Question: Question 5 Leasing Box Ltd must choose between leasing or buying an indispensable machine. The machine costs $800,000 and will be depreciated straight-line to zero

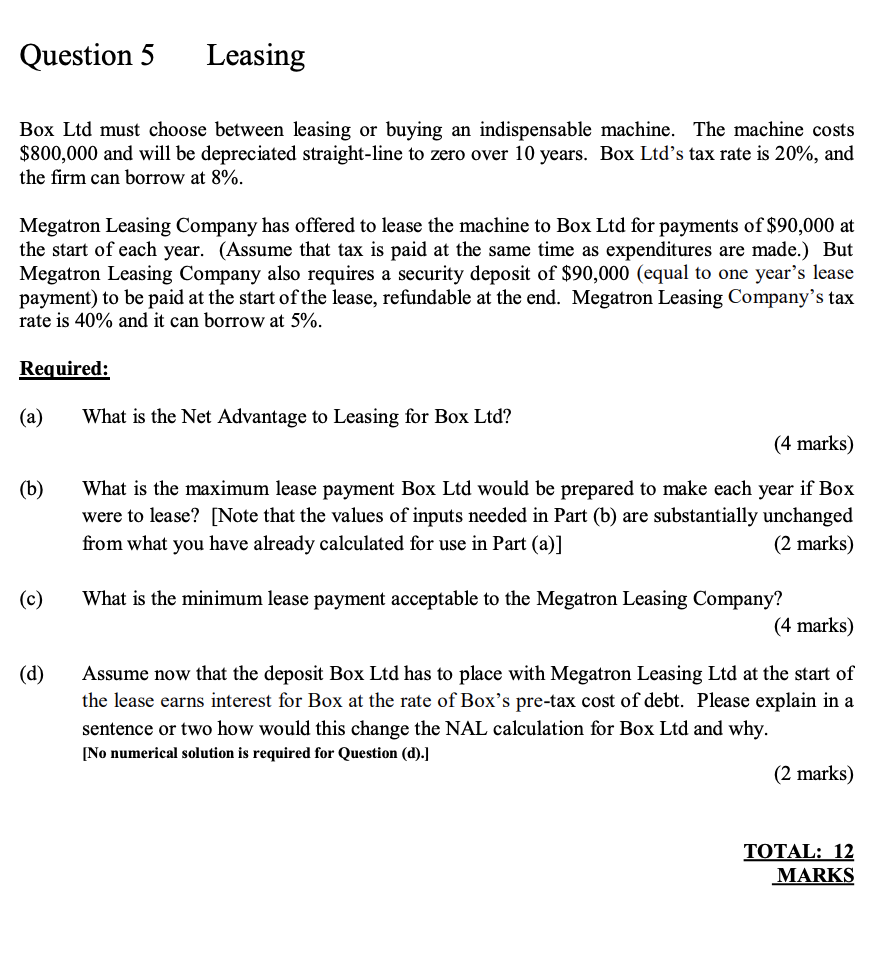

Question 5 Leasing Box Ltd must choose between leasing or buying an indispensable machine. The machine costs $800,000 and will be depreciated straight-line to zero over 10 years. Box Ltd's tax rate is 20%, and the firm can borrow at 8%. Megatron Leasing Company has offered to lease the machine to Box Ltd for payments of $90,000 at the start of each year. (Assume that tax is paid at the same time as expenditures are made.) But Megatron Leasing Company also requires a security deposit of $90,000 (equal to one year's lease payment) to be paid at the start of the lease, refundable at the end. Megatron Leasing Company's tax rate is 40% and it can borrow at 5%. Required: (a) What is the Net Advantage to Leasing for Box Ltd? (4 marks) (b) What is the maximum lease payment Box Ltd would be prepared to make each year if Box were to lease? [Note that the values of inputs needed in Part (b) are substantially unchanged from what you have already calculated for use in Part (a)] (2 marks) (c) What is the minimum lease payment acceptable to the Megatron Leasing Company? (4 marks) (d) Assume now that the deposit Box Ltd has to place with Megatron Leasing Ltd at the start of the lease earns interest for Box at the rate of Box's pre-tax cost of debt. Please explain in a sentence or two how would this change the NAL calculation for Box Ltd and why. No numerical solution is required for Question (d).] (2 marks) TOTAL: 12 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts