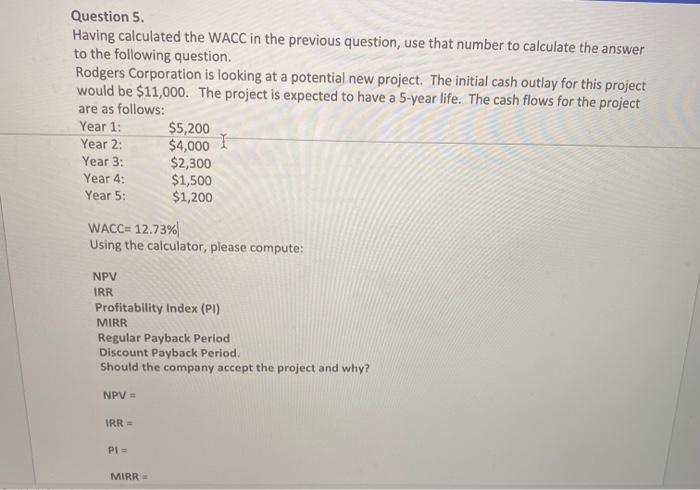

Question: Question 5. Having calculated the WACC in the previous question, use that number to calculate the answer to the following question Rodgers Corporation is looking

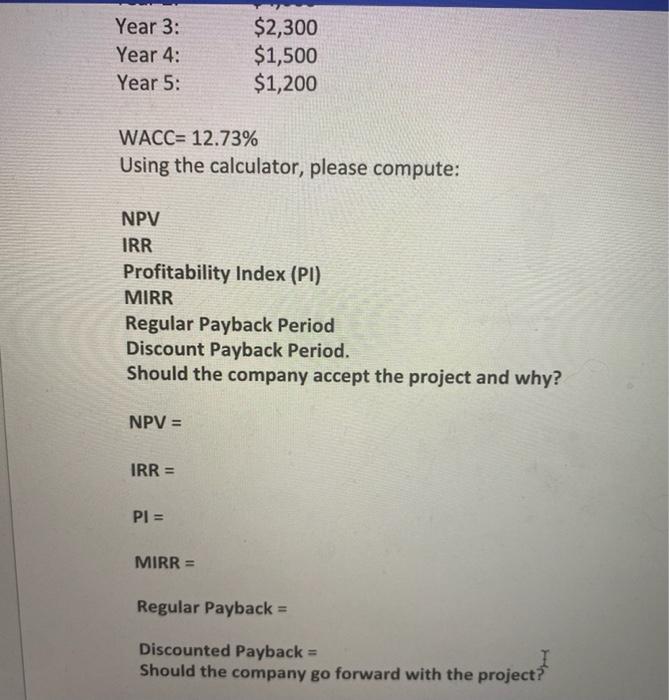

Question 5. Having calculated the WACC in the previous question, use that number to calculate the answer to the following question Rodgers Corporation is looking at a potential new project. The initial cash outlay for this project would be $11,000. The project is expected to have a 5-year life. The cash flows for the project are as follows: Year 1: $5,200 Year 2: Year 3: $2,300 Year 4: $1,500 Year 5: $1,200 WACC= 12.73% Using the calculator, please compute: $4,000 I NPV IRR Profitability Index (PI) MIRR Regular Payback Period Discount Payback Period. Should the company accept the project and why? NPV = IRR PI= MIRR Year 3: Year 4: Year 5: $2,300 $1,500 $1,200 WACC= 12.73% Using the calculator, please compute: NPV IRR Profitability Index (PI) MIRR Regular Payback Period Discount Payback Period, Should the company accept the project and why? NPV = IRR = PI = MIRR = Regular Payback = Discounted Payback = Should the company go forward with the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts