Question: Question 5: Capital Budgeting (8 MARKS) You work for a company that runs a fleet of buses that operate bus routes in a busy city.

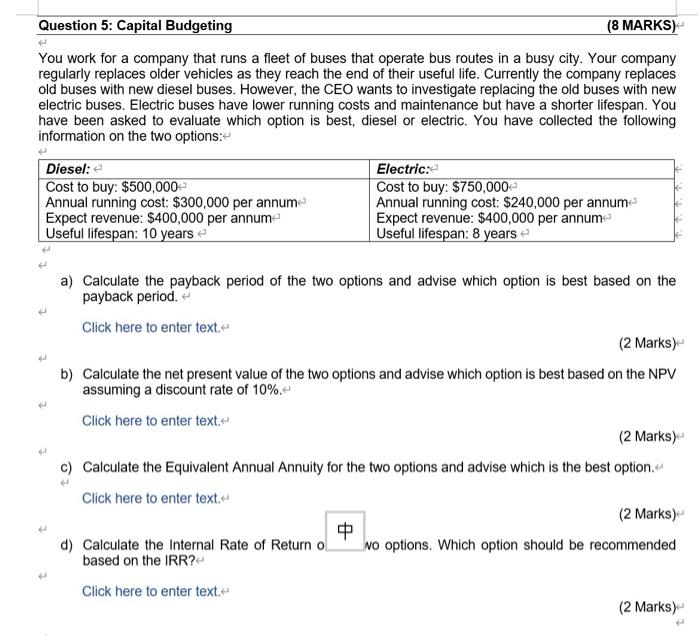

Question 5: Capital Budgeting (8 MARKS) You work for a company that runs a fleet of buses that operate bus routes in a busy city. Your company regularly replaces older vehicles as they reach the end of their useful life. Currently the company replaces old buses with new diesel buses. However, the CEO wants to investigate replacing the old buses with new electric buses. Electric buses have lower running costs and maintenance but have a shorter lifespan. You have been asked to evaluate which option is best, diesel or electric. You have collected the following information on the two options: Diesel: Cost to buy: $500,000- Annual running cost: $300,000 per annum Expect revenue: $400,000 per annum Useful lifespan: 10 years Electric:- Cost to buy: $750,000 Annual running cost: $240,000 per annum Expect revenue: $400,000 per annum Useful lifespan: 8 years a) Calculate the payback period of the two options and advise which option is best based on the payback period. Click here to enter text. (2 Marks) b) Calculate the net present value of the two options and advise which option is best based on the NPV assuming a discount rate of 10%. Click here to enter text. (2 Marks) c) Calculate the Equivalent Annual Annuity for the two options and advise which is the best option. Click here to enter text- (2 Marks) d) Calculate the Internal Rate of Return o wo options. Which option should be recommended based on the IRR? Click here to enter text. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts