Question: Which project would you invest in based upon your calculation of Net Present Value (NPV)? Project A Project B Project C Project D Which project

- Which project would you invest in based upon your calculation of Net Present Value (NPV)?

- Project A

- Project B

- Project C

- Project D

- Which project would you invest in based upon your calculation of the Payback Rule?

- Project A

- Project B

- Project C

- Project D

- Which project would you invest in based upon your calculation of the discounted Payback Rule?

- Project A

- Project B

- Project C

- Project D

- Which project would you invest in based upon your calculation of the Average Accounting Return (AAR)?

- Project A

- Project B

- Project C

- Project D

- Which project would you invest in based upon your calculation of the Profitability Index?

- Project A

- Project B

- Project C

- Project D

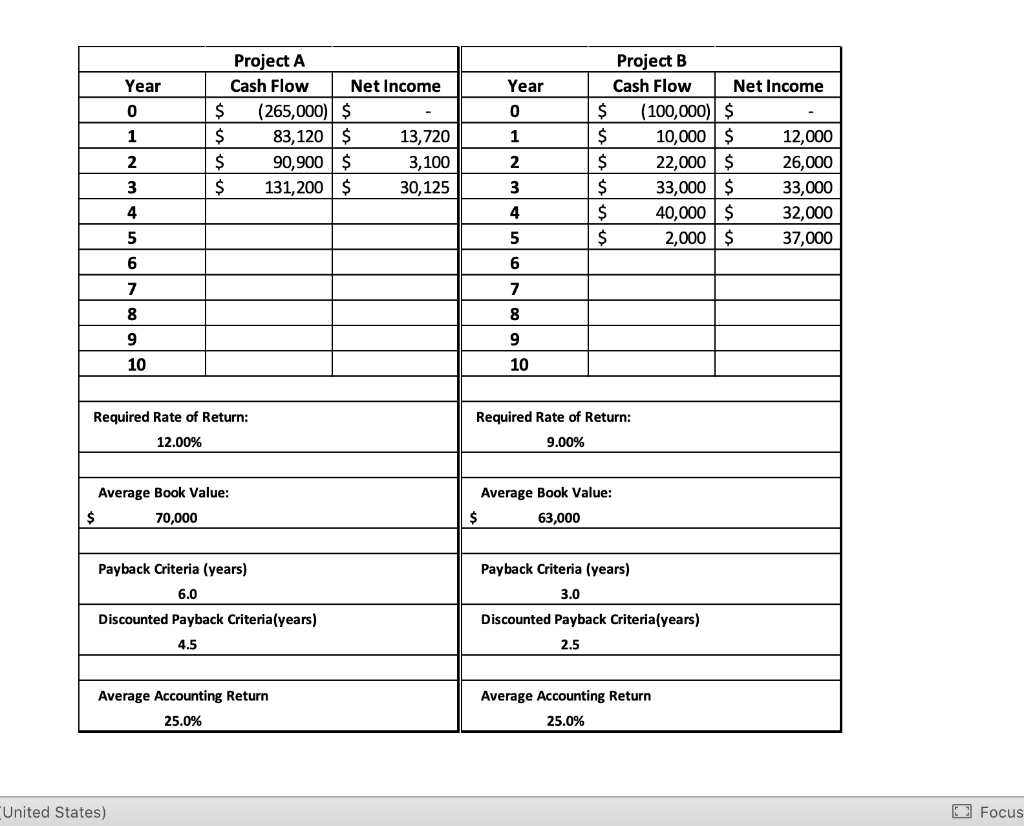

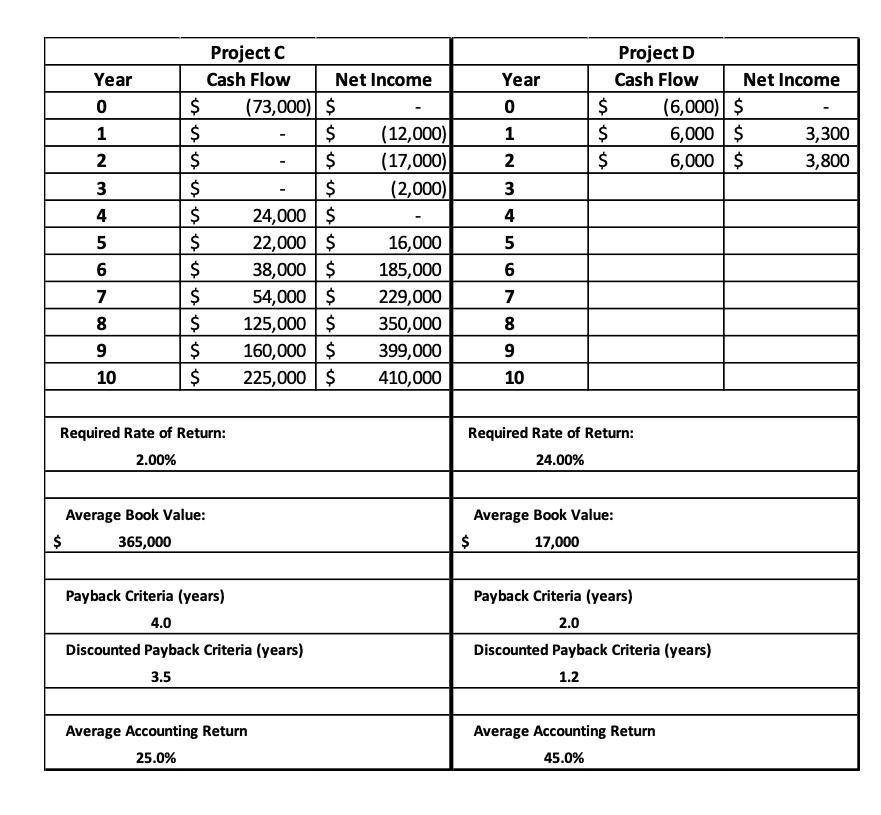

Year Project A Cash Flow Net Income $ (265,000) $ $ 83,120 $ 13,720 $ 90.900 $ 3,100 $ 131,200 $ 30,125 1 2 3 Year 0 1 2 3 4 5 $ $ $ $ $ $ Project B Cash Flow | Net Income (100,000) $ 10,000 $ 12,000 22,000 $ 26,000 33,000 $ 33,000 40,000 $ 32.000 2,000 $ 37,000 5 7 71 10 10 Required Rate of Return: 12.00% Required Rate of Return: 9.00% Average Book Value: 70,000 Average Book Value: $ 63,000 Payback Criteria (years) 6.0 Discounted Payback Criteria years) Payback Criteria (years) 3.0 Discounted Payback Criteria(years) 2.5 Average Accounting Return 25.0% Average Accounting Return 25.0% United States) 0 Focus Year Year O 1 Project D Cash Flow Net Income $ (6,000) $ . $ 6,000 $ 3,300 $ 6,000 $ 3,800 | | 1 2 3 | 3 | Project C Cash Flow Net Income 1 $ (73,000) $ - - $ (12,000) $ - $ (17,000)| I $ - $ (2,000) 24,000 $ 22,000 $ 16,000 38,000 $ 185,000 $ 54,000 $ 229,000 $ 125,000 $ 350,000 $ 160,000 $ 399,000 $ 225,000 $ 410,000 | | | 7 8 7 1 | | | 10 10 Required Rate of Return: 2.00% Required Rate of Return: 24.00% Average Book Value: $ 365,000 Average Book Value: 17,000 Payback Criteria (years) 4.0 Payback Criteria (years) 2.0 Discounted Payback Criteria (years) 1.2 Discounted Payback Criteria (years) 3.5 Average Accounting Return 25.0% Average Accounting Return 45.0% Year Project A Cash Flow Net Income $ (265,000) $ $ 83,120 $ 13,720 $ 90.900 $ 3,100 $ 131,200 $ 30,125 1 2 3 Year 0 1 2 3 4 5 $ $ $ $ $ $ Project B Cash Flow | Net Income (100,000) $ 10,000 $ 12,000 22,000 $ 26,000 33,000 $ 33,000 40,000 $ 32.000 2,000 $ 37,000 5 7 71 10 10 Required Rate of Return: 12.00% Required Rate of Return: 9.00% Average Book Value: 70,000 Average Book Value: $ 63,000 Payback Criteria (years) 6.0 Discounted Payback Criteria years) Payback Criteria (years) 3.0 Discounted Payback Criteria(years) 2.5 Average Accounting Return 25.0% Average Accounting Return 25.0% United States) 0 Focus Year Year O 1 Project D Cash Flow Net Income $ (6,000) $ . $ 6,000 $ 3,300 $ 6,000 $ 3,800 | | 1 2 3 | 3 | Project C Cash Flow Net Income 1 $ (73,000) $ - - $ (12,000) $ - $ (17,000)| I $ - $ (2,000) 24,000 $ 22,000 $ 16,000 38,000 $ 185,000 $ 54,000 $ 229,000 $ 125,000 $ 350,000 $ 160,000 $ 399,000 $ 225,000 $ 410,000 | | | 7 8 7 1 | | | 10 10 Required Rate of Return: 2.00% Required Rate of Return: 24.00% Average Book Value: $ 365,000 Average Book Value: 17,000 Payback Criteria (years) 4.0 Payback Criteria (years) 2.0 Discounted Payback Criteria (years) 1.2 Discounted Payback Criteria (years) 3.5 Average Accounting Return 25.0% Average Accounting Return 45.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts