Question: QUESTION 5 In its financial statements KR) reported (in $ thousands) net income of $405 and an effective tax rate of 33%. Total assets at

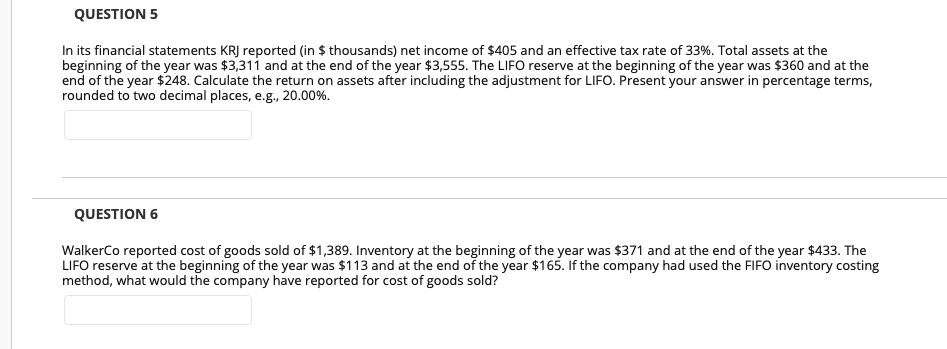

QUESTION 5 In its financial statements KR) reported (in $ thousands) net income of $405 and an effective tax rate of 33%. Total assets at the beginning of the year was $3,311 and at the end of the year $3,555. The LIFO reserve at the beginning of the year was $360 and at the end of the year $248. Calculate the return on assets after including the adjustment for LIFO. Present your answer in percentage terms, rounded to two decimal places, e.g., 20.00%. QUESTION 6 WalkerCo reported cost of goods sold of $1,389. Inventory at the beginning of the year was $371 and at the end of the year $433. The LIFO reserve at the beginning of the year was $113 and at the end of the year $165. If the company had used the FIFO inventory costing method, what would the company have reported for cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts