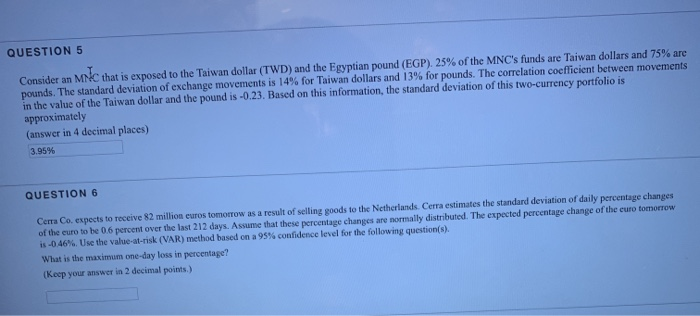

Question: QUESTION 5 Consider an MN C that is exposed to the Taiwan dollar (TWD) and the Egyptian pound (EGP) 25% of the MNC's funds are

QUESTION 5 Consider an MN C that is exposed to the Taiwan dollar (TWD) and the Egyptian pound (EGP) 25% of the MNC's funds are Taiwan dollars and 75% are pounds. The standard deviation of exchange movements is 14% for Taiwan dollars and 13% or pounds. The correlation coefficent between movements in the value of the Taiwan dollar and the pound is -0.23. Based on this information, the standard deviation of this two-currency portfolio is approximately (answer in 4 decimal places) 3.95% QUESTION 6 Cerra Co. expects to receive 82 million euros tomorrow as a result of selling goods to the Netherlands. Cerra estimates the standard deviation of daily percentage changes of the euro to be 0.6 percent over the last 212 days. Assume that these percentage changes are normally distributed. The expected percentage change of the euro tomorrow is-046%. Use the value-at-risk (VAR) method based on a 95% confidence level for the following question(s). What is the maximum one-day loss in percentage? Keep your answer in 2 decimal points.) QUESTION 5 5 points Save Answer Consider an MNC that is exposed to the Taiwan dollar (TwD) and the Egyptian pound (EGP), 25% of the MNC's funds are Taiwan dollars and 7 are ponds. The standard devation of exchange movements is 14% for Taiwan dollars and 13% for pounds. The correlation coefficient between movements in the value of the Taiwan dollar and the pound is-0.23. Based on this information, the standard deviation of this two-currency portfolio is approximately (answer in 4 decimal places) QUESTION6 5 points Save Answer Cerra Co. expects to receive 82 million euros tomorrow as a result of selling goods to the Netherlands Cerra estimates the standard deviation of daily percentage changes of the euro to be 0.6 percent over the la 212 days. Assume that these percentage changes are noen ally stributed. The expected pere efuge change ofthe euro tomorow is-046% Use the value-at-risk (VAR) method based on a 95% confidence level fr the following question(s). What is the maximum one-day loss in percentage (Keep your answer in 2 decimal poines

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts