Question: Question 5 Mark purchases a bond. A 1000 par value two-year bond with semiannual coupons at a rate of 8% convertible semiannually, is bought to

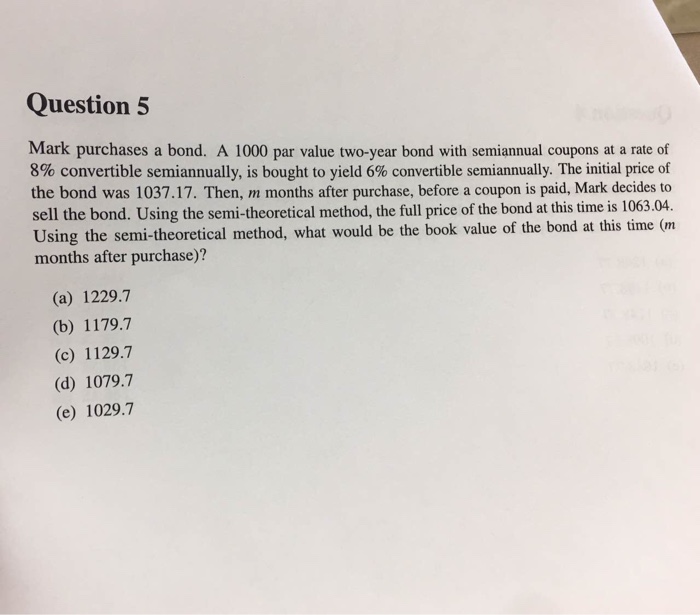

Question 5 Mark purchases a bond. A 1000 par value two-year bond with semiannual coupons at a rate of 8% convertible semiannually, is bought to yield 6% convertible semiannually. The initial price of the bond was 1037.17. Then, m months after purchase, before a coupon is paid, Mark decides to sell the bond. Using the semi-theoretical method, the full price of the bond at this time is 1063.04. Using the semi-theoretical method, what would be the book value of the bond at this time (m months after purchase)? (a) 1229.7 (b) 1179.7 (c) 1129.7 (d) 1079.7 (e) 1029.7

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock