Question: Question 5 , P 1 1 - 1 2 ( similar to ) HW Score: 4 1 . 8 % , 3 . 7 6

Question Psimilar to

HW Score: of points

Points: of

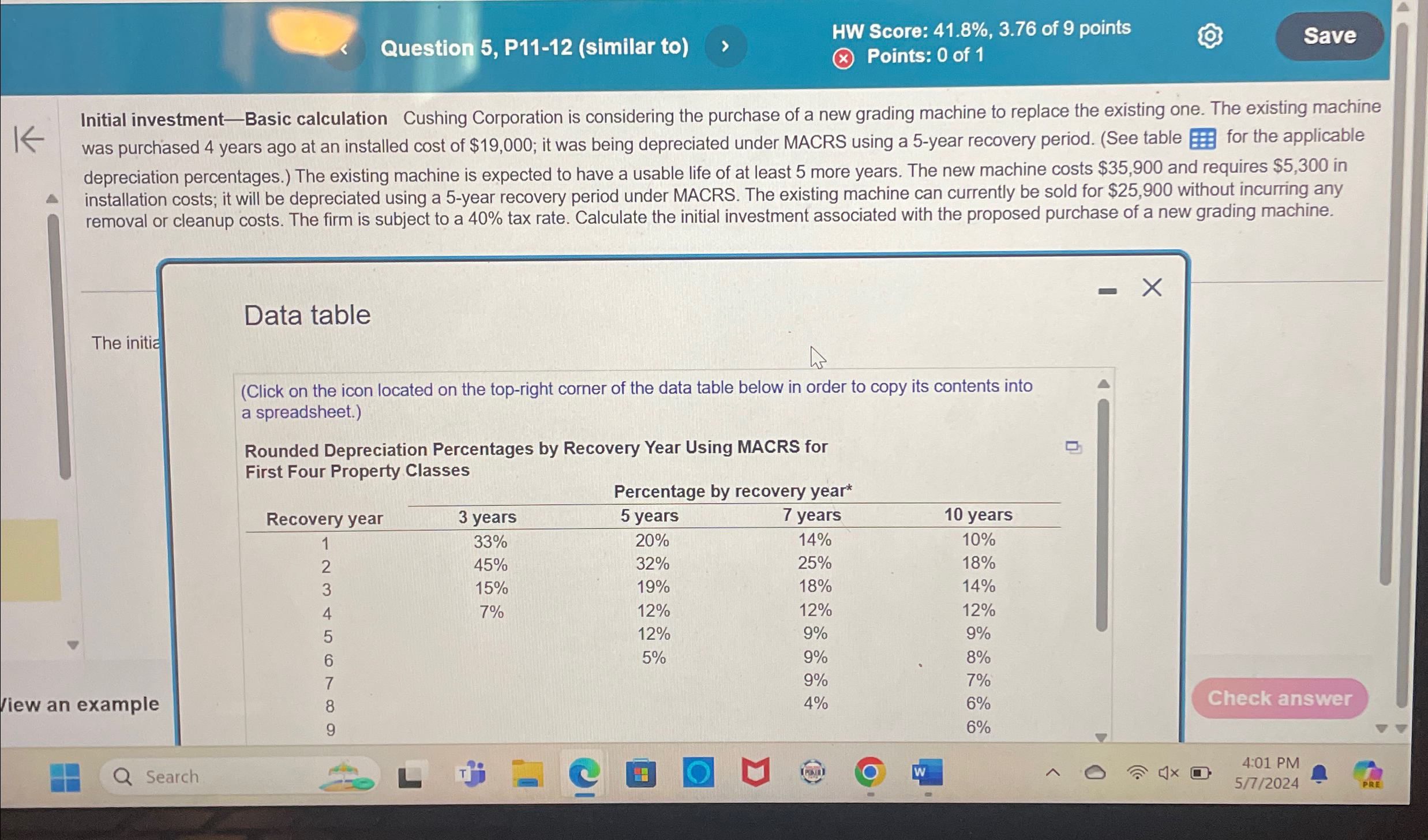

Initial investmentBasic calculation Cushing Corporation is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased years ago at an installed cost of $; it was being depreciated under MACRS using a year recovery period. See table for the applicable depreciation percentages. The existing machine is expected to have a usable life of at least more years. The new machine costs $ and requires $ in installation costs; it will be depreciated using a year recovery period under MACRS. The existing machine can currently be sold for $ without incurring any removal or cleanup costs. The firm is subject to a tax rate. Calculate the initial investment associated with the proposed purchase of a new grading machine.

Click on the icon located on the topright corner of the data table below in order to copy its contents into a spreadsheet.

Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes

liew an example

tablePercentage by recovery yearRecovery year, years, years, years, years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock