:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts